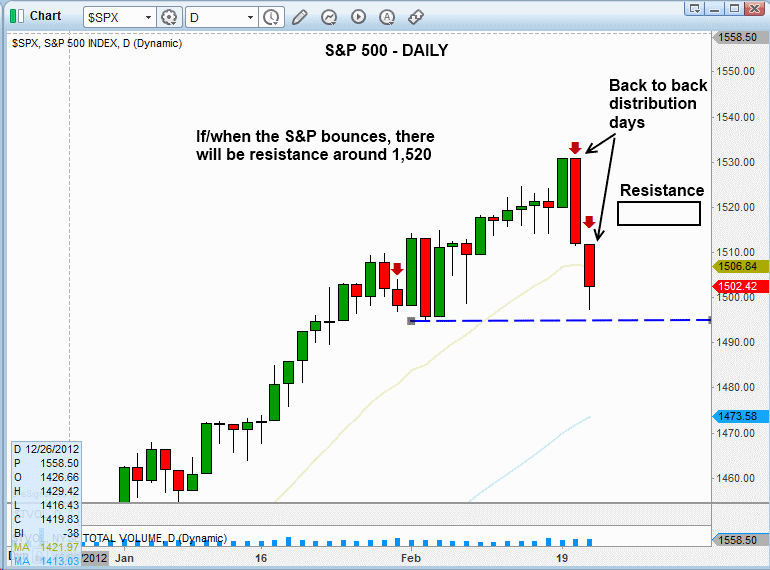

For the second day in a row, the broad market sold off across the board on higher volume. Although the percent losses were not as bad as Wednesday, the S&P 500 followed through to the downside for the first time in 2013. With turnover increasing on the both the Nasdaq and NYSE, the S&P 500 and Nasdaq have posted back to back distribution days.

Whenever distribution begins to cluster, we take notice. Although we never care whether or not stocks are “overbought,” the increasing presence of institutional selling is indeed one of the most important factors to apply when assessing the health of a rally.

Given the sudden reversal in market sentiment over the past two days, this is the perfect time to share our top 2 tips for managing your trading account in a stock market that may be forming a top:

1.) Be sure you know and are on aggressive mental defense against these 4 most dangerous psychological emotions for stock traders (greed, fear, hope, and regret). Given the sharp losses of the past two days, traders absolutely must be on alert for the natural human emotion of paralyzing fear that may prevent you from simply cutting your losses on any losing trades that have already hit your stop prices. To ignore your predetermined stop losses is always tantamount to playing Russian roulette with your trading account. But this is even more so the case right now, as the recent rally is beginning to show valid technical signals of a potential top.

2.) In case you missed most or all of the rally of the past two months, perhaps because you didn’t believe in it for whatever reason, you are now probably feeling the pain of regret. If this is the case, right now you must be very careful to avoid being a “Late To the Party Charlie” (LTPC). While the stock market’s current pullback may indeed turn out to be a low-risk buying opportunity, it is dangerous and way too early to make that determination now.

As far as the charts of the major averages go, the S&P 500, small-cap Russell 2000, and S&P Midcap 400 appear to be in decent shape. The same can not be said of the Nasdaq Composite, which has taken a beating the past two sessions and is already closing in on intermediate-term support of its 50-day moving average. The Nasdaq 100 Index, which basically did not budge during the entire rally in the rest of the broad market, is already trading below key support of its 50-day MA.

Looking at the daily chart of the S&P 500 below, it appears the price may be headed for an “undercut” of the prior swing low, around the 1,494 area:

If and when the S&P attempts to bounce from its current level, the subsequent price and volume action that immediately follows any recovery attempt will be extremely important at determining whether stocks are merely take a breather, or if the rally is dead.

Next week’s price action in the S&P is important because there is a cluster of technical price resistance around the 1,515 to 1,520 area (annotated by the black rectangle on the chart above). Four sessions of stalling action last week created overhead supply around 1,520, while the 1,515 level represents resistance of a 50% Fibonacci retracement, based on the range from the February 20 high down to the February 21 low.

If the S&P 500 generates another distribution day that follows just a feeble, light volume bounce off the current lows, that could be the nail in the coffin for the current rally. Still, unless leadership stocks suddenly begin breaking down en masse, a pullback to the 50-day moving average of the S&P 500 would be considered normal within the context of the strong rally of the past two months.

As we closely monitor price and volume action of the broad market over next week, we will gain a much better idea as to the likely direction of the stock market’s next major move, which will automatically cause our rule-based stock market timing system to be adjusted accordingly.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Top 2 Trading Tips For A Possibly Topping Stock Market

Published 02/23/2013, 06:11 AM

Updated 07/09/2023, 06:31 AM

Top 2 Trading Tips For A Possibly Topping Stock Market

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.