The S&P 500 finished lower yesterday by around 40 bps, with the index finding support multiple times around the 4,110 to 4,115 levels. The index also managed to close below the lower end of the rising wedge pattern, and it looks like the 2b reversal pattern may also be playing out. If the two patterns play out as I expect, we could see 3,950 in the near term.

Financial Conditions

The IEF/LQD ratio moved higher today and for the first time since July beyond the downtrend. It could be the start of something, and we will need to see a further move higher today. Financial conditions have eased significantly over the past month, which has acted as a tailwind for stocks. Should conditions begin to tighten, they will serve as a headwind.

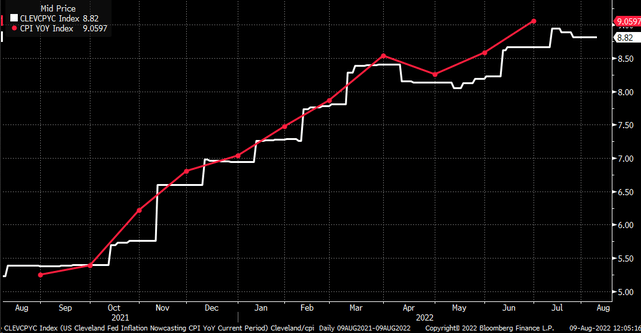

CPI

Today's CPI report will have a big say on whether financial conditions tighten further or not. The estimates are for 8.7% y/y, while the Cleveland Fed estimates that July inflation rose by 8.8%. However, the actual CPI report on a y/y basis has come in hotter than the Cleveland Fed estimates every time since the fall of 2021. A hotter than expected CPI would come as a shock to the market, which has bet on peak and inflation and a dovish Fed pivot. But a higher than expected number could trigger higher rates and tighter financial conditions.

HYG

The HYG may be sending a very subtle message on the matter, as it sits at a support level of around $77.50. Additionally, the RSI has fallen below the uptrend and is starting to trend lower. A break of support at $77.50 probably pushes the HYG to $75.75.

Roblox

Roblox (NYSE:RBLX) reported weaker than expected results, and the stock is down sharply. The conference call is today, so it will be essential to see what the company says. It reported solid booking for July, with a return to growth, which is a positive. The $37.75 level is a region of solid support that needs to hold.

Semis

The SMH ETF fell below the 10-day exponential moving average yesterday, and in the past, when that has happened, it has not been a good sign and tended to result in the start of a new leg lower.

Bitcoin

Finally, Bitcoin is very close to a big break lower and out of a bear flag, with a chance to revisit $17,000.