- US unemployment claims fall to two-month low

- Canada’s retail sales expected to ease on Friday

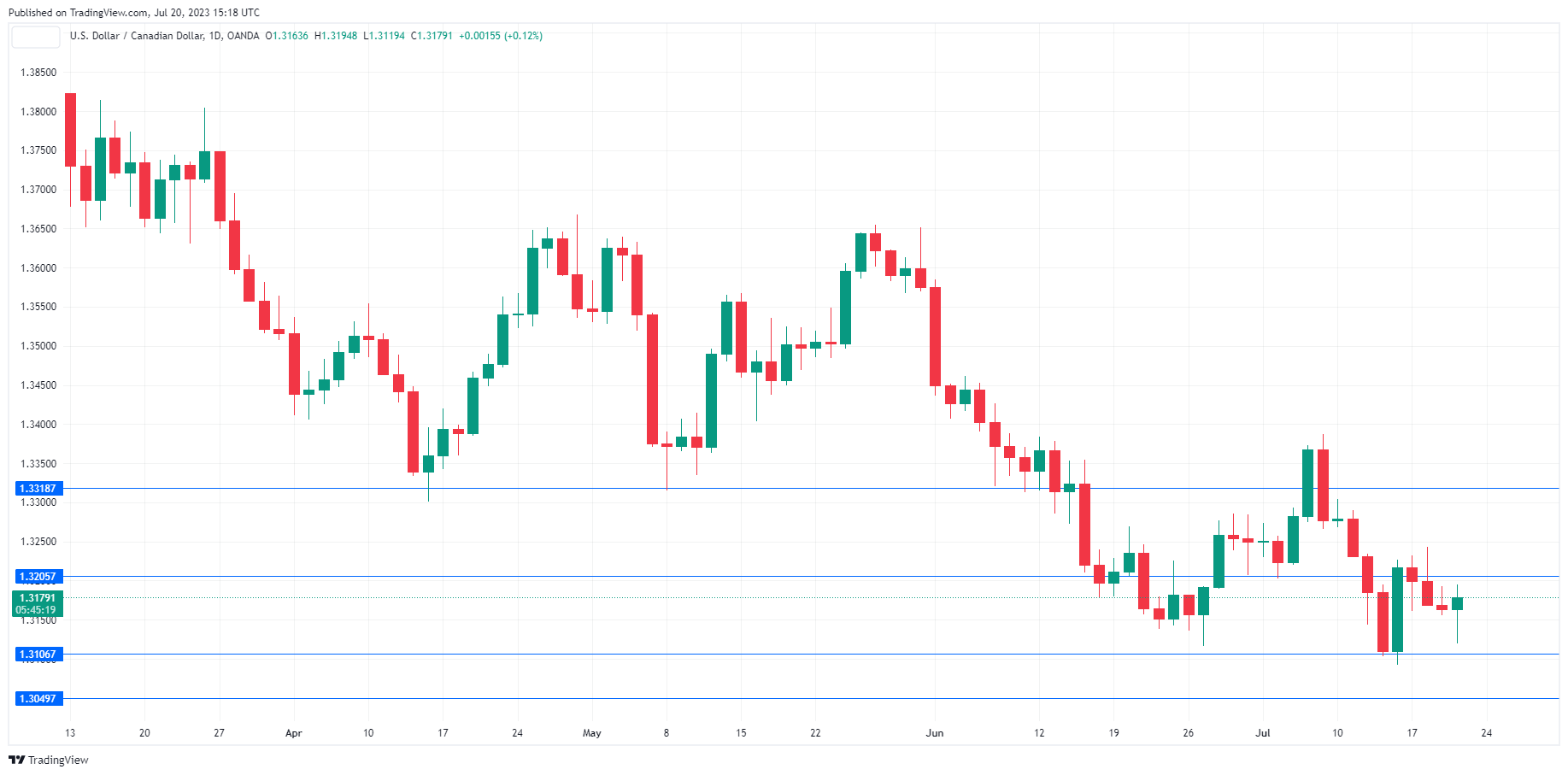

- USD/CAD is putting pressure on resistance at 1.3205. Above, there is resistance at 1.3318

- 1.3106 and 1.3049 are providing support

The Canadian dollar started the day with gains but the US dollar has rebounded after a strong unemployment claims report. In the North American session, USD/CAD is trading at 1.3173, up 0.07%.

US jobless claims fall to 2-month low

US unemployment claims fell last week to 228,000, down from 234,000 and well below the consensus estimate of 242,000. This marked a two-month low and suggests that the US labour market remains strong. Job growth may have slowed but businesses are still holding onto workers.

The Federal Reserve appears close to winding up the current rate-tightening cycle and is hoping that it can guide the economy to a soft landing. The robust employment numbers are an encouraging sign that a recession can be avoided.

The Fed will almost certainly raise rates at the next meeting on July 27th, but what happens after that? The answer will depend greatly on inflation levels. Headline CPI has fallen to 3%, but core CPI has been stickier than anticipated and hawkish Fed members have repeated that inflation has not been falling fast enough. The money markets have fully priced in a July hike and expect a pause in September, but this could be out of step with the Fed, which has hinted at one more rate hike after July.

Canada’s retail sales expected to slow

Canada wraps up the week with the May retail sales on Friday. Headline retail sales is projected to fall to 0.5%, down from 1.1%, and the consensus for the core rate is 0.3%, following 1.3% in April. A weak retail sales report could weigh on the Canadian dollar.

USD/CAD Technical