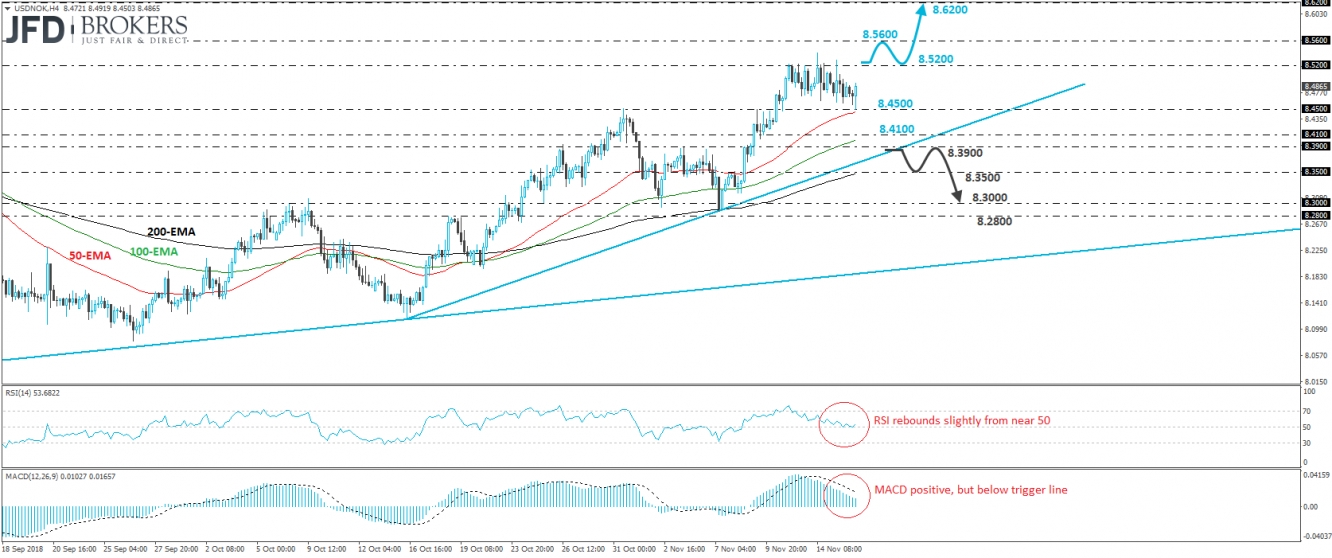

USD/NOK traded higher on Friday, after it hit support near the 8.4500 barrier, also marked by the inside swing high of the 31st of October. The pair continues to trade above the tentative upside support line drawn from the low 16th of October, as well as above all three of our moving averages. This keeps the near-term outlook positive in our view.

That said, we would like to see a 4-hour candle closing clearly above the 8.5200 zone before we get confident on the resumption of the prevailing uptrend. This week, the bulls were rejected several times around that zone, failing to achieve a clear close higher. Such a break could signal a forthcoming higher high and may initially aim for the 8.5600 territory, near the peaks of the 20th and 21st of June last year. Another break above 8.5600 may allow the rate to rise towards 8.6200, a resistance marked by the 12th of May 2017.

Taking a look at our short-term oscillators, we see that the RSI rebounded somewhat from near its 50 line, while the MACD stands positive, but below its trigger line. The RSI supports somewhat the case for the pair to trade higher, but the MACD make us cautious that another setback may be on the cards before the next positive leg, perhaps towards the 8.4100 zone or the aforementioned upside support line.

That said, we would still see a cautiously positive picture. In our view, there would still be a decent chance for the bulls to jump in from those territories. We would like to see a decisive dip below 8.3900 before we start assessing whether the bulls have lost the near-term battle. Such a dip could initially aim for the 8.3500 hurdle, the break of which could carry extensions towards the 8.3000 zone.