As dividend investors, safe payouts are our No. 1 (and 2! and 3!) priority. And with interest rates soaring and a recession looming, we’re going to be bigger sticklers than ever about this in 2023.

That’s why, last week, we talked about five popular dividend stocks whose payouts could be slashed this year. If you hold any of these laggards, you need to sell them yesterday.

But how do we tell which dividends are safe?

Well, there’s a surefire indicator that no one talks about: insider buying. And when you combine insider buying with another “signal” we look for in stock, high short interest, you can set yourself up for safe, growing dividends and serious price gains, too!

Let’s start our “contrarian 2-step buying plan” with those corporate insiders, because their purchases are almost always a bullish sign for us.

Only 2 Reasons Why Execs Buy

There are lots of reasons why a corporate exec might sell their company’s stock: to put in a pool, send a kid to school, pay for a divorce—you get the idea. But there are only two reasons why they’d buy:

- Because they believe the current dividend is safe, and

- They think the stock price is going to go up.

That first point is never discussed when it comes to insider buys, but it should be. Because you can bet that if an executive is collecting a fat dividend from their stock and they buy more, they’re sure the company can keep that income stream rolling out.

This brings me to “boring” chemical maker Chemours Co. (CC), which we bought in our Contrarian Income Report advisory in June 2020, when it yielded an outsized 7.4%.

Then, as now, the macro picture was uncertain. I probably don’t have to remind you that in June of ’20, stocks were bouncing back from the March crash, but lockdowns were still crippling the economy (and planting the seeds for today’s high inflation).

Everyone was feeling twitchy about stocks (and dividends, many of which had just been chopped). The mood wasn’t a lot different than it is now.

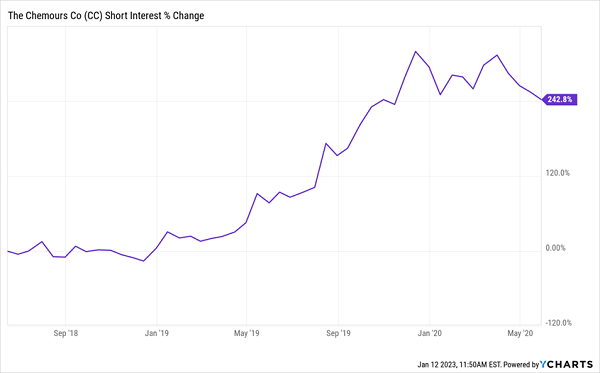

This is where the short interest comes in, as short sellers were also betting big against Chemours as the company faced pending litigation. By June 2020, 10% of Chemours’ shares were sold short, and these early sellers even had to pay the company’s fat dividend out of their own pockets! (That’s a risk of short selling that you rarely hear about—and why the practice can be especially costly with dividend stocks.)

CC Short Interest Spikes

That set the stage for gains, as any good news could result in a “short squeeze”—in which short sellers must buy the stock to cover their positions, driving the price higher still!

We liked the odds of that happening with Chemours, especially in light of the fact that Mark Newman, then-COO of the company (and now its president and CEO), picked up 2,500 Chemours shares in May 2020, bringing his total stake to 133,344 (worth nearly $1.9 million at the time).

With each share paying $1 a year, Mark’s annual dividend haul was a massive $133,344. That’s a very nice retirement income for most of us—on dividends alone!

Mark’s move caught our eye because if he was putting more skin in the game, he obviously thought the company’s dividend was safe. And from his perch in the C-suite (and the fact that he’d been with Chemours since it was spun off from Dupont in 2015) he had a good handle on the litigation.

He clearly thought the shorts were all wet.

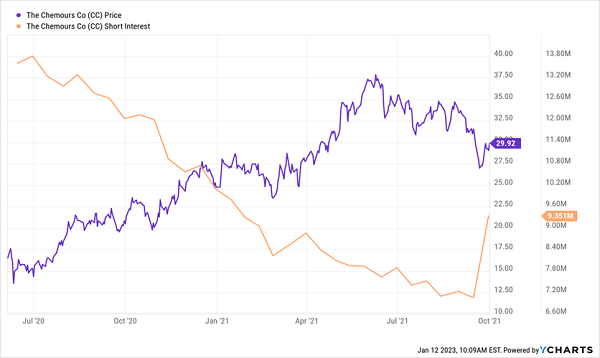

With all that in mind, it was a straightforward decision for us to buy alongside Mark. Here’s how things played out over our 16-month holding period:

Then Deflates, Driving Our Gains

Sure enough, as it became clear that the shorts were wrong, they began to lose their shorts. Each share they “bought back” helped nudge CC higher. Plus we collected our fat quarterly dividend alongside Mark—and enjoyed 90% total returns—more than double the S&P 500’s return in that time.

Insider Buying + High Short Interest = Fast 90% Returns

That’s the kind of profit that a combo of high short interest and insider buying (not to mention a 7.4% yield) can deliver. And with a similar macro setup in 2023, as we saw in mid-2020, we’ll be looking for often-overlooked signals like high insider buying and short interest as we plot our buys and sells in Contrarian Income Report this year.

3 Must-Own Stocks That Could Let You Retire on Dividends Alone

7%+ payers with hidden value (like high insider buying and short interest) are the key to what I call the “retirement holy grail”: the ability to clock out on dividends alone, leaving your principal intact.

It’s the only way to ensure you have a safe retirement because, with dividends paying your monthly bills (and therefore no need to sell your investments to supplement your income), you can largely ignore the day-to-day gyrations in the stock market!

Deep down, most investors know this is how they should be investing for the future. But they don’t know what to buy.

That stops now. Because I’ve released 2 Special Reports detailing my complete “No-Withdrawal” retirement strategy and revealing 3 off-the-radar investments you need to buy to get it done. With rich yields up to 12%, these 3 buys are the key to financial freedom.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."