The dynamics of stocks and currencies on Tuesday were comparable in amplitude, but in the opposite direction to Monday. Investors and traders seemed to be buying beaten shares, expecting stimulus from central banks and governments.

The rush of early buyers should be cooled down. It is much more likely that we saw a peak of volatility on Monday in the markets, but it may not coincide with the bottom of the recession.

On Wednesday morning, Asian indices and futures on American indices turned red again. Investors were disappointed that the US government did not make any announcements, which brought back the demand for safe assets, although not in such an ugly form as on Monday. Once again, the dynamics of the currency market may become a reflection of investor sentiment. And in this case, there are more negative signals tuning for further decline of the markets.

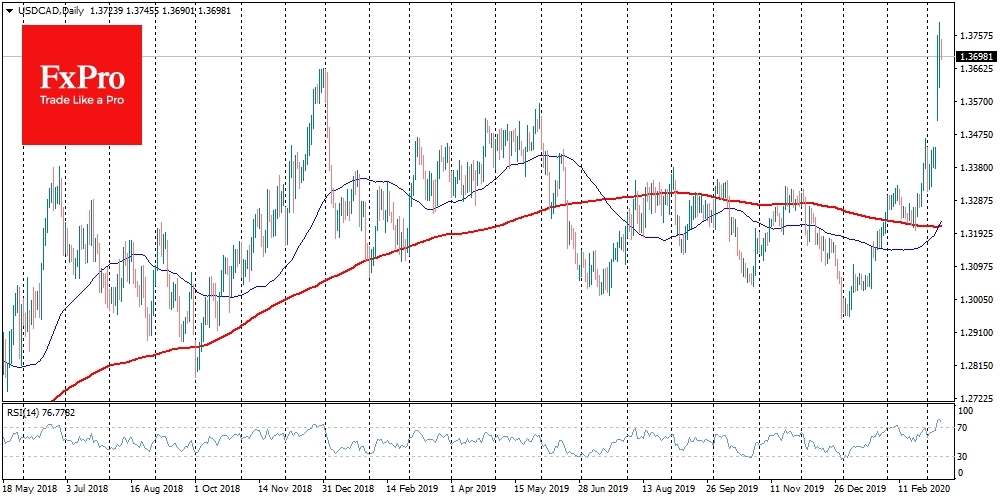

USD/CAD, despite the fluctuations in the stock market and cautious purchases of oil, updates the highs on Tuesday. The pair seems to be moving on inertia, having risen above the tops of late-2018 and mid-2017, reflecting the negative mood of American investors.

The AUD/USD trades on Wednesday morning around 0.6500. On Monday alone, the Aussie dropped from 0.6620 to 0.6300 and rose to 0.6680. However, the pair is now near this year low. Most likely, the markets are tuning that the peak of decline is already behind us as the Chinese factories are returning to work. At the same time, investors are waiting for some positive drivers, not rushing to buy risky assets. A decrease in AUDUSD to the same levels of the midst of the global financial crisis showed that sharp fluctuations might become a new reality for Aussie for the next few months. However, the bottom may have already passed here.

EUR/CHF is quite suitable as an indicator of sentiment in Europe. Since last December, it keeps the downward trend, avoiding the increased volatility in recent days. After sinking below 1.06 at the end of February, the pair entered the lows of 2015 area, reflecting the gradual decline of economic activity in Europe. Buyers became slightly more active as the exchange rate dropped below 1.06, and some indicators register that the selling momentum is weakening. However, so far, there are no significant signals that would allow us to talk about trend reversal upwards from Monday.

Neither buyers’ activity nor government actions allow us to say that the lowest point for the world markets are already behind us.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Currencies Indicate That The Market Bottom Is Yet To Come

Published 03/11/2020, 05:56 AM

Updated 03/21/2024, 07:45 AM

Currencies Indicate That The Market Bottom Is Yet To Come

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.