Uber-investor Warren Buffett and I are quite different. Whereas Buffett typically looks for undervalued companies and buys them for the long haul, I usually like to buy stocks that are on a long-term uptrend that have a temporary pullback. And the quicker I can make a decent profit, the better.

And I won't even get into politics. I don't share most of Buffett's views on that front, either.

But there is no question that Buffett has proved his investment acumen over and over again. So when I find that Buffett and I agree on a particular stock or sector, it's usually a pretty good chance that I'm on to something.

Let me explain...

Regardless of my disagreement with most of his politics, I agree 100% with his recent statement on U.S. banks. There is much fear in the market right now, particularly regarding banks and financial institutions due to the situation in the euro zone. Many financial pundits are disseminating rumours about the euro zone banking crisis spreading to the United States.

Buffett has come out vehemently against this fear-mongering, half-truth telling and use of scare tactics. For this, he has my complete agreement and support.

At Berkshire Hathaway's May 5 shareholder meeting, Buffett stated, in his down-home drawl, "U.S. lenders have liquidity coming out of their ears, and are in better shape than their European rivals." The Oracle of Omaha went on to state, "I would put European banks and American banks in two very different categories. The American banking system is in fine shape. The European system was gasping for air, a few months back, prior to getting assistance from the European Central Bank."

What I respect most about Buffett's stance on U.S. banks is that he puts his money where his mouth is. His firm, Berkshire Hathaway (NYSE: BRK-B) has more than $20 billion invested in U.S. banks. That's a huge vote of confidence in anyone's book.

The financial fear-mongering has served a profitable purpose for investors in U.S. banks. Every time an unwarranted fear knocks a bank stock off its uptrend, a buying opportunity is created.

Let's take a quick look at three bank stocks that are buys right now.

1. Citigroup (NYSE: C)

One of the largest shareholders in this behemoth is none other than Saudi Prince Alwaleed of Kingdom Holding Co., one of the shrewdest and wealthiest investors on the planet. Not to mention, it is also a prime holding of investment powerhouse JP Morgan Chase (NYSE: JPM), which increased its shares by 5.6 million during the last quarter.

Just recently, a very interesting technical set up has occurred in the stock. The falling price was stopped, as if it hit a brick wall, at the 200-day simple moving average in the $30 region. However, news of the JP Morgan Chase $2 billion trade debacle hit the wire on Friday, May 11. Being a prime holding of JP Morgan, the stock cut through the 200-day moving average like a knife through hot butter.

I am actually very excited about the JP Morgan debacle. It has potentially created a great trade set-up in Citigroup as a break-out trade. Buying Citigroup on a break-out above the 200-day moving average is the ideal play, as it could catch the stock on upward momentum, while the 200-day moving average would provide downside support.

2. Wells Fargo (NYSE: WFC)

Warren Buffett owns $10.6 billion of this U.S. bank. He has recently ramped up his holdings by 22.3 million shares in a clear vote of confidence in the institution. Other major institutional holders include BlackRock (NYSE: BLK), Vanguard Group, Fidelity, JP Morgan Chase and State Farm Insurance. No question about it, investors in Wells Fargo are part of a powerful and savvy group.

The technical picture shows the share price trending up along the 50-day simple moving average for most of 2012. The price recently dipped below the 50-day moving average for the first time this year, but quickly bounced back above the line. I would buy this stock on a break-out above $34 a share. Any upward moves will likely be backed by big money players, creating opportunity as a pure momentum play.

3. Bank of America (NYSE: BAC)

I saved my favorite U.S. bank stock for last. Citigroup just increased its holdings in this bank by 55.5 million shares, and at under $8 a share, who can blame them? Not to mention, Warren Buffett recently made a $5 billion investment in the institution.

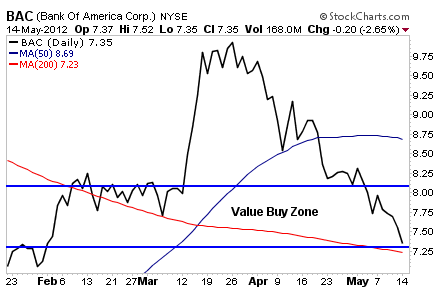

Taking a brief peek at a few fundamental metrics, the forward price-to-earnings (P/E) ratio for this stock is about 7, and its price-to-book (P/B) -- a measure of the stock's price in relation to the value of the company's assets -- is only 0.4, indicating the market is still allowing for further undisclosed mortgage losses. I think shares are a dirt-cheap value at these levels.

Technically, shares have pulled back into my value buy zone, which is my trademark pull-back trading tactic. As long as price stays in the zone, this stock is a solid buy.

Risks to Consider: Although I believe, like Warren Buffett, that the risk of the euro zone banking crisis spreading to the United States is little-to-none, the potential still exists. But as we witnessed on Friday with JP Morgan Chase, these banks have trade risk with their sometimes heavily-leveraged positions. Always use stops and position size based on your risk tolerance and account size.

These three stocks have the interest of the most powerful investment companies on the planet. Use any bad news as buying opportunities, or buy on upside momentum. All three have solid upside potential this year.

BY Dave Goodboy

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

There's An Unmistakable Value In Bank Stocks Right Now

Published 05/16/2012, 06:17 AM

Updated 07/09/2023, 06:31 AM

There's An Unmistakable Value In Bank Stocks Right Now

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.