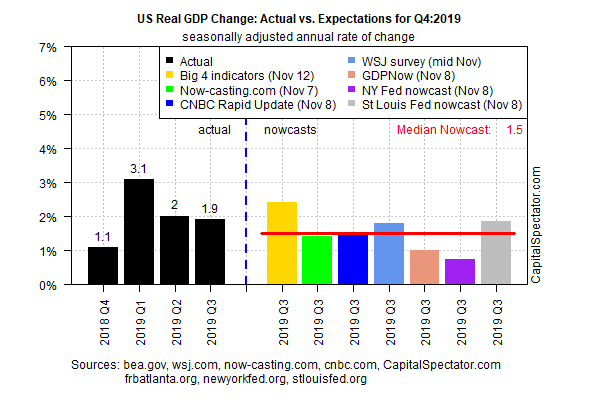

Preliminary estimates of U.S. economic activity for the fourth quarter are pointing to another downshift in growth, based on the median for a set of nowcasts compiled by The Capital Spectator. It’s still early in Q4 and so the projection should be viewed cautiously. But for now, it’s fair to say that the case appears weak for expecting output to stabilize, much less rebound.

The median nowcast is a soft 1.5%, which is modestly below the 1.9% increase reported by the Bureau of Economic Analysis for Q3 – the slowest gain so far in 2019. If today’s median 1.5% nowcast for Q4 is correct, economic activity is set to ease to the weakest advance since last year’s 1.1% rise in 2018.

A new survey of Americans’ outlook for the economy aligns with today’s nowcast. Sixty-five percent of the public say they’re expecting a US recession at some point in the year ahead, based on a CNBC-SurveyMonkey poll published on Monday. That alone doesn’t ensure that economic activity will decelerate, but it certainly doesn’t help.

Sunnier outlooks can be found elsewhere, at least for now. Boston Federal Reserve Bank President Eric Rosengren, for example, told journalists on Monday that “the US economy is in pretty good shape right now; the GDP looks to be growing around potential.”

You’d expect central bankers to play up the positive spin, of course, but Rosengren’s upbeat view can still draw on support from a broad set of data published to date. But as today’s Q4 nowcast suggests, the possibility of further slippage in Q4 can’t be ruled out.

On that note, this Friday’s updates (Nov. 15) on retail sales and industrial production for October offer the next round of stress testing the Q4 outlook. A mixed picture is expected, based on Econoday.com’s consensus point forecasts. Retail spending is expected to post a moderate rebound after slumping in September. Industrial output, by contrast, is on track to post another decline.

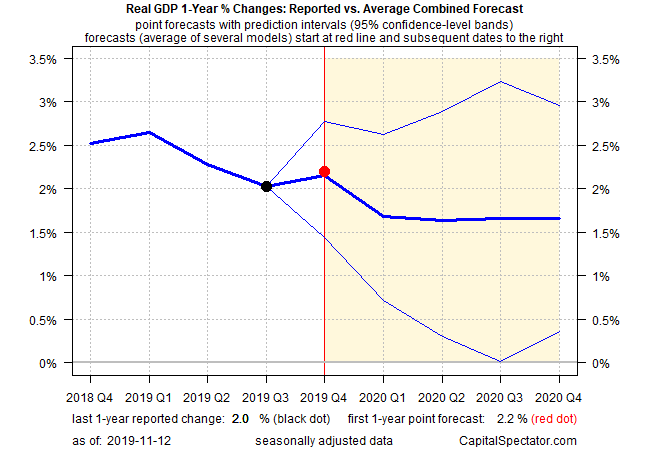

Meanwhile, projecting GDP in year-over-year terms offers a brighter outlook, thanks to comparing the current Q4 estimate with the unusually weak growth in 2018’s final quarter. But the expected bounce in this year’s Q4 in annual terms is projected to fade next year. The annual change in growth is on track to perk up to 2.2% in the current quarter (vs. Q3’s 2.0%) before decelerating further in 2020, based on The Capital Spectator’s average point estimate via a set of combination forecasts.

Mr. Market’s outlook, by comparison, remains sunny, or so recent trading activity suggests. The S&P 500 closed slightly below a record high yesterday (Nov. 11). Does the stock market know something that’s not yet obvious in the economic data? Part of the answer may arrive in this Friday’s updates on retail sales and industrial production.