Gold, silver, and mining stocks declined on Friday as the USD Index invalidated its breakdown. Is the top in the PMs in?

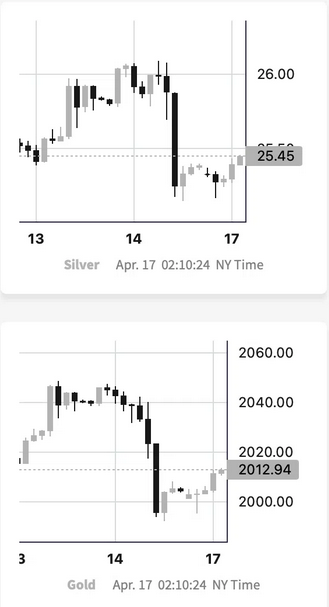

While I can’t make any guarantees, that’s very likely at this point. Gold hasn’t moved back below $2,000 yet, but what it did however, indicates that such a move is just around the corner.

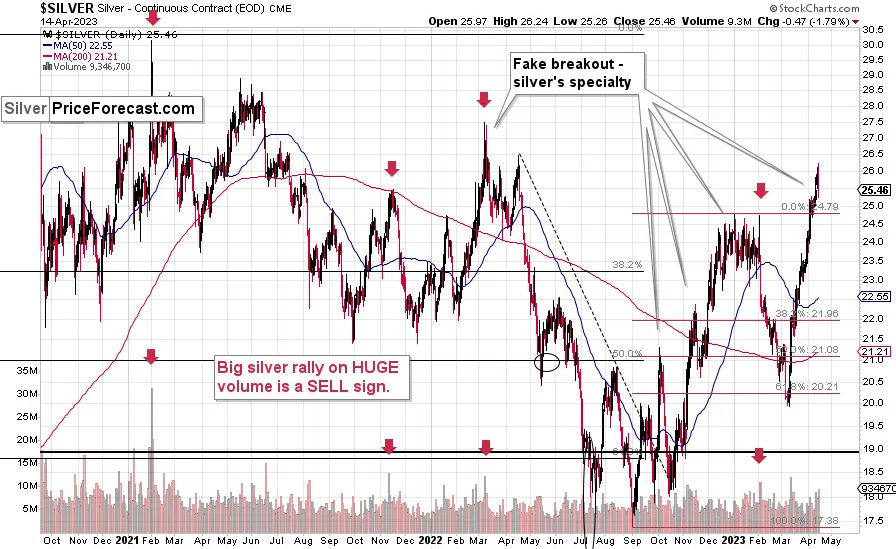

Namely, gold moved lower on visibly higher volume, and this – after a profound rally – marked the beginning of the decline in many cases. This includes the March 2022 and January 2023 tops.

The indication coming from the USD Index seems more important, though.

Breakdowns to new yearly lows and moves below the previous important bottoms are viewed as important bearish events… As long as they are confirmed.

Conversely, while many don’t realize it, there’s an even stronger signal in the opposite direction if the breakdown gets invalidated. And the more important the support level is, the more profound the bullish implications of the invalidations are.

What did the U.S. currency do on Friday?

It soared.

Right back above the previous lows.

And it wasn’t just “some lows.” It was the yearly low! Just when everyone and their brother had been expecting to see another powerful slide, the USDX rose back from the ashes like a phoenix!

This might not seem exciting right now, but just wait. The history tends to rhyme, and the current rhyme ends with, “and then the USDX soared”.

Why is this important for those who are interested in the gold price outlook?

Because of the very negative correlation between gold and the USDX. You can see it at the bottom of the above chart. It’s very close to -1, which is as low as it gets. But even without looking at the so-called linear correlation coefficient, it’s pretty clear that gold and the USDX have been moving in a mirror-like fashion for about a year.

As the USD Index appears to have bottomed, gold likely topped. The move back below $2,000 will confirm this.

Please note that silver volume increased visibly as well during Friday’s decline. When did that happen after a sizable short-term rally as well? In early 2023. And yes – that’s when the rally ended.

The above, thus, serves as a bearish confirmation.

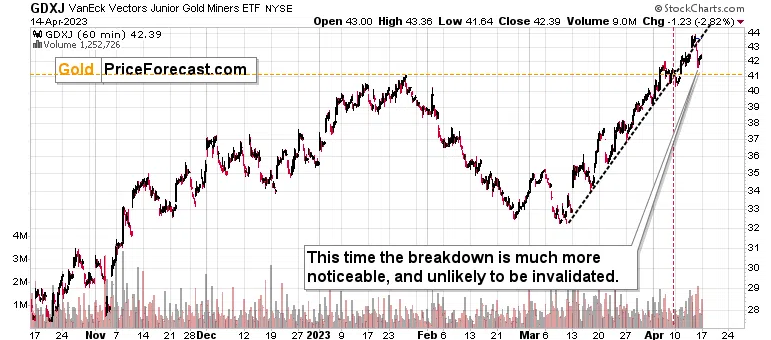

The VanEck Junior Gold Miners ETF (NYSE:GDXJ) – a proxy for junior mining stocks – declined on Friday, but just like gold and silver, it didn’t move back below its previous yearly high… Yet.

Just like in the case of silver, we see a subtle clue on the above hourly chart that this invalidation is about to take place. Namely, the size of the move below the rising, dashed support line is much bigger than what we saw earlier in April.

That first attempt was invalidated, and (remember what I wrote about invalidations earlier today?) it was followed by a rally. This time, the rebound took GDXJ only a little higher and definitely not back above the support line, which has now turned into resistance.

Source: SilverPriceForecast.com

So far in today’s (Monday’s) pre-market trading, gold and silver are up only barely, which suggests that the breakdown in the GDXJ is not going to be invalidated.

This, plus the situation on the forex market, suggests that gold is about to move below the all-important $2,000 level and that the next big move in the precious metals sector is going to be to the downside. It’s now very easy to be bullish on the precious metals market because it’s just as easy to look into the most recent past and think that what happened recently is going to be repeated. That’s what most people tend to do. And most people don’t tend to get great results on the markets, do they?

That’s the key reason – people tend to do what’s easy instead of looking beyond the initial impression and then acting based on cold logic and analysis of previous patterns. You see, people had been emotional… Probably for longer than our species exists, as many other species are emotional as well.

That’s not likely to change anytime soon. Instead of blindly following the herd, it’s best to take a deep breath and look at the situation from a broader point of view. It’s much easier to notice that some patterns are repeated if one looks at the situation properly.

Right now, this “broad look” tells us that the situation on the precious metals market is not as bullish as many think. In fact, it’s not bullish at all.