This firm stands as a formidable force in North America’s energy infrastructure landscape, boasting a storied history dating back to 1951. Headquartered in Calgary, Alberta, Canada, TC Energy (TSX:TRP) operates a sprawling network of pipelines, power generation facilities, and energy storage assets, spanning the length and breadth of Canada, the United States, and Mexico.

At the heart of TC Energy’s operations lie three core business segments:

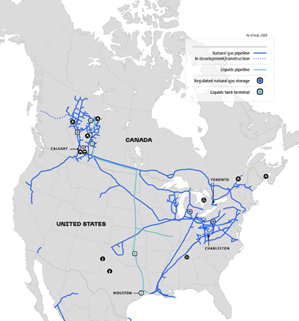

Natural Gas Pipelines: TC Energy commands an extensive web of natural gas pipelines, totaling approximately 93,700 kilometers (58,200 miles). This intricate system serves as the lifeblood of North America’s energy supply, efficiently transporting natural gas from production hubs to distribution centers, ensuring a consistent flow of clean energy for homes, businesses, and industries. This network taps into almost every major oil and gas basin in North America, and transports more than 25% of the continent’s daily gas demand.

Liquids Pipelines: The company’s reach extends to a robust liquids pipeline network, spanning about 4,900 kilometers (3,000 miles). This network is instrumental in ferrying crude oil, natural gas liquids (NGLs), and refined products, bolstering the region’s energy infrastructure.

Power and Storage: TC Energy diversifies its portfolio with a presence in power generation. The company operates a range of power plants, including natural gas, nuclear, and renewable energy facilities. Furthermore, TC Energy has ventured into energy storage projects, enhancing grid reliability and facilitating the integration of renewable energy sources. All in all, TC Energy produces more than 4.6 GW of power, about 70% of which comes from emissions-free nuclear energy.

This huge network of power lines, pipelines, and power generation means TC Energy is at the heart of America’s energy infrastructure – which in turn means it’s at the heart of the US economy, no matter what technologies we develop.

TC Energy’s investments extend south of the border, where the company is contributing to the development of natural gas pipelines in Mexico, bolstering the country’s burgeoning energy demands and fostering regional economic growth. The company is also actively exploring opportunities in renewable energy, including the construction of wind and solar projects.

The company also boasts an average annual shareholder return of 11% since 2000, and sports a 3% to 5% expected annual dividend growth rate.

Recommended Action: Buy TRP.