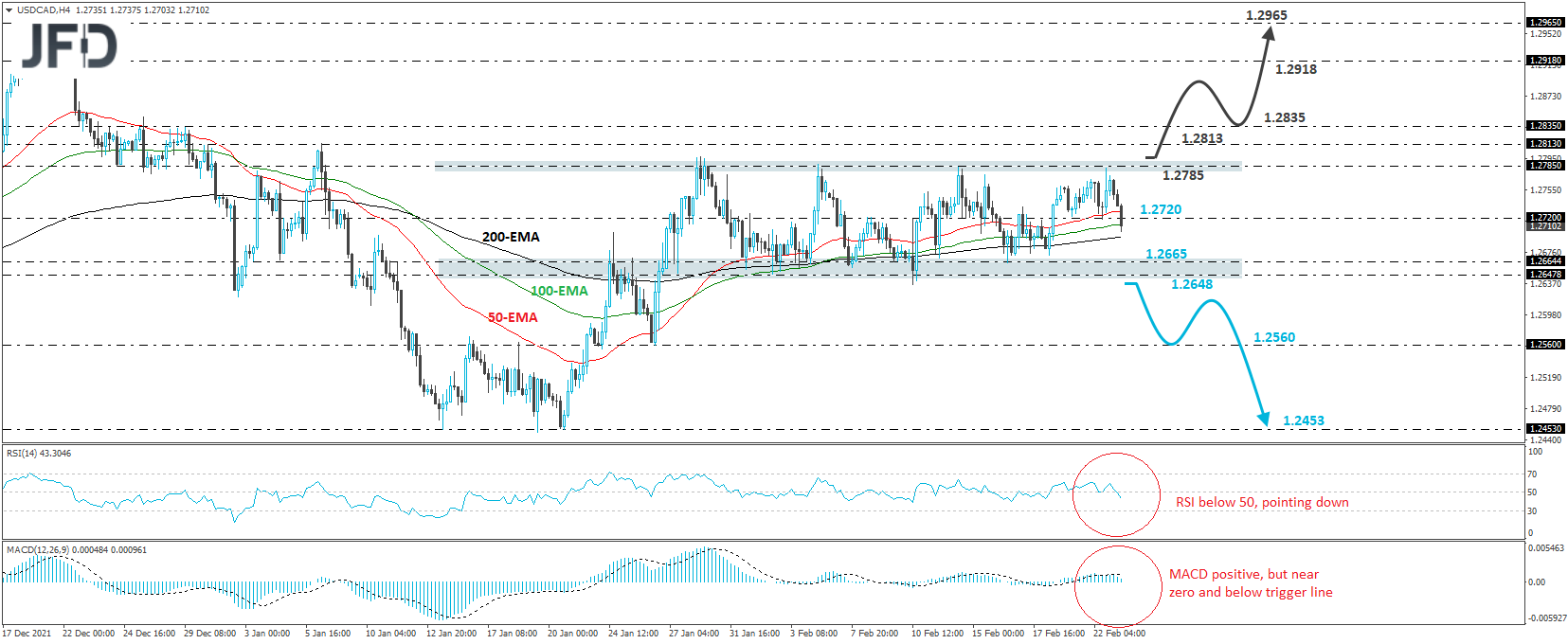

USD/CAD traded lower yesterday and today in Asia, after it hit resistance near the 1.2785 zone, which is the upper bound of the sideways range that has been containing the price action since Jan. 26. Today, the rate fell below the 1.2720 barrier, marked by yesterday’s low, and it looks to be heading towards the 1.2664 zone, or the lower end of the range, at around 1.2648. That said, until we see an apparent dip below that hurdle, we will stay neutral.

A clear and decisive dip below 1.2648 would confirm the downside exit out of the range and may initially pave the way towards the low of Jan. 26, at 1.2560. If the bears are unwilling to stop there, then a lower break could see scope for more significant declines, perhaps towards the 1.2453 territory, which acted as support between Jan. 13 and 20.

Shifting attention to our short-term oscillators, we see that the RSI turned down, fell below its 50 line, and continues to point south. At the same time, the MACD, although fractionally positive, lies below its trigger line, ready to dive into the negative territory. Both indicators suggest that the rate has begun, or is about to begin, gathering negative momentum, which increases the likelihood of further declines. However, we stick to our guns that, to get confident on the downside, we would like to see an apparent dip below 1.2648.

The outlook could change to positive upon a break above the upper end of the range, at around 1.2785. The bulls could then get encouraged to aim for the 1.2813 barrier, or the 1.2835, marked by the highs of Jan. 6 and Dec. 29, respectively. Now, if neither barrier can halt the advance, we could see bullish extensions towards the 1.2918 zone, marked by an intraday swing high formed on Dec. 22. If the buying activity stays strong, even near that level, then a break higher could aim for the peak of Dec. 20, at 1.2965.