- This week’s CPI report will be a big factor in helping to tip the scales on whether the Fed will cut interest rates in March.

- The market may be more vulnerable to an upside surprise in CPI given current positioning.

- USD/JPY is consolidating below resistance in the 145.00-50 area ahead of the CPI report.

The December US CPI report will be released at 8:30am ET on Thursday, January 11, 2024.

Traders and economists expect the US CPI report to rise at 3.2% y/y on a headline basis, with the “Core” (ex-food and -energy) reading anticipated at 3.8% y/y.

US CPI Forecast

As you’ve no doubt noticed if you’ve been trading in the early part of this week, market volatility is subdued as traders wait with bated breath for Thursday’s US CPI report.

Last week’s US Non-Farm Payroll report came in above expectations, though the revision to prior month’s readings were negative, leaving expectations for a Fed interest rate cut in March relatively unchanged at a bit over 60%, per CME FedWatch.

In other words, traders are split nearly 50/50 on the timing of the Fed’s next move, and that means that this week’s CPI report will be a big factor in helping to tip the scales one way or another, likely driving market moves in the process.

Interestingly, the year-over-year reading on headline CPI is expected to rise for only the third time since mid-2022, but the increase is expected primarily due to so-called “base effects;” in other words, last December’s sharp decline in energy prices will fall out of the year-over-year calculation and be replaced by this year’s minimal change in December energy prices. Because energy prices are excluded from the Core CPI reading, this will have the effect of narrowing the gap between the two inflation measures.

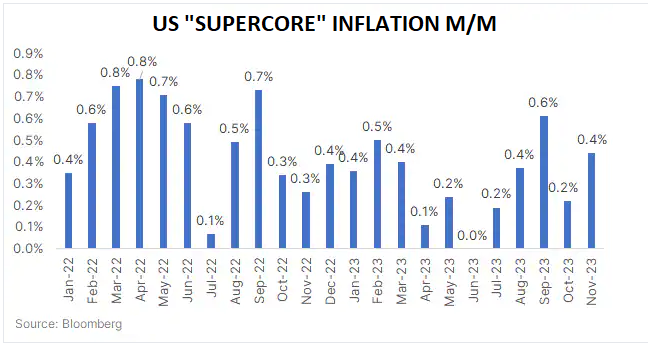

For its part, the Fed has been most interested in the “Supercore” measure of inflation, or core services inflation ex-housing, and on that front too, more good news is expected. As the chart below shows, each of the next 4 months will see 0.4-0.5% m/m readings drop out of the annualized measure, likely leading to a consistent decline in the year-over-year reading:

Source: Bloomberg

As it stands, markets are still pricing in five or six 25bps interest rate cuts by the end of the year, roughly twice as many as the three signaled by the Fed itself. Accordingly, the market may be more vulnerable to an upside surprised in CPI, which would signal that the US economy remains healthier than expected and that the Fed’s plan for interest rates may be more appropriate, whereas traders are already positioned for continued declines in inflation.

US Dollar Technical Analysis – Japanese Yen Daily Chart

Source: TradingView, StoneX

After trending lower throughout all of November and December of last year, USD/JPY burst out above its bearish trend line last week. Last week’s rally stalled out at the confluence of key previous support/resistance and the falling 50-day EMA in the lower-145.00s, though this week’s pullback has failed to hold below 144.00 for more than a couple of hours.

The exact CPI reading will go a long way toward determining where USD/JPY heads next: A stronger-than-anticipated reading could lead to a bullish breakout and opened the door for a move into the upper-140s on expectations of fewer/later Fed rate cuts, whereas a soft CPI report could take USD/JPY back toward the 5-month lows in the lower-140s.