The Canadian dollar’s slide has paused on Friday, after four straight losing sessions. Currently, USD/CAD is trading at 1.2882, down 0.12% on the day. The Canadian dollar has suffered a rough week, declining 1.3 percent. On the release front, it’s a busy day in Canada, with three key releases. GDP, which is released monthly, is expected to post a small gain of 0.1%. Employment Change is forecast to slow to 10.2 thousand, and the unemployment rate is expected to edge lower to 6.2%. Later in the day, the US releases ISM Manufacturing PMI, which is expected to dip to 58.4 points. We’ll also hear from FOMC members Robert Kaplan and Patrick Harker. Traders should be prepared for some movement from USD/CAD during the North American session.

Canada’s economy has slowed down, as GDP numbers have softened in the second half of 2017. In July, GDP came in at a flat 0.0%, and this was followed by a decline of 0.1%, in August, the first contraction since October 2016. Another weak reading for GDP on Friday could make investors frown and hurt the shaky Canadian dollar. On Thursday, USD/CAD climbed to a high of 1.2909, breaking above the 1.29 line for the first time since October 31. Weaker economic activity has given the Bank of Canada some breathing room, and the BoC is not expected to raise interest rates before April 2018. As well, uncertainty over NAFTA, which the US has threatened to torpedo, is weighing against another rate hike.

All eyes are on Washington, as the Senate is set to vote on its version of tax reform. A vote was expected on Thursday night, but this has been delayed until Friday. Republican lawmakers are confident that they have the necessary votes to pass the bill, but with the vote expected along party lines, the results will be close. If the Senate does pass the bill, the stock markets and US dollar will likely respond with gains. The next step in the tax reform saga would be for the House and Senate to bridge the differences between the two bills and come up with a single version, which would have to be voted on by both the House and the Senate.

USD/CAD Fundamental

Friday (December 1)

- 8:30 Canadian Employment Change. Estimate 10.2K

- 8:30 Canadian GDP. Estimate 0.1%

- 8:30 Canadian Unemployment Rate. Estimate 6.2%

- 9:30 US FOMC Member Robert Kaplan Speaks

- 9:45 US Final Manufacturing PMI. Estimate 53.8

- 10:00 US ISM Manufacturing PMI. Estimate 58.4

- 10:00 US Construction Spending. Estimate 0.5%

- 10:00 US ISM Manufacturing Prices. Estimate 67.0

- 10:15 US FOMC Member Patrick Harker Speaks

- All Day – US Total Vehicle Sales. Estimate 17.5M

*All release times are GMT

*Key events are in bold

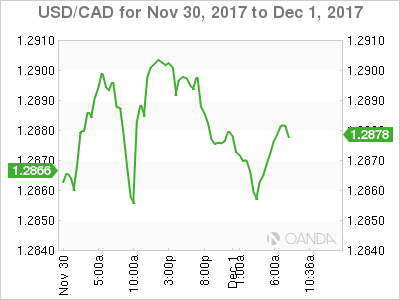

USD/CAD for Friday, December 1, 2017

USD/CAD, December 1 at 7:10 EDT

Open: 1.2897 High: 1.2902 Low: 1.2854 Close: 1.2882

USD/CAD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2630 | 1.2757 | 1.2860 | 1.3015 | 1.3165 | 1.3268 |

USD/CAD posted small losses in the Asian session and is steady in European trade

- 1.2860 was tested earlier in support and remains a weak line

- 1.3015 is the next resistance line

- Current range: 1.2860 to 1.3015

Further levels in both directions:

- Below: 1.2860, 1.2757 and 1.2630

- Above: 1.3015, 1.3165 and 1.3268

OANDA’s Open Positions Ratio

USD/CAD ratio is showing little movement in the Friday session. Currently, long and short positions are evenly split, indicative of a lack of trader bias as to what direction USD/CAD will take next.