Let’s talk about this banking “crisis” one more time. Because even though it’s starting to fade from the headlines, it’s still giving us a terrific setup for 9% dividends and upside.

What we’re going to talk about today is the very essence of contrarian investing. I’m talking about profiting from the gap between what the media is (often breathlessly!) reporting and what regular folks on the ground actually think.

And if you’ve been to any news website lately, you could be forgiven for thinking this banking issue sounds like it could spark a mass panic and a bank run, taking down the economy with it. That’s the media’s take. But what about regular folks on the ground? Are they standing ready, debit cards in hand?

Well, no.

According to a new Harvard CAPS/Harris Group poll of over 2,000 Americans, the vast majority aren’t scared of a bank failure. In fact, 91% of respondents said they weren’t bothered or thought it would have a small effect on them. “Surprisingly, while Wall Street is fixated on the banking crisis, most average Americans show little concern and believe their deposits are safe,” Mark Penn, a director of the poll, said.

While only 40% said they’re not worried at all, if not for the overhyped coverage, that number would be closer to 100%, especially now that all deposits (even from failed Silicon Valley Bank) are guaranteed. Moreover, the other troubled banks have already been taken over or have gotten guarantees to keep humming along.

It’s good that people aren’t panicking, but there’s still way too much-stoked fear, so let’s talk about how things are likely to play out. A little further on, we’ll look at a 9%-yielding closed-end fund (CEF) that’s nicely positioned to profit as today’s deep-discounted banks return to favor.

Why Banks’ Risk Is Completely Misunderstood

A bank doesn’t keep all of its customers’ money in a vault at once; like all businesses, they use leverage to boost profits. Unlike most other businesses, though, banks have very strict limits on how much leverage they can use.

Those limits are usually no big deal, unless a bunch of depositors take their money out at once. Which was what happened to Silicon Valley Bank when billionaire Peter Thiel told many startups he’d invested in to take their money out. When your customer base is a close-knit community in one sector (like a bunch of startups in Silicon Valley), this is a huge risk.

Big banks like Morgan Stanley (NYSE:MS), however, don’t have that risk, because they have a large and varied base of depositors. Which is why the results of the Harvard survey are both important and reassuring: not enough Americans are scared, meaning your money is safe.

And yet…

Here’s an Opportunity

Morgan has, like many banks, erased its 2023 gains, and entirely because of bank-run fears that started with Silicon Valley Bank (and to be sure, memories of the 2008 financial crisis don’t help). And since the Harvard poll tells us a bank run is unlikely, Morgan is now a strong buy.

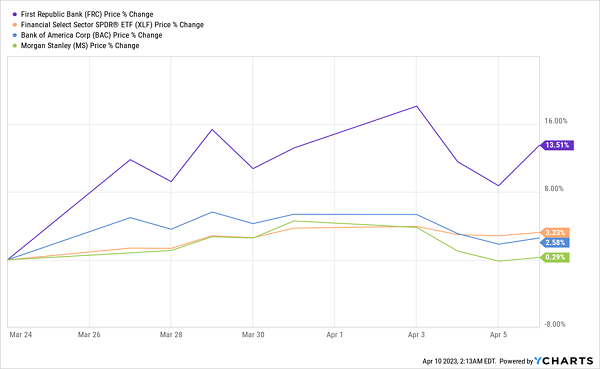

However, the sector as a whole remains volatile in the short run, though we have seen the beginnings of a recovery, as investors try to reprice both failing banks, like First Republic (FRC), and healthy banks, like Bank of America (NYSE:BAC) and Morgan Stanley.

Big and Small Banks Struggle to Find Their Footing

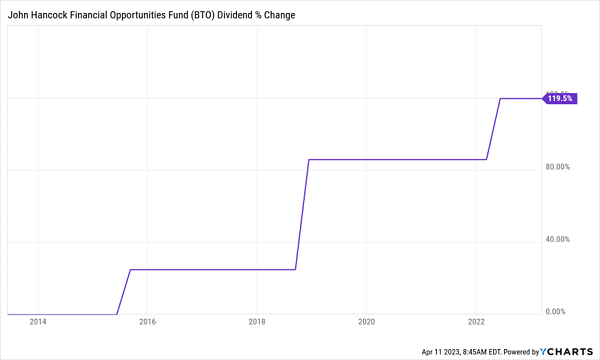

John Hancock Financial Opportunities Fund (NYSE:BTO) yields an outsized 9% today. We also love the fact that the CEF’s payout has more than doubled in the last decade:

Big Income Stream Keeps Getting Bigger

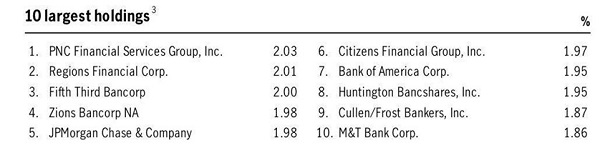

The portfolio not only holds the best banks but it also didn’t (and currently doesn’t) have Credit Suisse, First Republic or any other dogged bank as a major position:

Source: John Hancock

Finally, a note about that management team. The fund’s three current managers have been at their posts for years. But the thing we love is that they were all understudies of the former manager, Susan A. Welch, who had a long career in bank regulation before she left.

That expertise, which has almost certainly been handed down, is more important than ever today—and it gives this fund extra appeal.

***

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."