- The US CPI report is expected to show headline inflation fell to 3.1% in November, with Core prices still rising at 4.0%

- Declines in energy and goods prices could keep the headline reading in check, though persistent service inflation is cause for concern at the Fed.

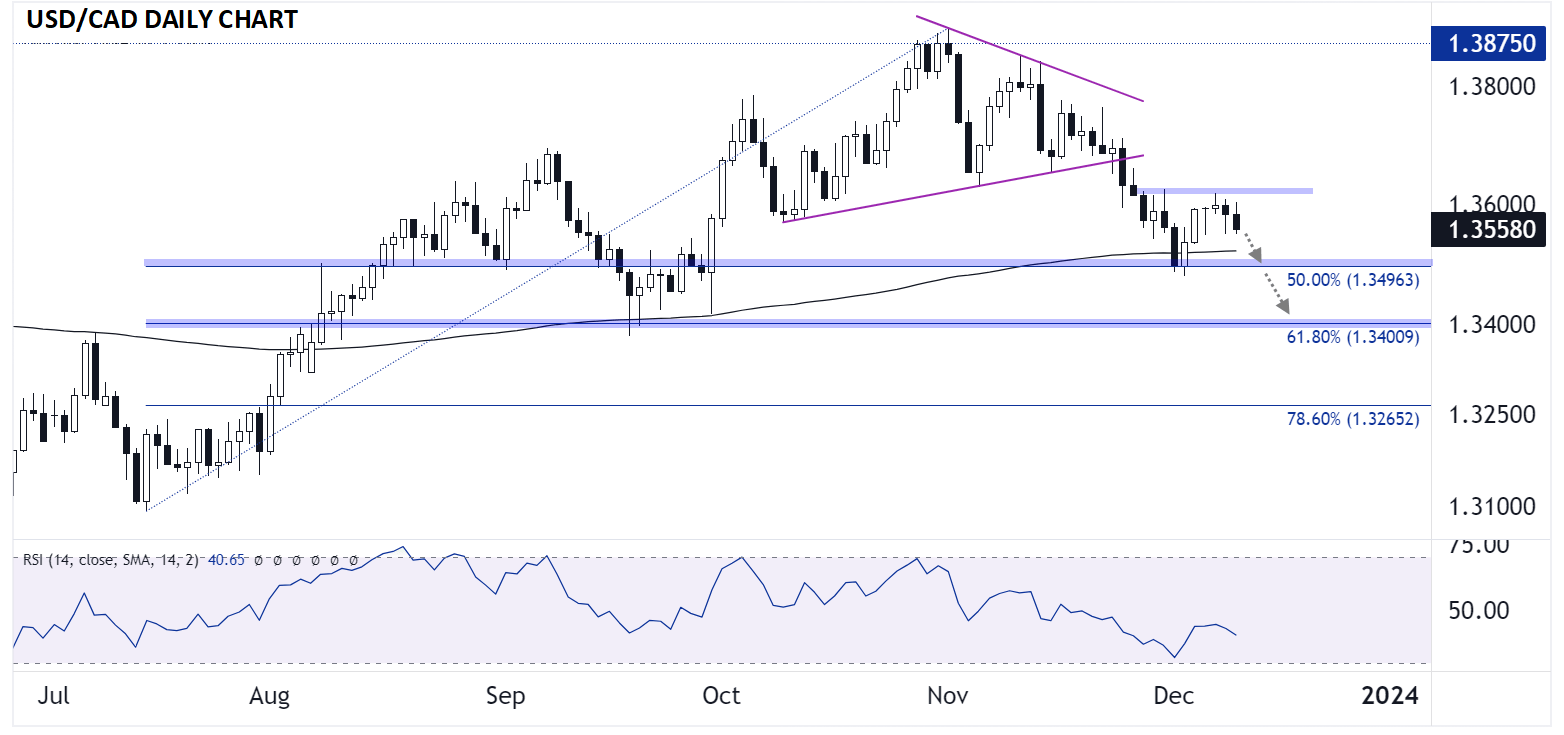

- USD/CAD is showing signs of rolling over after last week’s bounce – bears are eyeing support in the 1.3500 and 1.3400 area next.

The November US CPI report will be released on Tuesday, December 12 at 8:30am ET.

Traders and economists expect the CPI report to show that consumer prices rose 0.0% m/m (3.1% y/y), with core CPI expected at 0.3% m/m (4.0% y/y).

US CPI Overview

One of the busiest weeks for economic data and major central bank meetings kicks off in earnest tomorrow with the release of the November US CPI report. As noted above, traders and economists expect overall consumer prices to come in roughly flat on a month-over-month basis, bringing the year-over-year rate down a tick to 3.1%.

While headline inflation is expected to keep moderating, policymakers (and by extension, traders) will be far more interested in the so-called “Core” CPI reading that filters out food and energy prices. This reading is expected to come in at 4.0% y/y, fully twice the Federal Reserve’s 2% target, and tends to be more predictive of future price pressures.

Delving deeper into this month’s inflation report, energy prices moderated through November, explaining the expectation for a continued decline in headline inflation. At the same time, prices for goods likely saw an outright decline last month, whereas service prices (including both shelter and non-shelter costs) are expected to see notable increases.

Coming as it does on the eve of a Federal Reserve decision, readers might expect the potential for some volatility in markets around the CPI report, but with the Fed seemingly committed to leaving its benchmark interest rate “higher for longer” (at least for now), we may not see as much movement as we have around past CPI reports. Ultimately, regardless of what this week’s US inflation report shows, Jerome Powell and company will want to see at least a few more months of job and inflation data before tweaking the current monetary policy settings.

US Dollar Technical Analysis – USD/CAD Daily Chart

Source: TradingView, StoneX

The US dollar generally recovered off its lows last week, but its bounce against the Canadian dollar looks like it may be running out of gas already. As the chart above shows, USD/CAD found support at the convergence of its 200-day EMA and the 50% Fibonacci retracement in the 1.3500 area to start last week. However, the pair now appears to be rolling over in line with its downtrend off the November 1 high near 1.3900.

To the downside, bears will first look to target last week’s low near 1.3500, followed by the 61.8% Fibonacci retracement at 1.3400 if it breaks. Meanwhile, a hotter-than-expected US CPI report or a relatively hawkish Fed meeting could erase the near-term bearish bias and lead to a break above last week’s high near 1.3620.