USD/JPY has reversed directions and posted gains on Friday after three straight losing sessions. The yen is trading at 139.39, up 0.54% on the day. US markets are open for limited hours due to the Thanksgiving holiday, and there are no US releases on the schedule.

Tokyo inflation hits 40-year high

The caption above may sound dramatic, but inflation in Japan is far from the levels we see elsewhere, such as double-digits in the UK and the eurozone. Still, Japan finds itself dealing with rising inflation after decades where deflation seemed a permanent part of the economic landscape. Tokyo Core CPI rose to 3.6% in November, nudging above the consensus of 3.5% and 3.4%. This marked the highest reading since April 1982.

There’s no arguing that core inflation isn’t accelerating – Tokyo Core CPI has strengthened for six months and BOJ Core CPI for the ninth consecutive month. This extended uptrend belies BOJ Governor Kuroda’s insistence that cost-push inflation is only temporary and that an ultra-accommodative policy is needed to ensure that inflation becomes sustainable.

The BOJ is not showing any inclination to change policy and the recent improvement in the yen means one less headache, as the need for a currency intervention has diminished. It’s likely to be business as usual for the BOJ until the spring of 2023, with two key developments on the calendar – wage negotiations and a new governor for the central bank.

The Federal Reserve remains in a hawkish mode, sort of. The Fed’s stance, reiterated in this week’s minutes, remains somewhat mixed. On the one hand, the Fed has signaled that it will reduce the size of rate hikes “soon,” and the markets have priced in a ‘modest’ 50 bp hike in December after four consecutive 75-bp increases.

At the same time, some Fed members are projecting that the terminal rate will be higher than previously expected. This mixed message has created uncertainty about what it means for the US dollar – will “lower for longer” raise risk sentiment and weigh on the dollar, or will investors view the Fed as remaining hawkish and stick with the US dollar? We’ll have to wait and see how the markets answer this question.

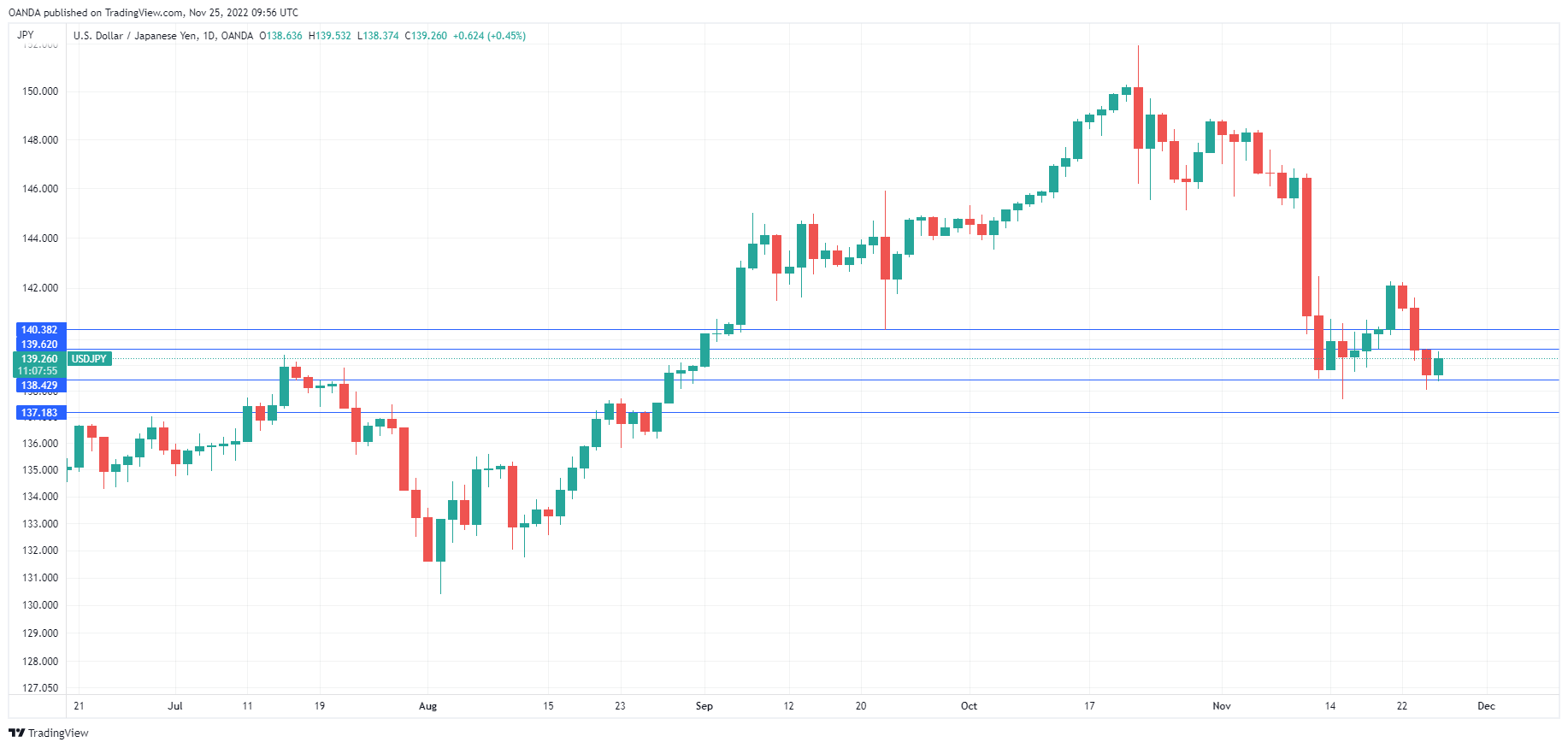

USD/JPY Technical View

- USD/JPY faces resistance at 139.62 and 140.37

- There is support at 138.43 and 137.19