- BoJ Core CPI rises to 3.0%

- USD/JPY hits 6-mth high

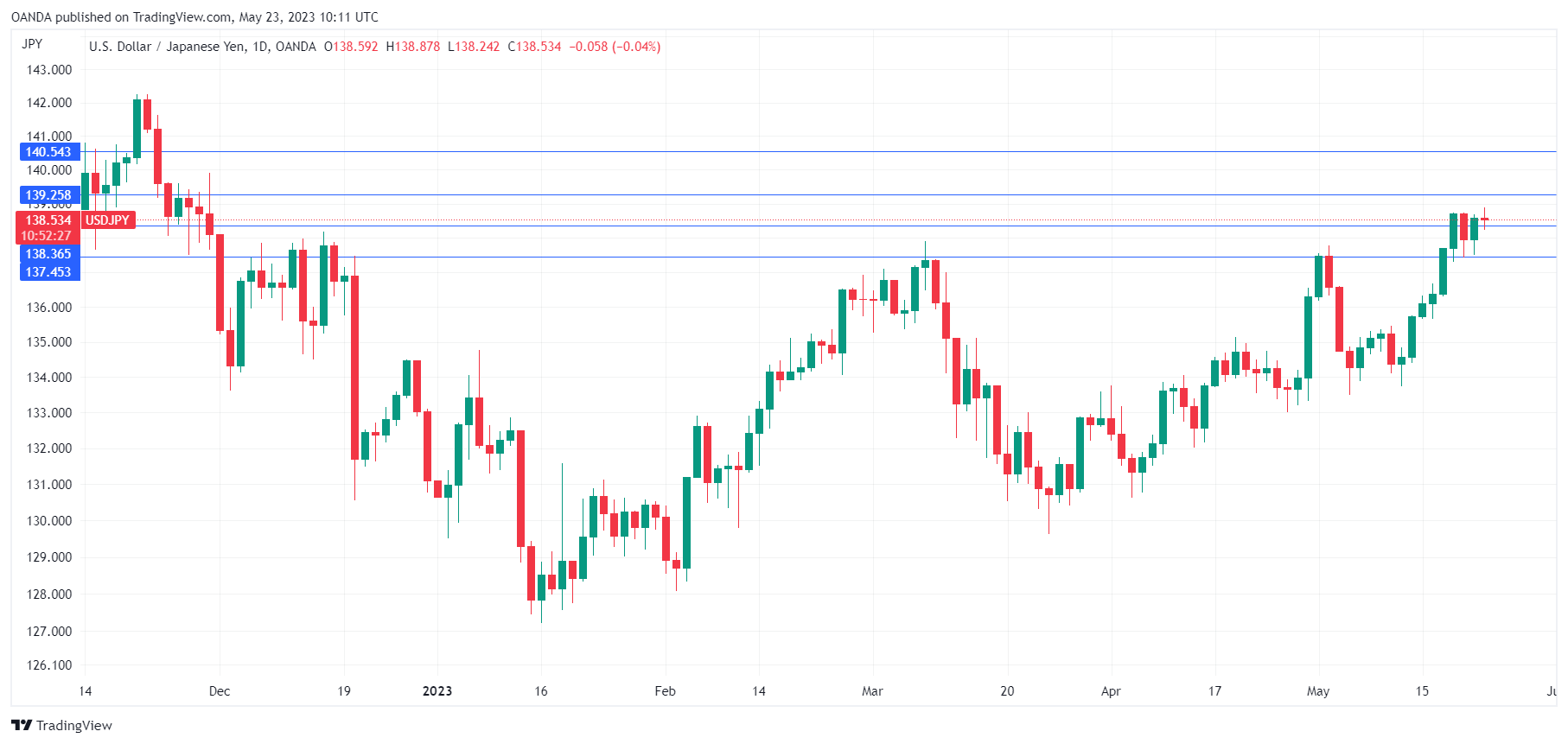

- USD/JPY tested support at 138.37 earlier in the day. Below, there is support at 137.45

- There is resistance at 139.25 and 140.55

USD/JPY climbed as high as 138.87 earlier on Tuesday, its highest level since May 28th. The yen has edged lower and is trading at 138.43 in the European session, down 0.17%.

BoJ Core CPI surprises to the upside

Japan released BoJ Core CPI earlier in the day. The March reading rose to 3.0%, up from 2.9% in February and above the estimate of 2.8%. This is the BoJ’s preferred inflation gauge and is another indication that inflation remains sticky and above the Bank’s target of 2%.

There is a widespread feeling in the markets that change is coming to the Bank of Japan, after years of deflation and an ultra-loose policy. The new Governor, Kazuo Ueda has kept a fairly low profile, perhaps to keep market volatility at a minimum during a sensitive time for the central bank. Ueda has indicated that he would consider tightening policy if it was evident that inflation was sustainable at 2%. The BoJ insists that inflation is still temporary but this argument will start to ring hollow if inflation indicators continue to point to inflation hovering around 3%.

If the BoJ were to tighten, it would likely adjust or phase out its yield control curve policy, rather than raise interest rates. The BoJ widened the target band for 10-year Japanese government bonds in December, which sent the yen sharply higher. Another widening of the target band would likely send the yen higher, and speculators are betting that the Ueda will eventually shift policy which will boost the yen.

We’ll get another inflation reading on Thursday, with Tokyo Core CPI expected to ease to 3.3% in May, following a 3.5% gain in April.

USD/JPY Technical