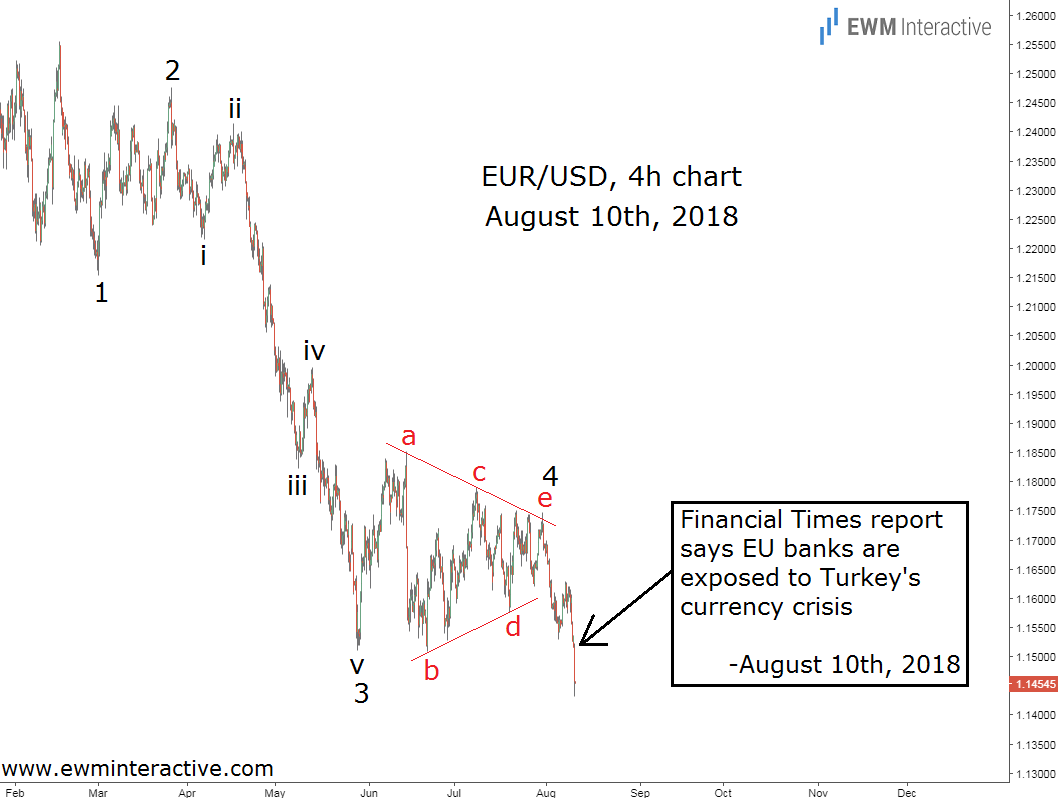

EUR/USD’s selloff has resumed. The pair fell to as low as 1.1432 earlier today, following a Financial Times report stating the European Central Bank is concerned about some European banks’ exposure to Turkey’s currency crisis. Spain’s BBVA (MC:BBVA), Italy’s Unicredit (MI:CRDI), and France’s BNP Paribas (PA:BNPP) were among the big names mentioned in the report. Now, let’s see how bad it is on the price chart of EUR/USD below.

Today’s EURUSD slump fits into the position of wave 5, following a triangle wave 4 within a larger five-wave impulse to the south from 1.2556. As you can see, the Financial Times report only reinforced a bearish trend, which has been in progress for months already.

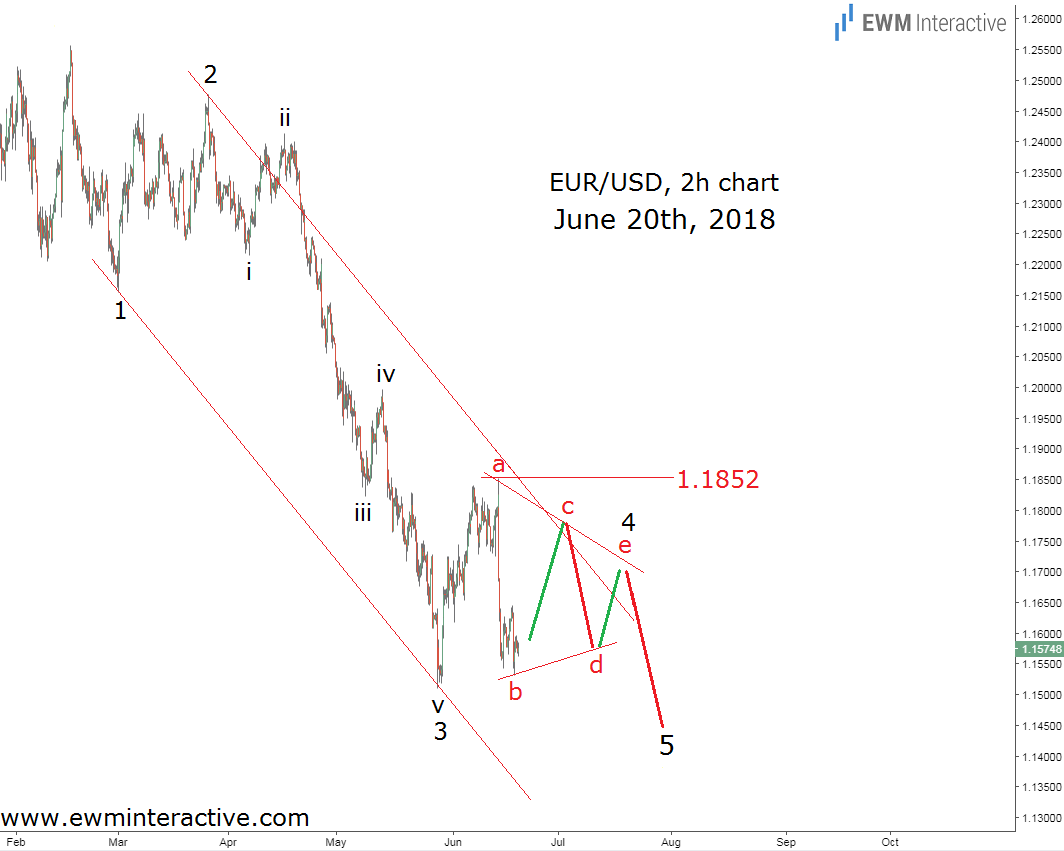

As they usually do, the media’s explanation for today’s EUR/USD weakness makes sense. The problem is that it indirectly suggests that without the FT report, today’s EUR/USD crash would not have happened. As Elliott Wave analysts we cannot accept that. In fact, the chart below, sent to clients on June 20th, proves that the stage for the European currency’s current plunge was set nearly two months ago.

As it turns out, the Elliott Wave principle managed to prepare traders not only for the recent decline, but for the occurrence of the entire triangle pattern, as well. Given the bigger picture outlook, which is also included in our premium analyses, we assumed a five-wave impulse was developing from the top at 1.2556.

Keeping in mind the guideline of alternation, it made sense to expect a sideways correction in wave 4, most likely a triangle, since wave 2 was a sharp zigzag recovery. If this count was correct, as long as 1.1852 remained intact, waves “c”, “d” and “e” of 4 had to emerge before the bears return to drag EUR/USD to a new low in wave 5.

This chart did not tell us “why” this was going to happen. It did not come up with explanations like “Trump’s trade war weighs on the Euro” or “Turkey’s crisis threatens European banks.” Instead, it only provided us with a road map for the most likely Elliott Wave scenario. The news that came out after that simply fit into it and was quickly absorbed by the pattern. We believe that if it wasn’t the Financial Times report and Turkey’s crisis, something else would have triggered EUR/USD’s slump. Unfortunately, you never know exactly what or when. That is we prefer to rely on the Elliott Wave principle for guidance.