The Yen has clawed back some serious ground in the last few days as risk aversion has been the name of the game, given the spate of events in Russia and minor worries over China and its ability to grow further. However, itseems to have subsided now and returned to its normal form.

USD/JPY Daily" title="USD/JPY Daily" height="242" width="474">

USD/JPY Daily" title="USD/JPY Daily" height="242" width="474">

It certainly has been a bit of a ranging market as of late, and some might think it would continue. However, with the upcoming events over the course of the next two months, I believe Yen weakness is inevitable.

Firstly, the sales tax in Japan is the first major tax rise in 17 years – that’s a long time for a developed economy. This sales tax is likely to dampen consumption somewhat, as goods are set to increase in price. In Japan, there has been a surge before the sales tax comes into force, as people look to stock up on goods. Hence, do expect some very unflattering figures in the first couple of months.

Secondly, the Bank of Japan (BoJ) is looking more and more likely to intervene again in the markets. With the advent of the sales tax, it would not surprise me to see the hawkish BoJ look to stimulate the markets further – after holding back this year – this in turn would certainly ease the pain. It would also help to boost the rhetoric of the Central Bank, which has found its guidance to keep underdelivering.

The sales tax, and the possibility of Kuroda will all have major impacts on the Yen, and not for strengthening it.

The technical aspect is the main focus for the short term.

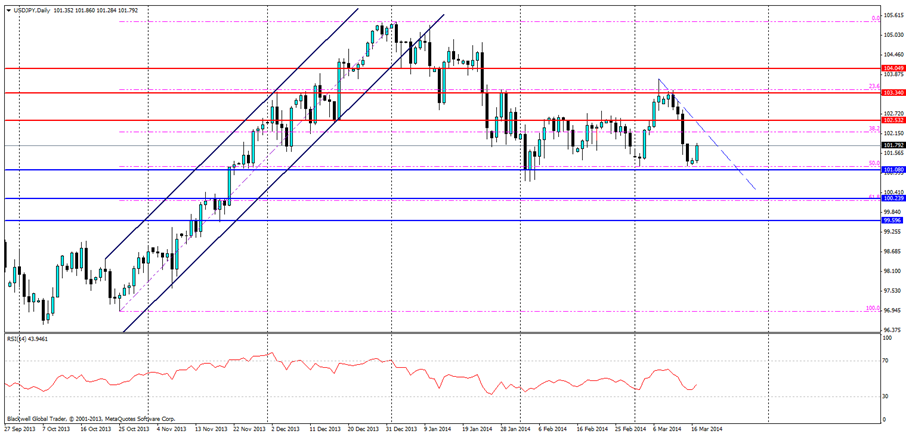

Current support levels are looking very strong, especially given the ranging pattern that has formed in recent weeks. These supports can be found at 101.096 (50.0 Fib level), 100.239 and 99.596; with the 101.096 level acting as very strong support and unlikely to break, unless we saw massive strengthening in the Japanese economy.

Having said that, the case for a jump higher is certainly there, especially after the recent touch and push back upwards. With fundamental factors starting to come into play, we could certainly see a strong trending market which has been an event after the major fundamental announcement.

Looking at key resistance levels its clear to see that markets will push higher in line with recent ranging patterns. Two key price targets would be 102.532 and 103.340, if you’re looking at short term gains. Clearly, the market has liked these key points, until it can find direction with upcoming economic events.

All in all, markets are poised to move for the Yen. I would pay very close attention to the upcoming Kuroda speech and the possibility of the BoJ looking to support the Japanese economy by guiding the Yen lower. Short term gains are certainly there, and long term opportunities are possible given the state of Japans economy.