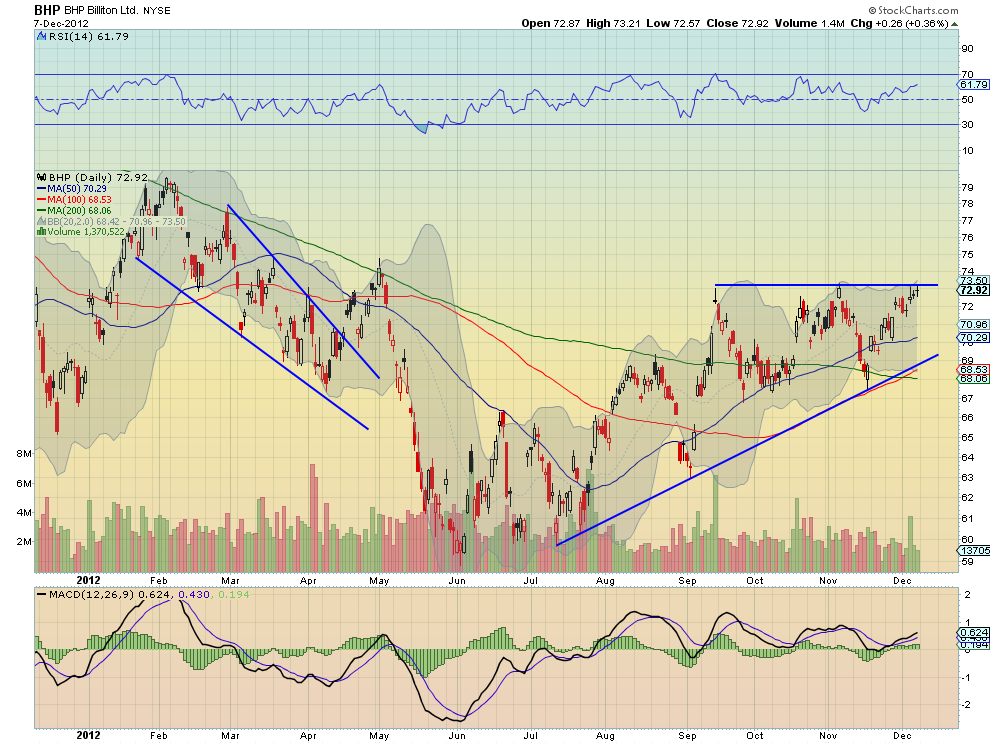

BHP Billiton (BHP) had been capped by the 200-day Simple Moving Average (SMA) throughout the first 8 months of the year. Moving above it in September and then retesting in October and November, it is now a floor under the stock. On a shorter term basis the series of higher lows since July are creating an ascending triangle with resistance at 73.25.

Testing the top of that triangle now it has a Measured Move higher to 83.50 on a break above the top rail. There is resistance at 74.75 and 77.80 followed by 79.66 along the way to that price objective. Support lower comes at 72.50 and 71.40 followed by 69.30 and 67.40, below the 200 day SMA.

Trade Idea 1: Buy the stock on a break over 73.25 with a stop at 72.25.

Trade Idea 2: Buy the January 75 Calls (offered at $1.20 late Friday) on a break over 73.25.

Trade Idea 3: Buy the January 75/80 Call Spreads ($1.03) on a break over 73.25.

Trade Idea 4: Sell the January 67.5 Puts (58 cents) on a break over 73.25.

Trade Idea 5: Buy the January 75/80 Call Spread Risk Reversal selling the January 67.5 Puts (45 cents) on a break over 73.25.

Trade Idea 6: Buy the February 75/80 Call Spread Risk Reversal selling the February 67.5 Puts (27 cents) on a break over 73.25

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Saturday which, heading into next week sees the markets are slowing but positive. Gold looks to consolidate the latest move lower while Crude Oil joins it to the downside. The US Dollar Index is bouncing higher while US Treasurys are set up to move lower or consolidate.

The Shanghai Composite and Emerging Markets are biased to the upside with the Chinese market doing so in a downtrend while Emerging Markets are gaining strength. Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. The SPY and IWM seem strong while the QQQ is the weakest of the 3 and should be the one to watch on a rollover. Use this information as you prepare for the coming week and trade’m well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post