Asian markets closed mixed on Friday, while ending the quarter with strong gains. The Nikkei eased 31 points to 10084, up 19.3 for the first quarter, and the Kospi settled flat, cementing a gain of 10% for the first quarter. The Hang Seng slipped .3% to 20556, climbing 11.8% in the first quarter, and the Shanghai Composite rose .5%, inching up a mere 2.9% in the first 3 months of the year. Finally, the ASX 200 edged down .1%, up 7% for the quarter.

In Europe, stocks rallied as finance ministers agreed to expand the region’s rescue fund., as concerns over Spain’s debt troubled escalated. The CAC40 advanced 1.3%, the DAX climbed 1%, while the FTSE rose a more modest .5%. Gains in Europe were more muted than elsewhere, as the FTSE rose just 3.5% for the quarter.

US stocks closed mixed. The Dow rose .5% to 13212, the S&P 500 gained .4% to 1408, while the Nasdaq eased .1% to 3092. For the quarter the Dow gained 8%, the S&P climbed 12%, and the Nasdaq surged 18.7%. All three indexes had their best showing since the 1990′s.

Nasdaq Climbs 18.7% in First Quarter, Largest Gain Since 1991

Research in Motion shares jumped 7.1% even though the company posted a loss, after suggesting the company will launch an internal review which may involve a sale of the company.

Currencies

European currencies advanced, encouraged by the expansion of the rescue fund to 700 billion Euros. The Euro rose .3% to 1.3340, the Pound gained .4 to 1.6012, and the Swiss Franc climbed .5% to 1.1086. The Yen slid .5% to 82.86, the Australian Dollar declined .3 to 1.0342, and the Canadian Dollar eased .2 to .9987.

Economic Outlook

Personal income rose .2%, less than forecast, while personal income jumped .8%, exceeding forecasts. Chicago PMI declined slightly to 62.2 from 64, while consumer sentiment jumped to 76.2, its highest level in more than a year.

Asian and European Stocks Skid, Energy Sinks

Equities

Asian markets fell on Thursday as mounting fears of a global slowdown weight on investors’ nerves. The Nikkei slid .7% to 10115, the Kospi slumped .9%, and the ASX 200 eased .1%. The Shanghai Composite tumbled for a second day, skidding 1.4% to 2252, and the Hang Seng sank 1.3% to 20609.

Selling pressure intensified in Europe, as the DAX tanked 1.8% to 6875, the CAC40 fell 1.4%, and the FTSE dropped 1.2%. Financial shares fell nearly 3%, and Italy’s MIB index plunged 3.3%.

Germany's DAX Drops 1.8%

In contrast, US stocks continued to show their resilience, as the major indexes bounced back from a 1% slide to close mixed. The Dow rose 20 points to 13146, 113 points off its low for the day. The Nasdaq declined .3%, and the S&P 500 eased .2% to 1403.

Currencies

The currency markets traded mixed with no clear direction. The Yen advanced .5% to 82.44, the Pound rose .4% to 1.5952, and the Canadian Dollar edged up .2% to .9965. The Euro, Swiss Franc, and Australian Dollar all slipped .1%.

Economic Outlook

Weekly unemployment claims fell to 359K, a 4-week low, but fell short of analyst forecasts for 351K. GDP for the 4th quarter rose at 3%, as expected.

Solid PMI Data from China and US Energizes Stocks

Equities

PMI data from China exceeded analyst forecasts, rising to an 11-month high of 53.1, lifting some Asian markets. The Nikkei rose .3% to 10110, led by car makers, and the Kospi climbed .8% to 2029. Moody’s raised its credit rating on South Korea’s sovereign debt, boosting financial stocks. The Hang Seng slipped .2% to 20522, and the ASX 200 eased .1%, while the Shanghai Composite was closed for a holiday which will extend through Wednesday.

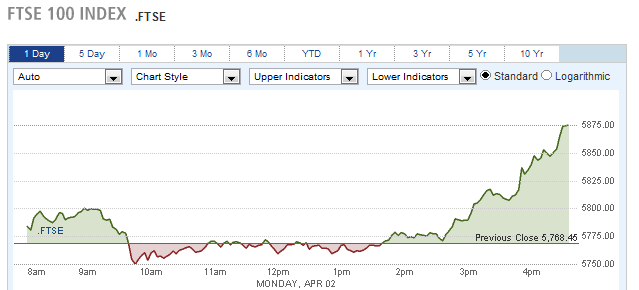

European markets traded sharply higher, as the upbeat news from China, and solid US data lifted investor optimism. The FTSE rallied 1.9%, the DAX climbed 1.6%, and the CAC40 gained 1.1%. The gains came despite a disappointing manufacturing report from the euro zone, indicating the region is in the midst of another recession.

Afternoon Rally Boosts FTSE 1.9%

US stocks gained, with the Dow ticking up 52 points to 13264, the Nasdaq jumping .9% to 3120, and the S&P 500 climbing .7% to 1419.

Currencies

The Yen climbed 1% to 82.03 in a steady day-long rally, and the commodity currencies gained, with both the Australian Dollar and the Canadian Dollar up .8%. The Euro eased .1% to 1.3326, the Swiss Franc declined .2% to 1.1067, while the Pound edged up .1% to 1.6032.

Economic Outlook

Monday’s economic data was mixed. ISM manufacturing PMI rose to 53.4 from last month’s 52.4 reading, slightly above forecasts. However, construction spending unexpectedly fell 1.1%, extending last month’s decline.

FOMC Minutes Suggest No More Easing

Equities

Asian markets traded mostly higher, following Monday’s advance in Western shares. The Hang Seng climbed 1.3% to 20791, and the Kospi gained 1% to 2049. The ASX 200 edged up .2%, as the country’s central bank held rates steady. Lagging behind, the Nikkei slipped .6% to 10050, as the yen spiked to a 3-week high against the dollar, hurting exporters.

European stocks slumped, as concerns over Spanish debt weighed on investors. The CAC40 tanked 1.4%, the DAX sank .8%, and the FTSE fell .4%.

US stocks mostly recovered from their losses, but still ended down. The Dow dropped 65 points to 13200, the S&P 500 fell .4% to 1413, and the Nasdaq declined .2% to 3114. Following the release of the minutes from the FOMC’s last meeting, the indexes briefly tumbled 1%. The minutes indicated it is unlikely the Fed will authorize another round of easing, thanks to an improving economy.

Currencies

The Dollar rallied against global currencies. The Yen fell 1% to 82.90, erasing Monday’s gains, and the Australian Dollar fell .9% to 1.0318. The Pound, Euro, and Swiss Franc all dropped .8%. The Canadian Dollar largely escaped the downtrend, easing less than .1% to .9914.

Economic Outlook

US factory orders rose by 1.3%, slightly below forecasts for a 1.5% gain. Monthly auto sales also fell short of forecasts, as the annual rate declined to 14.4M from last month’s 15.1M reading.

Global EquitiesTumble on Spanish Debt Fears

Equities

Asian markets tumbled on Wednesday, as hopes for another round of easing by the Fed faded. The Nikkei tanked 2.3% to 9820, its steepest drop in 5 months. The Kospi slumped 1.% to 2019, while the ASX 200 managed to ease just .1%, as a slide in the Australian Dollar helped exporters. In China, the Shanghai Composite and Hang Seng were closed for a holiday.

Selling pressure intensified in Europe following a weak Spanish bond auction. The DAX plunged 2.8%, the CAC40 tumbled 2.7%, and the FTSE skidded 2.3. Spain sold just 2.6 billion euros in short-term debt, an amount which was at the bottom of its target range, and yields on Spanish 10-year notes climbed to 5.61%.

US stocks fared modestly better, but still closed sharply lower. The Dow dropped 125 points to 13075, the S&P 500 fell 1% to 1399, and the Nasdaq shed 1.5% to 3068.

Currencies

The US Dollar benefited from the shift away from risk, climbing .7% against the Euro, Swiss Franc, and Australian Dollar. The Yen climbed .5% to 82.42 as traders unwound carry trade positions. The Canadian Dollar declined .6% to .9966, while the Pound eased .2% to 1.5888.

Economic Outlook

The ADP payroll report indicated the economy added 209K jobs last month, slightly more than forecast, but a smaller gain than last month’s 230K jump. On Friday, the government will release the official non-farm payroll report, which is expected to show a gain of 211K jobs. ISM non-manufacturing PMI slid to 56.0 from 57.2, slightly below forecasts.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Stocks Complete Best Quarter Since The 90′s

Published 04/25/2012, 08:14 AM

Updated 05/14/2017, 06:45 AM

US Stocks Complete Best Quarter Since The 90′s

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.