Container shipping companies have not been immune to the disruptive factors roiling markets at the moment, namely rising interest rates, soaring inflation and a potential recession, not to mention the war in Eastern Europe.

However, we remain bullish on the global shipping industry for several reasons. Below are three charts showing how carriers look to be in positive territory heading into year-end.

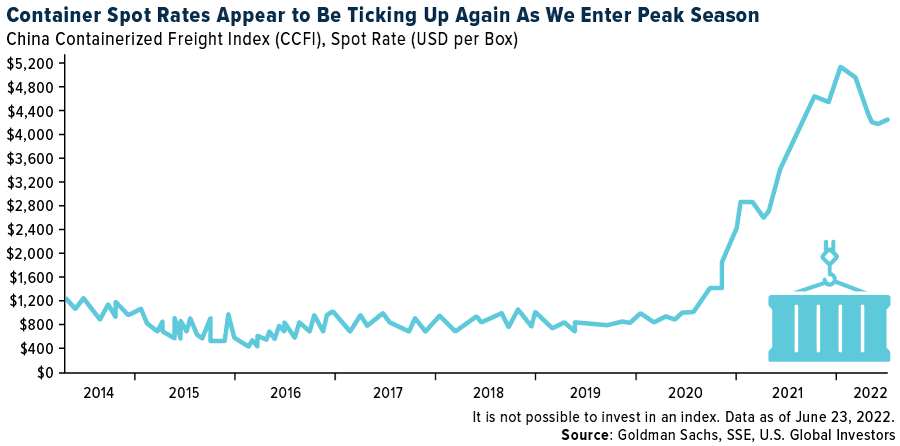

Shipping Rates Remain Highly Elevated on a Historical Basis

The equity research team at Goldman Sachs recently released a report highlighting corporate commentary from its annual conference held in London. Companies across the transport, leisure, construction and business services industries attended, with key takeaways focused on the global transport markets, specifically air travel and shipping.

Below is one of the most compelling charts from the bank’s report. Spot rates for containers leaving major Chinese ports are off their peaks from earlier this year as consumers’ spending habits have shifted from goods to services, but there are two things to keep in mind here. Number one, despite the decline, rates are still highly elevated on a historical basis, which we believe could result in shipping companies posting another profitable year. And number two, it appears that rates may be trying to turn up again as we enter the peak summer shipping season.

Shipping Is a Long-Term Growth Story

Similar to other industries, shipping is seeing higher rates of volatility due to sporadic COVID lockdowns, the conflict in Ukraine, surging inflation and other challenges. As a result, shares of container shipping companies have fallen from their March highs.

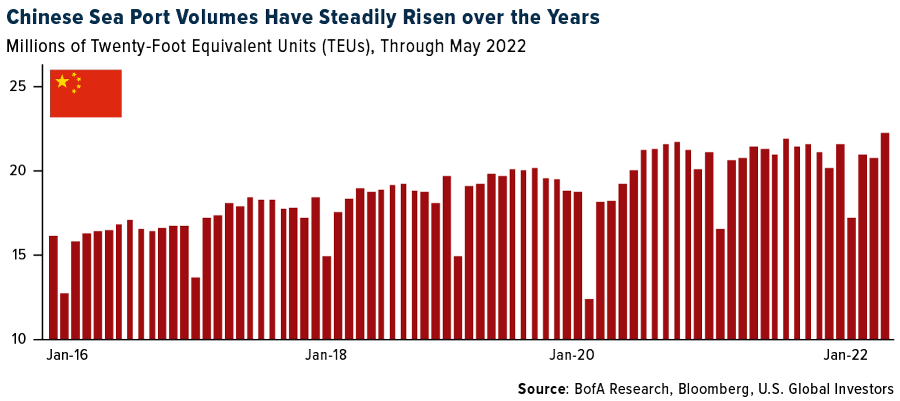

It’s important for investors to keep in mind, though, that shipping is a long-term growth story, particularly in emerging and developing economies. Many countries, most notably in Asia, are undergoing significant economic change as millions of individuals and families join the middle class, a group whose members spend between $11 and $110 a day. According to the World Data Lab, more than 1 billion Asians are expected to join the global middle class by 2030.

We believe this could be constructive news for companies involved in the global shipment of goods. As you can see below, sea port volumes in China have steadily been rising over the years as more and more households have entered the middle class and insisted on buying consumer goods—from furniture to appliances to gadgets—that reflect this socioeconomic change.

Global Dry Bulk Demand Expected to Increase as Need for Raw Materials Expands

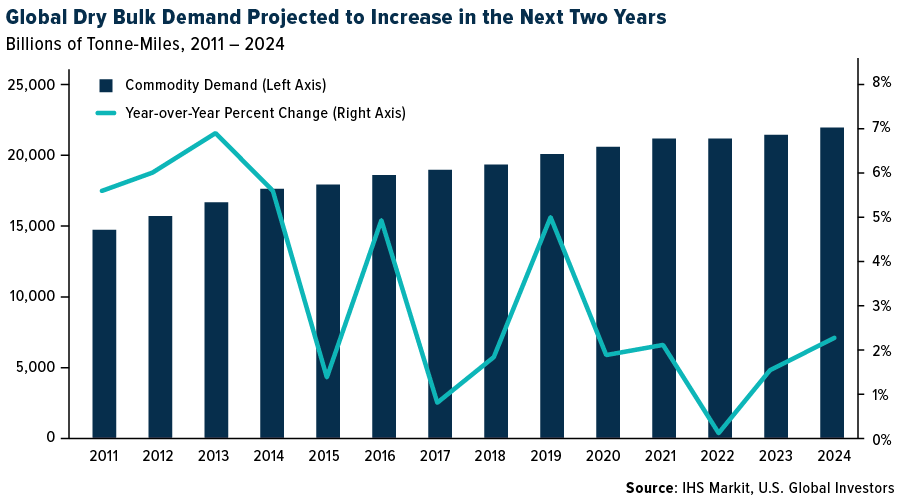

Dry bulk cargo includes the shipment of commodities and raw materials such as Iron, steel, wheat, sugar, coal, and cement. As the global population continues to expand, the more of these materials will need to be moved across the globe for use in infrastructure, manufacturing, food and other applications. Again, we believe this could benefit companies responsible for carrying dry bulk.

Below is IHS Markit’s dry bulk demand forecast through 2024. Although year-over-year growth is expected to go sideways in 2022 due to sky-high inflation, demand growth could resume in the following two years as prices stabilize.

What this means is now may be a good time to get exposure.

The China Containerized Freight Index is the most widely used index for sea freight rates for import China worldwide. This index has been calculated weekly since 2009 and shows the most current freight prices for container transport from the Chinese main ports, including Shanghai. Smart-beta refers to investment strategies that emphasize the use of alternative weighting schemes to traditional market capitalization-based indices.

***

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.