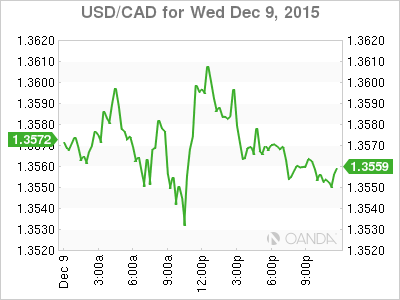

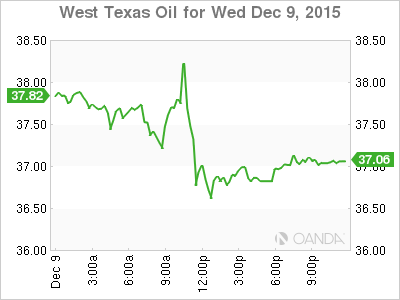

The USD/CAD lost 0.17 percent as the USD retreated across the board ahead of the Federal Reserve’s rate decision announcement on December 16. There was no data to guide investors as the agenda was empty for both U.S. and Canadian releases with left the pair trading at 1.3565. West Texas crude recovered 0.36 percent in the past 24 hours in a volatile trading session that printed highs of $38.58 and lows of $36.49 but the WTI priced settled at $37.02

The stockpile of U.S. crude fell by 3.6 million barrels according to the Energy Information Administration EIA when the forecast called for a gain of about half a million barrels. The price of oil could not capitalize on the drop in crude supply given that refined oil also surprised with a larger than expected increase. The larger stockpile of distillates offset the earlier gains on lower crude inventories. Warmer than usual weather is blamed for distillate demand being lower. The worldwide supply glut of crude and refined oil means that U.S. producers have nowhere to send the excess inventory, putting further downward pressure on the price of oil.

The Canadian dollar will get little guidance from economic releases as the current week looks very thin on the economic calendar. The New Housing Price Index (NHPI) will be published on Thursday, December 10 at 8:30 am. U.S. economic indicators to note are the U.S. unemployment claims published on Thursday and the retail sales figures on Friday, December 11.

CAD events to watch this week:

Thursday, December 10

8:30 am USD Unemployment Claims

Friday, December 11

8:30 am USD Core Retail Sales m/m

8:30 am USD PPI m/m

8:30 am USD Retail Sales m/m

10:00 am USD Prelim UoM Consumer Sentiment