U.S. consumer spending rose 1 percent in September. What does it mean for the gold market?

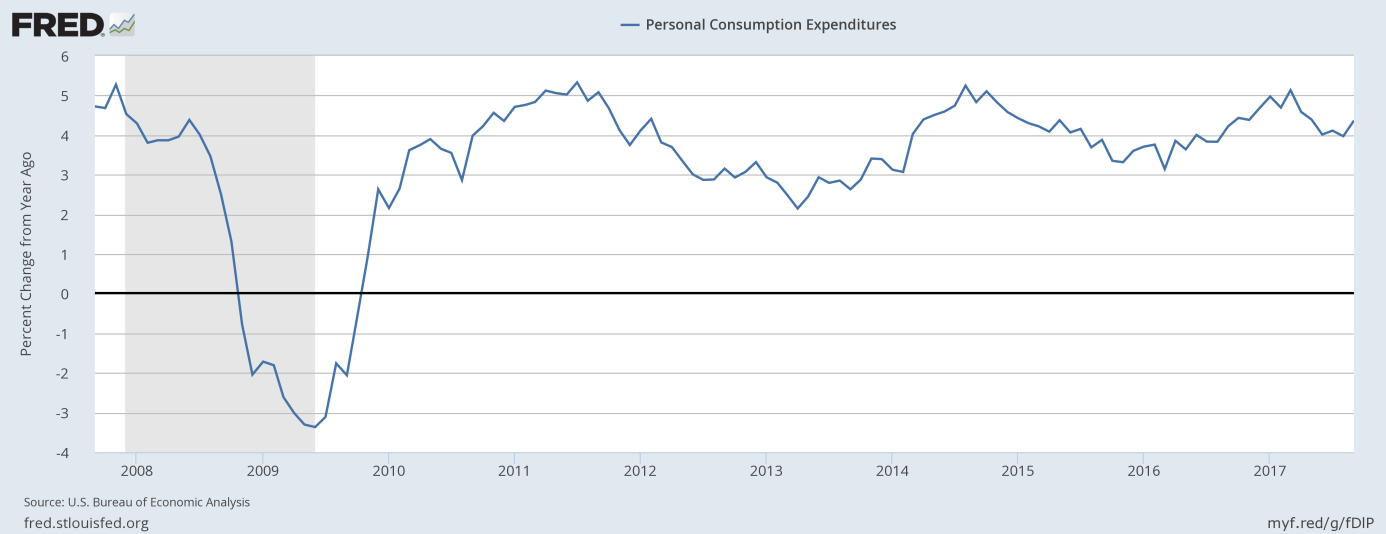

Personal consumption expenditures increased 1 percent in September, following a 0.1 percent rise in August. The rise was strong and slightly above expectations. Actually, it was the biggest gain since 2009. Moreover, real spending increased as well (spending rose 0.6 percent, if adjusted for inflation). And consumer spending rose 4.4 percent on an annual basis, which means that the pace of personal consumption expenditures growth accelerated from August, as one can see in the chart below.

Chart 1: Personal consumption expenditures from 2007 to 2017 (as percent change from year ago).

However, the surge in expenditures was driven by a 14.7 percent increase in spending on new motor vehicles, as Americans replaced vehicles destroyed by hurricanes Harvey and Irma. Hence, the increase in spending is not sustainable.

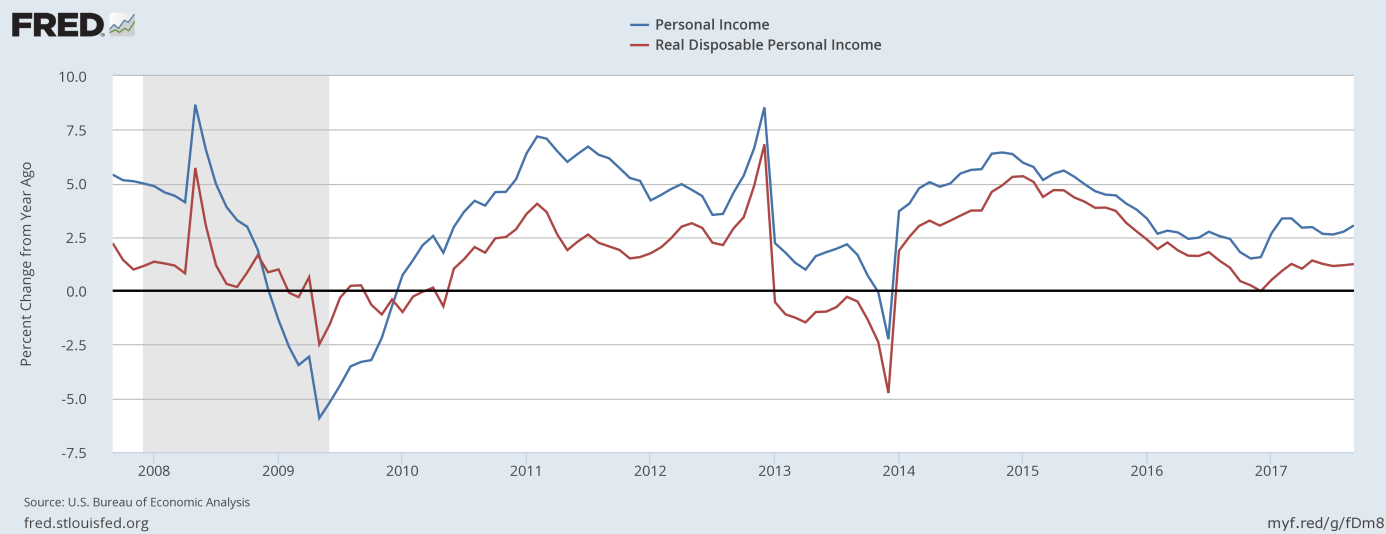

Another reason why we should see some slowdown in the future is the fact that incomes are rising only modestly. Personal incomes rose 0.4 percent in September, following a 0.2 percent increase in the previous month, but real disposable incomes were flat. As a result, consumers still had to dip into their savings to finance their purchases (the savings rate dropped to a 10-year low in September). However, both nominal personal incomes and real disposable incomes accelerated slightly on an annual basis, as the chart below shows.

Chart 2: Nominal personal income (blue line) and real disposable personal income (red line) over the last 10 years (as percent change from year ago).

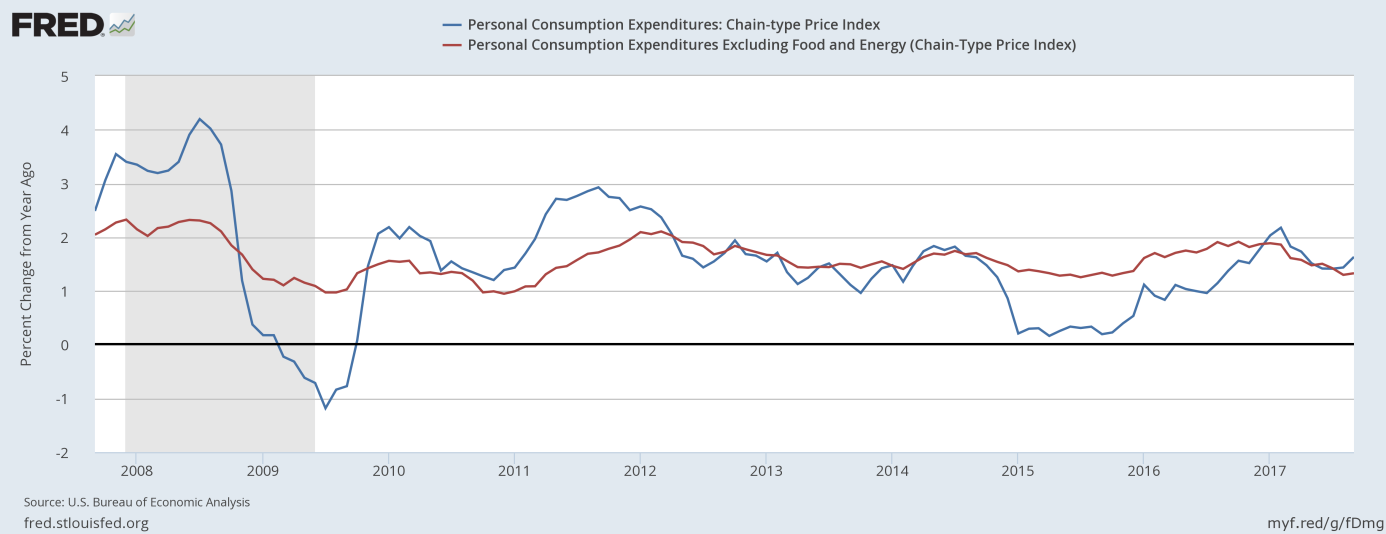

Inflation remained subdued in September. The PCE price index rose 0.4 percent, following a 0.2-percent increase in August. But the core version of the index rose 0.1 percent for the fifth month in a row. On an annual basis, the PCE price index rose 1.6 percent, while the core version jumped 1.3 percent, as in the previous month. It implies a slight rebound, as one can see in the chart below, but it was caused by supply disruptions caused by the hurricanes. However, the pressure on energy prices has already faded, so the inflation rate may decrease in the near future.

Chart 3: PCE Price Index (blue line) and Core PCE Price Index (red line) from 2012 to 2017 (as percent change from year ago).

What does it all mean for the gold market? Well, inflation remained subdued, but the overall report was quite solid. The economy is steadily growing without significant inflationary pressures. Such a macroeconomic mix is not good news for the gold market. However, the recent report was affected by replacement demand after the hurricanes. The next issue will be perhaps more telling. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.