USD/JPY: BoJ kept its policy unchanged, as widely expected

Macroeconomic overview

The Bank of Japan maintained its short-term interest rate target of minus 0.1 and a pledge to guide the 10-Year government bond yield at around zero percent. It also kept intact a loose pledge to maintain the pace of its annual increase in Japanese government bond holdings, which is JPY 80 trillion.

The move was in stark contrast to the U.S. Federal Reserve's decision hours earlier to hike interest rates for the second time in three months in an effort to return policy to a more normal footing.

Bank of Japan Governor Haruhiko Kuroda made clear the BOJ would not follow the Fed's footsteps any time soon, saying that Japan still needed massive monetary support with inflation distant from the bank's 2% target and risks to growth skewed to the downside. He shrugged off market speculation the BOJ may raise its target on bond yields later this year, when consumer inflation is expected to approach 1% due mostly to a rebound in fuel costs and rising import prices from a weak yen. Instead of looking at a single price data point, the BOJ will take into account various factors like the health of the economy and long-term inflation expectations, he said.

Japan's long-stagnant economy has shown signs of life in recent months, with exports and factory output benefitting from a recovery in global demand. Core consumer prices rose for the first time in over a year in January and analysts expect them to continue to pick up slowly but steadily. That has led to a dramatic shift in market expectations, with the market predicting the BOJ's next move would be to start scaling back its ultra-easy policy. The BOJ may be forced to raise its yield target to avoid ramping up bond purchases if Japanese long-term interest rates track global bond yield rises, which are being driven by expectations of higher U.S. interest rates. Kuroda rebuffed such a view, saying that he does not see the need to raise the yield target just because the Fed is doing so.

U.S. President Donald Trump has accused Japan for using "money supply" to weaken the yen and give its exports an unfair trade advantage. Kuroda stressed the BOJ's easing was aimed at beating deflation, and that interest rate differentials between Japan and the United States alone would not determine currency moves.

Technical analysis

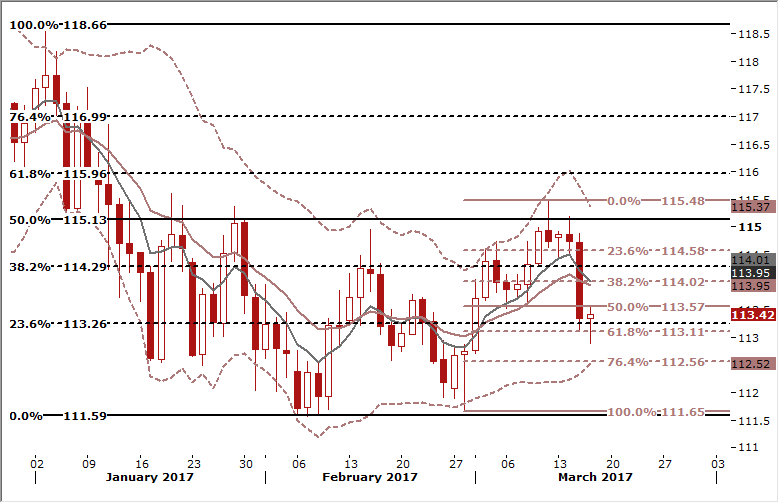

The USD/JPY dropped after yesterday’s Fed statement, as we expected. It broke below 113.11 support (61.8% retrace of the February-March rise). 112.59 (76.4% retrace) is now unmasked for a retest.

Trading strategy

We have lowered the target on the USD/JPY short to 112.90.

Source: GrowthAces.com - your daily forex trading strategies newsletter