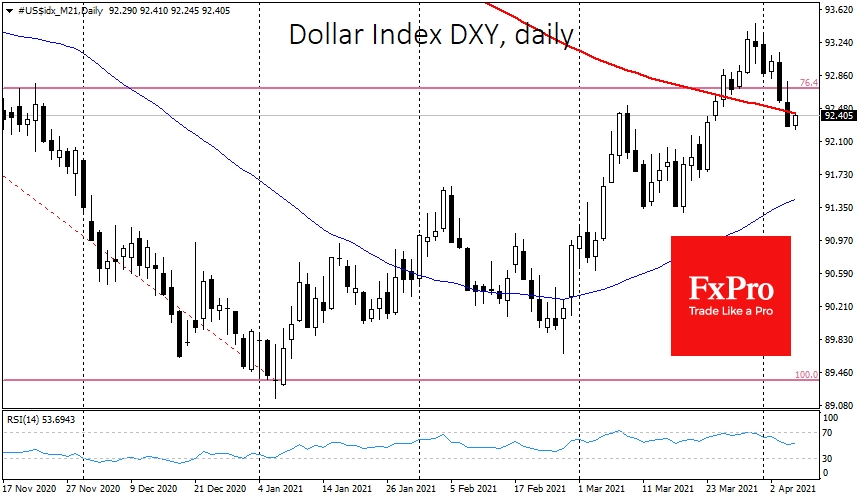

The dollar index lost another 0.3% on Tuesday to 92.27, under moderate pressure since late March, when it peaked at 93.46. The exchange rate has fallen below the 200-day moving average during this decline, a meaningful long-term trend signal line.

More recently, at the end of March, the DXY crossed this line upwards but soon lost the upside momentum, indicating indecisiveness from buyers. In this situation, investors and traders should see several signals.

Behind the crossing of the 200 SMA, the instrument often instinctively follows the break-up direction for some time. Therefore, a USD index decline below its trend line could be followed by a further downward movement. Also, the RSI indicator might be attractive for USD sellers. It has recently returned to normal values after being overbought (above 70), supporting the dollar's pressure.

With a slightly longer trading horizon, traders would be wise to wait for a bullish or bearish confirmation because such swings around an important line often turn out to be false. For instance, there have been about a dozen episodes of dips under the 200-day average in DXY over the past two years. However, the dollar has reversed to the upside, gaining support from buyers on those declines.

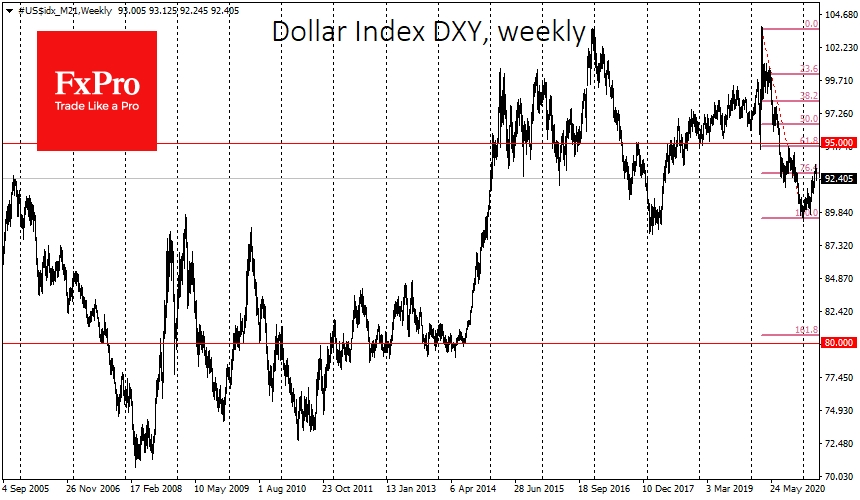

We didn't see a decisive break in the dollar's uptrend until May last year, followed by an 8% dip in the index before seeing stabilization and a pullback. Thanks to the correction from January, the DXY briefly got back above the 200-day average in late March. However, this pullback is the same hesitant attempt to break the trend, as we saw in 2019 and early 2020.

If our bearish expectations are correct, then the USD growth in the last three months turned out to be nothing more than a slightly sloppy correction from the previous declines. Its move above the 200-day average and the 23.6% Fibonacci retracement level from the March 2020-January 2021 decline was only temporarily.

If that is the case, we will already see the Dollar Index return to the year's lows near 90 in the coming months. This is also the bottom area of 2018. A drop below would pave the way for the DXY index to go to 80, the lowest rate since 2014.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Dollar Abandoning Key Level Confirms Long-Term Decline Bias

Published 04/07/2021, 05:03 AM

Updated 03/21/2024, 07:45 AM

U.S. Dollar Abandoning Key Level Confirms Long-Term Decline Bias

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Usd didnt break 200 dma, but it is testing it. Your bearish expectation is not correct. USD is correcting to resume its rally. check the history!

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.