The price forecast for US steel markets, much like me after contracting salmonella poisoning last week, has been quite lethargic lately.

An imminent pullout from the doldrums doesn’t look all too likely due to several major factors, which we’ll dive into shortly, and is supported by MetalMiner’s monthly Raw Steels MMI® clocking in with a value of 59 in June, a 1.7% drop from 60 in May.

The monthly Raw Steels MMI® – a price sub-index tracking a basket of finished steel and raw material prices from all corners of the globe – has been unhealthy for quite a while, and (after undergoing a slight recalibration at the end of 2014) has hit a new all-time low this month. Why?

Today’s Steel Market: Some Factoids to Consider

Here are a few elements to take into account:

- Imports are a huge issue for the US domestic market. For the first 4 months of 2015, total and finished steel imports were 15,015,000 net tons and 12,428,000 NT, respectively, up 12% and 26% from the same period in 2014. China plays an outsize role in this: according to data compiled by James May of Steel-Insight.com, Chinese supply of CRC was 6% of the US market in 2014 while Chinese and Indian supply of HDG was a combined 8%. Construction markets in China have stagnated, and rather than shutter mill capacity, the Chinese just ship it out to foreign shores. Ministry of Commerce spokesman Shen Danyang has been quoted as taking a defensive line, saying the rise in steel exports is due to higher global demand and is a result of Chinese steel products having strong “export competitiveness” – but we have our doubts.

- Therefore, capacity has been dinged. According to the American Iron and Steel Institute (AISI), adjusted year-to-date steel production through May 16, 2015 was 33,210,000 net tons, at a capability utilization rate of 72.3%. That is down 7.2%from the same period last year, when the capacity utilization rate was 77%.

- Distributors are well-stocked with inventory. Until inventories (which are nicely loaded with that imported steel we mentioned) are drawn down, it will be hard to make price increases stick in the near term.

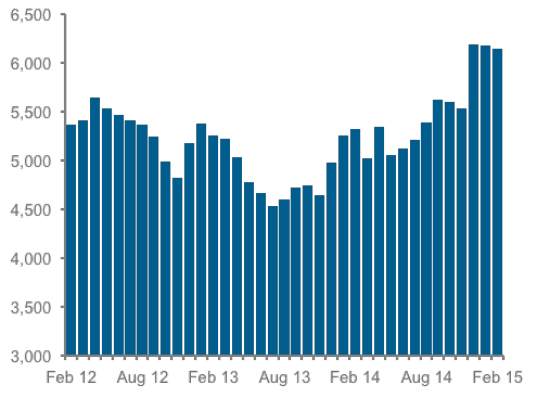

Carbon flat-rolled inventories. Values in millions of tons (add 000 to the end of each number on the chart). Source: MSCI, Steel-Insight. Chart courtesy of Steel-Insight.

Tomorrow’s Steel Prices: Wild Cards to Watch

- Anti-dumping filings may help steel prices – but “may” being the operative word, and if so, only in the short term. Filings against imported Chinese coil products may succeed in removing some of that low-priced steel from the US inventory pool, thereby helping US mill volumes, but again, from what we’re hearing, that’s simply a temporary “Band-Aid” solution.

- What will happen with scrap pricing? As part of this month’s Raw Steels MMI®, our shredded scrap price rose 1.6% over last month, and is in a 3-month uptrend. According to industry sources, scrap is expected to rise anywhere from $10 to as much as $30 per gross ton, depending on the region and product. We’ll have to wait and see where prices end up by the end of June, as that may clue us further into where finished steel pricing is headed.

- And a last longer-term bit of news from China…An announcement made at the recent Singapore Iron Ore Week, hailed by some as a gamechanger, indicated that steps are being taken toward international trader/broker access to Dalian iron ore. If this indeed goes down, it would signal a big move toward internationalization of China’s futures markets.

Steel Price Outlook: HRC, CRC, HDG, Plate

The US price of hot-rolled steel coil (HRC) has recently bumped up near the end of May on our IndX, which indicates more broadly that HRC, as well as CRC and HDG steel, seem to be stabilizing after falling for over a year. However, it seems early to call for a bottom. While commodity markets remain bearish and the dollar holds, we don’t expect HRC, CRC or HDG prices to make significant upside moves.