"It’s not the healthiest recovery," but "we believe that we have avoided the worst, and the economic world no longer looks quite as dangerous as it did," says the International Monetary Fund's managing director. That roughly sums up the state of the US economy too, as suggested in today's update of The Capital Spectator's Economic Trend Index (ETI) and Economic Momentum Index (EMI). Both indexes, which reflect a diversified set of economic and financial indicators, remain at levels historically associated with economic expansion. In addition, the near-term projection for these indexes also looks encouraging, based on econometric estimates for next several months.

There are still plenty of macro risks, to be sure, and so the analysis could change quickly, depending on how the April data compares. But based on the current numbers through the March profile, which is nearly complete in terms of economic releases, recession risk remains low. Growth overall is still sluggish, which raises obvious caveats for looking ahead. But it's growth nonetheless and the numbers in hand imply that we'll see more of it for the near term. Let's take a closer look at this analysis, starting with a review of the individual indicators that comprise ETI and EMI:

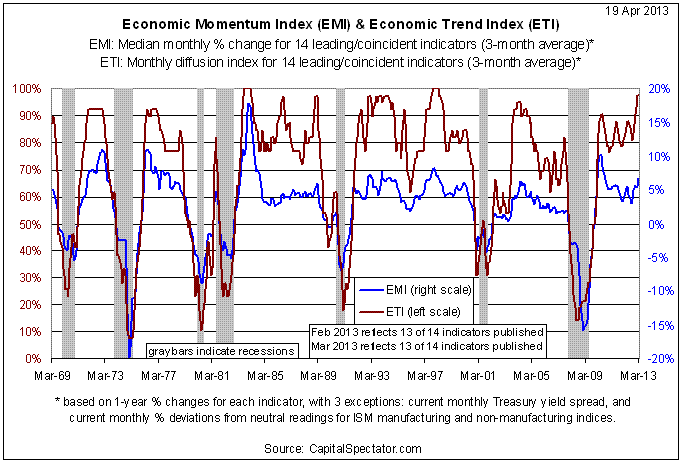

Here's how the indicators in the table above compare in the aggregate, when profiled through the lens of a diffusion index (ETI)—a measure of the percentage of indicators trending positive (as defined in the table's "Transformation" column). A companion index tracks the median monthly changes of the indicators (EMI). Both indexes are computed based on a rolling 3-month average. As you can see, ETI and EMI remain well above their respective danger zones—50% for ETI and 0% for EMI.

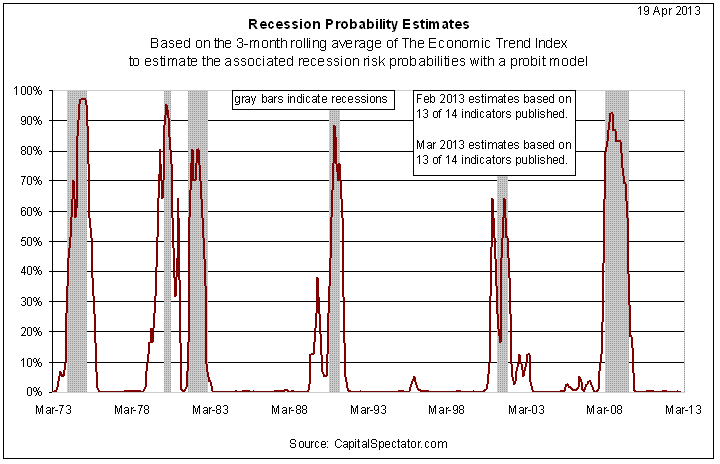

Translating ETI's values into recession-risk probabilities via a probit model also suggests that the economy was trending positive through March, as the next chart shows. Using the current data set through March, recession risk is virtually nil, according to this estimate. (A similar profile emerges for EMI after crunching the numbers in a probit model.)

Finally, let's consider the near-term outlook for ETI and EMI by predicting future values with an econometric technique known as an autoregressive integrated moving average (ARIMA) model. The projections of the ARIMA model, which estimates the missing data points for each month, suggests that ETI will remain at levels associated with growth for the immediate future. Forecasts are always suspect, of course, but recent projections of ETI have proven to be relatively reliable guesstimates vs. the reported numbers that followed (shown by the red squares). As such, the latest projections (the four maroon-colored bars) offer some support for cautious optimism. For comparison, the chart below also includes ARIMA projections published on these pages in previous months, which you can compare with the actual data, as currently known (red squares). The assumption here is that while any one forecast is likely to be wrong, the errors may cancel one another out to some degree by aggregating the estimates.

For additional, context, here are the last three monthly ETI and EMI updates:

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Economic Profile

Published 04/19/2013, 07:46 AM

Updated 07/09/2023, 06:31 AM

U.S. Economic Profile

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.