Finding companies with the criteria you want isn’t always easy. You could spend hours searching ticker after ticker, only to find companies which aren’t worthy of your hard earned cash. An easier way to navigate through this is by using high quality stock screeners. Screening helps investors narrow down companies to invest in based on their ability to meet every criteria selected. Any company who misses even one of the criteria requirements will be filtered out.

This lets one easily choose ideal metrics. Screens are effective because they sift out bad stocks and only keep the cream of the crop in. It isn’t always easy to create an effective screen. Our Zacks Premium Screens have helped with this, bringing profits to many investors over time. Our predefined criteria are chosen carefully to capture special kinds of companies.

Today, we’ve dug up two stocks using one of our premium screens known as “Quality Fundamental Outperformers”. Some of the metrics of this screen requires a stock to have a grade of “A” for momentum in our Style Scores and a Zacks Rank #1 (Strong Buy). One additional criterion we added to the screen allowed us to search for companies from the tech sector. This space of the market is quickly evolving and changing our world, so it makes sense to invest in some high-flying candidates from this space.

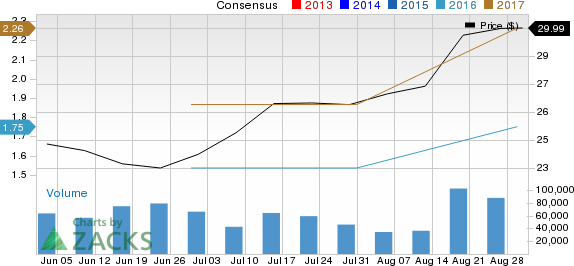

Applied Materials Inc- (NASDAQ:AMAT)

Applied Materials manufactures and services semiconductor wafer fabrication equipment and other related parts for the broader semiconductor industry. Their customers include various types of semiconductor manufacturers. The company also manufactures display and solar products. AMAT is a Zacks Rank #1 (Strong Buy) and the stock has gained over 22% in value since June.

In spite of the recent positive share price performance, AMAT still trades at a reasonable valuation. The stock has a forward PE and PEG of just 17.13 and 1.09 respectively. On top of all this is the fact that earnings and orders came in at all-time highs over the most recent quarter.

On August 18th, the company posted earnings results from its third quarter and it beat the Zacks Consensus Estimate by 6.38%. Since releasing its Q3 earnings report, the stock has picked up 7.8% in value. Things are looking up in the near term as well since 16 analysts have unanimously revised their earnings estimates upwards for the fourth quarter over the last 60 days. This year, Applied Materials is expected to see its sales and earnings grow by 12.17% and 47.13% respectively.

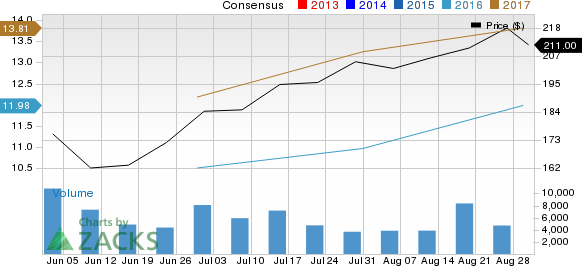

NetEase Inc- (NASDAQ:NTES)

NetEase develops applications, services, and other technologies for the Internet in China. It offers online gaming services that are developed in-house. It also provides online advertising, community services, entertainment content, and e-mail services. NetEase has a market cap of $27.98 billion.

Like AMAT, NetEase trades at pretty attractive valuation levels. Its forward PE comes in at 17.61 and it has a PEG of 0.67. In the last three months, NTES stock has gained 20%, and over that span of time our fiscal year EPS consensus estimate has improved, going from $10.50 to $11.98. This year, sales are expected to increase by 55.61%. EPS is forecasted to see a large jump this year as well, with expectations coming in at growth of 52.47%.

Bottom Line

One magical screening ingredient which can’t be overlooked is the Zacks Rank #1 (Strong Buy). The rank helps to find companies which look like strong earnings candidates. In addition to this great metric, the Zacks Premium Screens help you to add other criteria to find the most superior investment choices. While this article outlined potential candidates from one screen, the Zacks Premium service gives you access to the “Quality Fundamental Outperformers” and 45 other premium screens designed to give you superior investment returns.

To use Zacks Premium Screens to find more stock picks based on criteria that’s most important to you— plus, gain access to the Zacks Rank for your stocks, mutual funds and ETFs; Zacks Style Scores, Equity Research Reports; Focus List portfolio of 50-longer-term stocks and more—start your 30-day free trial to Zacks Premium.

NETEASE INC (NTES): Free Stock Analysis Report

APPLD MATLS INC (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research