The USD/JPY is stable on Tuesday, as the pair trades in the mid-101 range late in the European session. On the release front, the Bank of Japan announced at its policy meeting that it would continue its current monetary policy. In the US, Monday's highlights are Core Retail Sales and Retail Sales. As well, Federal Reserve chair Janet Yellen will begin two days of testimony on Capitol Hill.

Janet Yellen visits Capitol Hill this week, starting with testimony on Tuesday before the Senate Banking Committee. The Federal Reserve minutes, released last week, did not shed much light on when the Fed plans to raise interest rates, but policymakers did agree to wind up the QE scheme by October. The asset purchase program flooded the economy with over $2 trillion, and the Fed has been steadily reducing the program since last December. Winding down QE, which currently stands at $45 billion/month, will require several more tapers by the Fed, but that shouldn't pose a problem, as the US economy continues to improve. The markets will be closely following Yellen's remarks, looking for clues regarding the timing of a rate hike.

The week started on the right foot in Japan, as Revised Industrial Production bounced back last month with a gain of 0.7%, beating the estimate of 0.5%. Late last week, Japanese manufacturing numbers was a mix. Core Machinery Orders plunged 19.5%, its third decline in four readings. The markets had expected a respectable gain of 0.9%. Tertiary Industry Activity bounced back from a sharp decline in May, posting a gain of 0.9%. However, the markets had expected a much stronger gain of 1.9%. There was good news on the inflation front, as the Corporate Goods Price Index continues its impressive upward trend in the second quarter. The index improved to 4.6%, edging past the estimate of 4.5%.

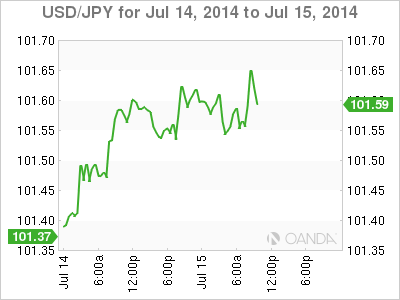

USD/JPY July 15 at 12:30 GMT

USD/JPY 101.59 H: 101.64 L: 101.51

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 99.57 | 100.00 | 101.19 | 102.53 | 103.07 | 104.17 |

- USD/JPY has shown little change in the Asian and European sessions.

- 102.53 is a strong resistance line.

- 101.19 continues to provide weak resistance. There is stronger support at the round number of 100, which has held firm since November.

- Current range: 101.19 to 102.53

Further levels in both directions:

- Below: 101.19, 100.00, 99.57 and 98.97

- Above: 102.53, 103.07, 104.17 and 105.70

OANDA's Open Positions Ratio

The USD/JPY ratio is pointing to gains in short positions on Tuesday, reversing the direction seen a day earlier. This is not consistent with the lack of movement we're seeing from the pair. The ratio is made up of a large majority of long positions, indicating strong trader bias towards the dollar moving higher.

USD/JPY Fundamentals

- 2:58 BOJ Monetary Policy Statement.

- 6:30 BOJ Press Conference.

- 12:30 US Core Retail Sales. Estimate 0.5%.

- 12:30 US Retail Sales. Estimate 0.6%.

- 12:30 US Empire State Manufacturing Index. Estimate 17.2 points.

- 12:30 US Import Prices. Estimate 0.5%.

- 14:00 US Federal Reserve Chair Janet Yellen Testifies Before Senate Banking Committee.

- 14:00 US Business Inventories. Estimate 0.6%.

*Key releases are highlighted in bold

*All release times are GMT