This is a challenging time for stocks. Quarterly S&P 500 earnings are going down, and global traumas are causing investors to panic.

In yesterday’s issue, Matthew Carr shared some compelling tables and charts suggesting we could be staring at a market bottom. If so, things could get a whole lot rosier in the near term. But regardless, there is one outside force that should send select stocks surging...

The presidential election.

Some stocks are proven winners during elections. I’m going to profile one industry and two possible plays for you today.

Politics as Usual

To be clear, this isn’t a new idea. During the Obama/Romney face-off, I studied companies that gave the most money to each presidential candidate. No matter which side the companies contributed to, share prices went up.

There are a couple reasons for this. For one, broad markets went up anyway. The S&P 500 is up about 50% since the November 2012 election.

The other reason is that companies who make political contributions don’t stop with the president. They donate to all sorts of people in Congress. And those donations pay off.

A study by the Sunlight Foundation found that 200 of America’s most politically active corporations spent a combined $5.8 billion on federal lobbying and campaign contributions in the years leading up to the 2012 election. Those same companies reaped $4.4 trillion in federal business and support.

That’s something like a 75,762% return on investment. Just politics as usual in Washington.

But my focus during this election cycle isn’t on campaign contributors. I’m going after bigger, more profitable game..

Out Goes the “Big-Government Anti-Gun Socialist”...

I’m talking about gun manufacturers.

Wait a minute - what do gun manufacturers have to do with elections?

They reap the publicity of drum-beating by the National Rifle Association (NRA) and other groups. The NRA and its friends tell people that Democrats are going to take their guns away. People run out and buy more guns.

After Obama beat McCain in 2008, gun sales surged.

Then, in his first term, the only gun law President Obama passed was one that made it easier to bring firearms into national parks. That didn’t matter, though.

Running up to the 2012 election, the NRA warned that if that “big-government anti-gun socialist” won a second term, he’d take everyone’s guns away for sure.

Guess what happened to gun sales?

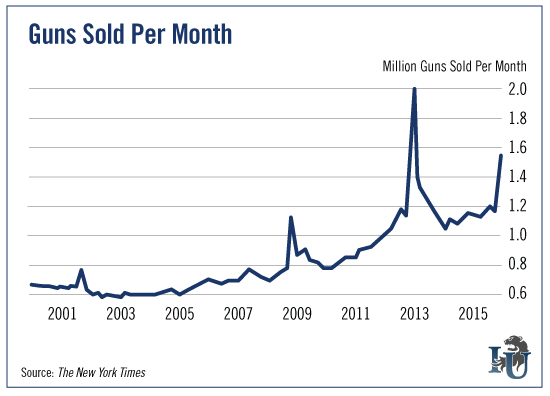

You can see that sales slowed a little after the first Obama victory. Then they really accelerated. This was due to rising fears of gun confiscation - and an increased number of multiple-victim massacres.

For example, after the Sandy Hook shootings in 2012, gun sales spiked to 2 million in one month. They spiked again after the terrorist attack in San Bernardino last month.

In fact, full-year gun sales hit the highest level on record in 2015.

And now, guess what? After years of not doing anything about guns, President Obama actually did something about guns. He issued an executive action that will...

- Implement more universal background checks

- Allow sharing of private mental healthcare records

- Close the so-called “gun show loophole” (sales of firearms by private individuals).

You can practically hear heads exploding across the Second Amendment landscape.

Of course, Obama has one foot out the door. And if the NRA didn’t like what he had to say, you can bet they’re clutching their Berettas over who could be next...

Here Comes Hillary

It’s looking like Hillary Clinton will be the Democratic nominee. And Hillary has promised even tougher rules on guns. That includes removing the immunity gun manufacturers have - by law - from being sued when their guns are used in a crime.

Here’s the thing. Gun manufacturers funnel tens of millions of dollars into the NRA. The group basically works to preserve and promote the interests of gun manufacturers. It does that with ads and campaign contributions.

How do you think those companies might react when they’re threatened with being held liable for gun violence? I’d say they’ll freak out the same way many gun owners did at the thought of a Kenyan Communist taking away their guns.

To be sure, Hillary could never get such legislation through Congress. It’s dead on arrival. But it won’t matter. Just the idea of further gun restrictions should whip up a frenzy of rhetoric... and sales.

And that brings me to two stocks.

These companies did very well during the last election. They’ll ride a tidal wave of campaign speeches, talk-radio rhetoric and Second Amendment fear to higher profits this year, too.

Hitting New Highs and Raising Guidance

Remember how I told you the S&P 500 rallied 50% after the last election? In that time, one of these stocks has shot up 85%. (In fact, it recently hit a new high.) The other rallied 89% in the two years after the 2012 election before backing off.

The stocks are Smith & Wesson Holding Co. (O:SWHC) and Sturm, Ruger & Co. (N:RGR). Both spiked after the San Bernardino shootings and recently pulled back to support.

Smith & Wesson owns one-sixth of the U.S. handgun market. The company said units shipped jumped 21% in the most recent quarter. Last month, it raised earnings guidance for this quarter twice.

Smith & Wesson trades at 13.75 times forward earnings, which is relatively cheap. And it just announced plans to expand through acquisitions.

Sturm, Ruger & Co. has a higher price-to-earnings multiple than Smith & Wesson but makes up for it by paying a 2.5% dividend yield. It also buys back its own stock. Plus, it’s debt-free.

You may or may not like guns. But as an investor, there is plenty to like about gun manufacturers.

Especially in an election year.