US crude futures have posted gains on Monday, trading at $41.31 a barrel in the North American session. Brent crude futures are almost at an identical price, trading at $41.26. In economic news, today’s only event was US Existing Home Sales, with the indicator slipping to 5.08 million, well below expectations.

Last week crude pushed above the symbolic level of $40, and climbed on Friday to a high of $42.51, its highest level since early December. Crude commenced this rally at the conclusion of the Federal Reserve meeting on Wednesday, as the Fed did not raise interest rates and issued a very dovish policy statement. Crude prices also gained ground on the news that Qatar will host a meeting of oil producer nations on April 17 to discuss freezing outputs. Previous efforts at capping production have not succeeded, with producers unable to reach agreement. Will we see a different outcome this time around? Iran is one of the obstacles to oil exporters agreeing to reduce output. The country recently tripled its production and is not interested in cutting back on output. Iran was shut out of international markets until January, due to international sanctions, and is eager to regain its status as a major oil exporter.

There were no surprises from the widely-anticipated Federal Reserve rate announcement on Wednesday. The Fed remained on the sidelines and did not raise interest rates at its policy meeting on Wednesday, maintaining the benchmark rate at 0.25%. The Fed statement noted that the US economy remains vulnerable to an uncertain global economy, but expects to raise rates later in the year due to moderate growth and “strong job gains”. The statement was dovish in tone, a clear departure from the December meeting, when the Fed raised rates for the first time in nine years and talked about four rate hikes over the course of 2016. In just a short three months, global demand has weakened, precipitated by the Chinese slowdown, and US numbers have cooled in comparison to the economy’s torrid pace in the second half of 2015. If inflation and employment numbers push higher in next several months, a rate hike in mid-2016 seems a good bet.

WTI/USD Fundamentals

Monday (March 21)

- 10:00 US Existing Home Sales. Estimate 5.32M. Actual 5.08M

*Key events are in bold

*All release times are DST

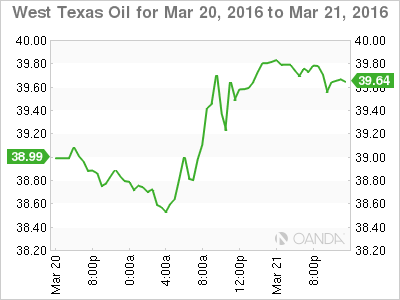

WTI/USD for Monday, March 21, 2016

WTI/USD March 21 at 12:35 DST

Open: 40.48 Low: 40.40 High: 41.81 Close: 41.31

WTI/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 35.09 | 37.75 | 40.00 | 43.45 | 46.69 | 50.89 |

- There is resistance at 43.45

- 40.00 is providing support

Further levels in both directions:

- Below: 40.00, 37.75, 35.09 and 32.22

- Above: 43.45, 46.69 and 50.89