It was announced this week that the U.S. and Mexico are very close to settling on the next version of their trade policy. But don’t get distracted. The real trade war is going on with the great red dragon.

Since 2017, China has been by far the biggest exporter to the U.S. It accounts for more than 20% of total U.S. imports (almost double that of each Mexico and Canada). With few labor laws and regulations in China, its goods are often much cheaper than American alternatives. This makes it difficult for U.S. companies to compete, so tariffs are meant to even the playing field.

Democrats and Republicans agree that U.S. trade policy with China has to change. American businesses should not have to step into the ring against Chinese counterparts whose lack of human rights regulations gives them weighted gloves. Even Sen. Elizabeth Warren, one of the president’s toughest critics, admitted, “Tariffs should be part of America’s trade policy moving forward.”

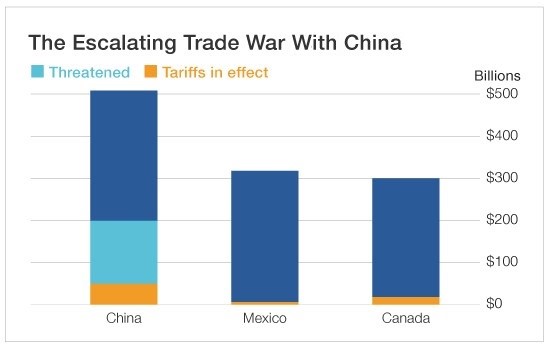

Last Thursday, the U.S. put in place another $16 billion in tariffs on Chinese imports. This brings the total active tariffs on Chinese goods to $50 billion. That's almost 10% of the overall $506 billion that is shipped in each year from China.

The new tariffs affect everything from bridge parts to speedometers. And they are further proof that the U.S. is not backing down from this trade war. President Trump is serious about bringing down the trade deficit (total value of imports minus total value of exports) - and for good reason too.

The Bureau of Economic Analysis found that the trade deficit grew from $504.8 billion in 2016 to $568.4 billion in 2017. This is a direct result of the U.S. importing more than it exports. In order to reverse that growth, the President’s plan includes another $200 billion in tariffs on Chinese imports in the near future.

On the other side, China has placed tariffs on $16 billion of American goods. Many American exports going into China, including cars, motorcycles, coal, grease and plastic products are now assessed a 25% charge right off the bat.

Though we aren’t hearing about it much in the States, the Chinese are feeling the heat from the new tariffs already. After the latest round of U.S. tariffs were levied, Chinese Finance Minister Liu Kun acknowledged they’re already affecting Chinese jobs and causing noticeable problems for the economy as a whole.

It seems fitting that this Labor Day weekend we are talking about American businesses and the American worker, both pillars of our society. The scales of world trade have been out of balance for a while, and our government is within its rights to pull what levers it can to protect U.S. workers and businesses - and coerce the red dragon to comply.

Remember, this is just the beginning. Even after this latest wave of tariffs, there are still $150 billion in Chinese imports that will be hit with tariffs down the line. That is sure to be a great boon to American businesses, and the stock market should reflect that in the coming months.