Fundamental Forecast for Dollar:Bullish

- Despite relief for Greece, the euro continues to decline and thereby bolster the case for USD

- Janet Yellen continued to beat the rate hike drum, now we are in the blackout period before the July meeting

The US dollar advanced for the fourth straight week – a feat we haven’t seen accomplished since January when the currency was still in the midst of its strongest move in decades. The swell behind the benchmark has a sound enough fundamental platform: competitive economic advantage, interest rate timing advantage and a haven status that is ever-ready to open the door to the frightened. These are broad themes with enduring position in the market. However, motivation is somewhat lacking. And, given the sparse docket in the week ahead along with the very dense period that follows it; further drive may prove restrained.

For mileage, there is no other fundamental theme that has leveraged as much strength from the Greenback as monetary policy forecasts. While most are still cutting rates (the BoC, RBNZ, RBA) or pursuing open-ended stimulus efforts (ECB, BoJ, PBoC), the Federal Reserve is in a very small group that is moving ever closer towards tightening. This past week, Fed Chairwoman Janet Yellen repeated familiar warnings that signal the group is ready to lift rates rather soon. In her Congressional testimony she reiterated that the current pace of conditions warranted a removal of accommodation earlier so that the subsequent pace could be more reserved. She would also voice a concern that some of her more hawkish colleagues have been more outspoken about: the risks of waiting too long.

According to the consensus for rate expectations through the end of 2015 the Fed issued at its last policy meeting, we are likely looking at two 25 basis point hikes before the year closes. Strategically, that would leave September as the latest start as they have consistently remarked that they are averse to back-to-back tightening. That being said, the market has maintained its skepticism. Fed Fund futures still do not price a first rate hike fully until March of next year. According to the curve, the market believes there is an 84 percent probability that the first move will come by December.

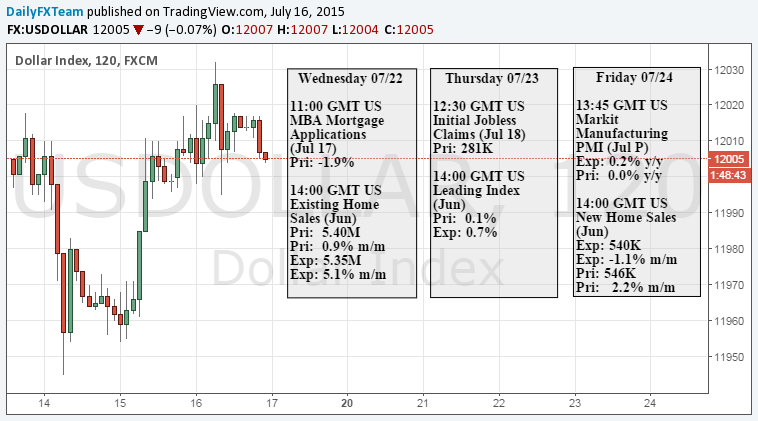

There is plenty of doubt in this market that can feed further dollar rally should it be stamped out. While we gained some traction on this last week with data and commentary, we are likely to see little further motivation in the week ahead. With the next Fed meeting on June 29, we are in the blackout period where policy officials traditionally refrain from making remarks on monetary policy. Data is also light – particularly compared to the US 2Q GDP figures also due the following week.

Left to its own devices, the dollar can certainly drift higher. However, there are external forces that may divert trajectory or leverage velocity. The movement of the Greenback’s largest counterparts can certainly prove strong motivation. Despite finding relief from the pressure of impending doom for Greece, the Euro has still stumbled. Should it turn to outright selling, the Dollar will likely reap much of the benefit. And, of course, if general risk trends start to flounder, the dollar will certainly surge on the haven demand.