The USD/CAD continues to climb this week and the pair is making a strong move on Tuesday, having gained close to one cent. The pair is trading in the mid-1.07 range early in the North American session. In economic news, Canada posted a trade deficit of -$0.9 billion, much higher than the estimate. Ivey PMI was dismal, dropping to its lowest level in almost three years. South of the border, the US trade deficit narrowed to $-34.3 billion, well below the forecast. On Monday, ISM Non-Manufacturing PMI dropped to 53.0 points, well short of the estimate. As expected, the Senate confirmed Janet Yellen to head the Federal Reserve, starting in February.

The Canadian dollar has taken a hit on Tuesday after weak Canadian releases. Canada posted a trade deficit of -$0.9 billion, compared to a surplus of $0.1 billion the month before. This weak release was way off the estimate of -0.2 billion. There was more bad news as Ivey PMI dropped below the 50-line to 46.3 points. This was well below the estimate of 55.0 points. In the US, as the trade deficit narrowed to -34.3 billion, up from -40.6 billion in November. This easily surpassed the estimate of -40.2 billion.

Canadian inflation levels have been anemic, and there was no change for the better as we start 2014. The Raw Materials Price Index, an important gauge of inflation in the manufacturing sector, slumped badly, falling 4.2%. This was its sharpest drop since June 2011. The estimate stood at -1.1%. The Industrial Product Price Index posted its first gain in three months, as it edged above the 0.0% forecast with a small gain of 0.1%. The weak inflation numbers point to a slow economy which is weighing on the struggling Canadian dollar.

As expected, the US Senate confirmed Susan Yellen as chair of the Federal Reserve by a wide margin on Monday. Yellen becomes the first woman to head the powerful central bank. She has been a strong supporter of outgoing chair Bernard Bernanke, who lowered interest rates and implemented a QE program in order to boost a struggling US economy. The Fed has now started to trim the $85 billion QE scheme, with a $10 billion cut as of January. We could see another taper at the next Fed policy meeting in late January. Yellen takes over the helm on February 1, and will chair her first policy meeting in March.

We’ll get a look at some key employment numbers this week, including Unemployment Claims, Non-Farm Payrolls and the Unemployment Rate. Last week’s Unemployment Claims were almost identical to the previous week, coming in at 339 thousand. This was slightly above the estimate of 334 thousand. The Non-Farm Payrolls release could impact on the next Fed decision, after 2013 ended with QE tapering. While it was small, the Fed did indeed change policy, and this could have a significant positive impact on the US dollar. Meanwhile, ISM Non-Manufacturing PMI disappointed with a reading of 53.0 points, well off the estimate of 54.6 points. USD/CAD Daily Chart" title="USD/CAD Daily Chart" width="400" height="300">

USD/CAD Daily Chart" title="USD/CAD Daily Chart" width="400" height="300">

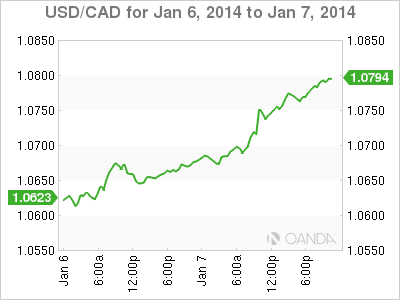

USD/CAD January 7 at 16:00 GMT

USD/CAD 1.0755 H: 1.0762 L: 1.0659

- USD/CAD has posted strong gains in Tuesday trading. The pair burst above the 1.07 line in the European session and the pair continues to climb in North American trading.

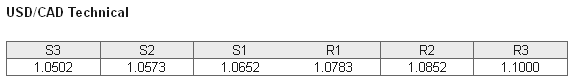

- On the downside, 1.0652 continues to provide support. This line has some breathing room as USD/CAD trades at higher levels.This is followed by resistance at 1.0573.

- 1.0783 is providing resistance. This line has weakened and could face strong pressure if the pair's upward trend continues. This is followed by resistance at 1.0852, which has remained intact since May 2010.

- Current range: 1.0652 to 1.0783

Further levels in both directions:

- Below: 1.0652, 1.0573, 1.0502, 1.0442 and 1.0337

- Above 1.0783, 1.0852, 1.10 and 1.1094

OANDA's Open Positions Ratio

The USD/CAD ratio is pointing to gains in short positions. With the US dollar posting sharp gains on Tuesday, a large number of long positions have been covered, resulting in a larger percentage of open short positions. The ratio continues to have a majority of short positions, indicating a trader bias towards the Canadian dollar reversing direction and moving up against the US currency.

The Canadian dollar is under the gun this week and continues to lose ground. USD/CAD has been moving higher early in the North American session as the greenback enjoys some solid upward momentum.

USD/CAD Fundamentals

- 13:30 Canadian Trade Balance. Estimate -0.2B. Actual -0.9B.

- 13:30 US Trade Balance. Estimate -40.2B. Actual -34.3B.

- 15:00 Canadian Ivey PMI. Estimate 55.0 points. Actual 46.3 points.