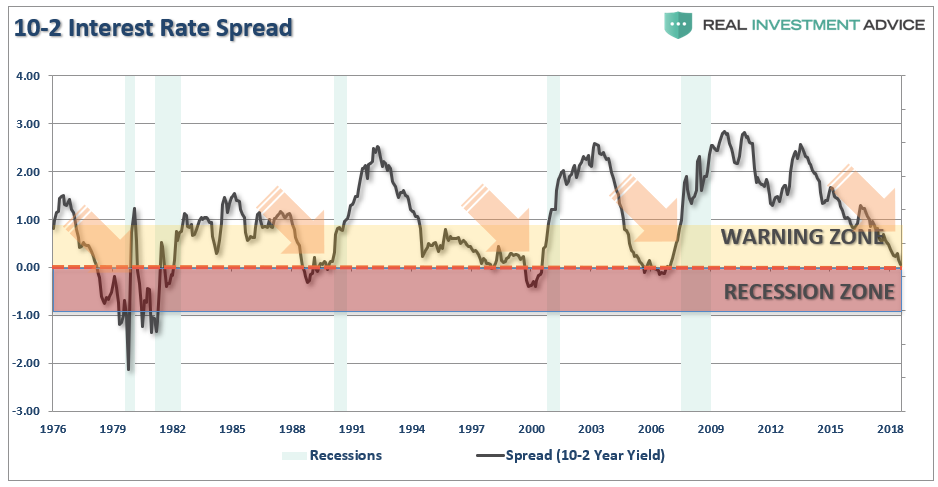

Yesterday, Michael Lebowitz wrote an interesting piece discussing the “yield curve” and the message it is sending. To wit:

“Recently, Wall Street and the Financial Media have brought much attention to the flattening and possible inversion of the U.S. Treasury yield curve. Given the fact that an inversion of the 2s/10s Treasury yield curve has predicted every recession over the last forty years, it is no wonder that the topic grows in stature as the difference between the 2-year Treasury yield and the 10-year Treasury yield approaches zero. Unfortunately, much of the discussion on the yield curve seems to over-emphasize whether or not the slope of the curve will invert. Waiting on this arbitrary event may cause investors to miss a very important recession signal.”

Mike is right. The problem is that when the yield curve INITIALLY inverts or comes close to inverting, there won’t be a “recession” immediately noticeable in the data. This is because, as discussed previously, while the calls of a “recession” may seem far-fetched based on today’s economic data points, no one was calling for a recession in early 2000 or 2007 either. By the time the data is adjusted, and the eventual recession is revealed, it won’t matter as the damage will have already been done. As you notice in the chart above, the yield curve predicted each recession, but the yield curve was already rising sharply by the time the recession was officially announced.

But is there anything to fear currently?

Not according to Treasury Secretary Steve Mnuchin:

“We see no indications whatsoever of a recession on the horizon. The administration’s efforts to cut taxes, slash regulations and overhaul trade deals have had a very strong impact on the U.S. economy.”

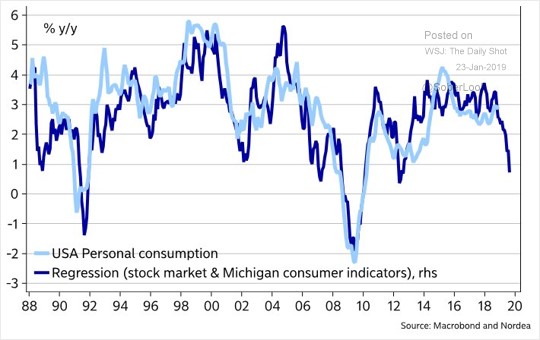

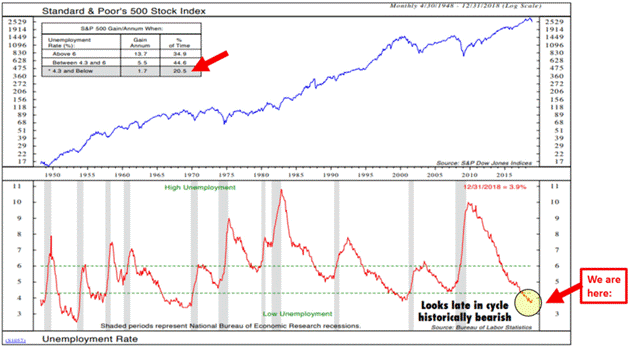

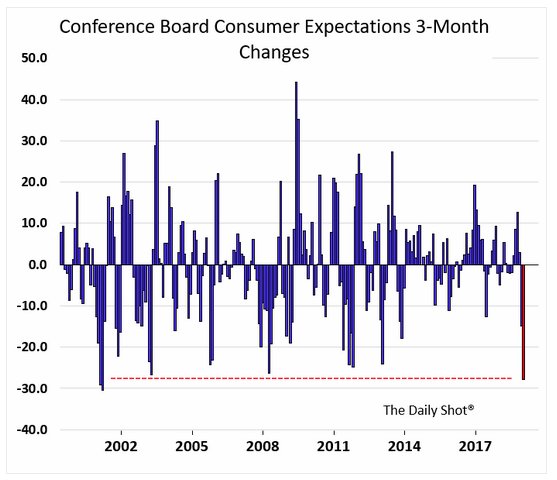

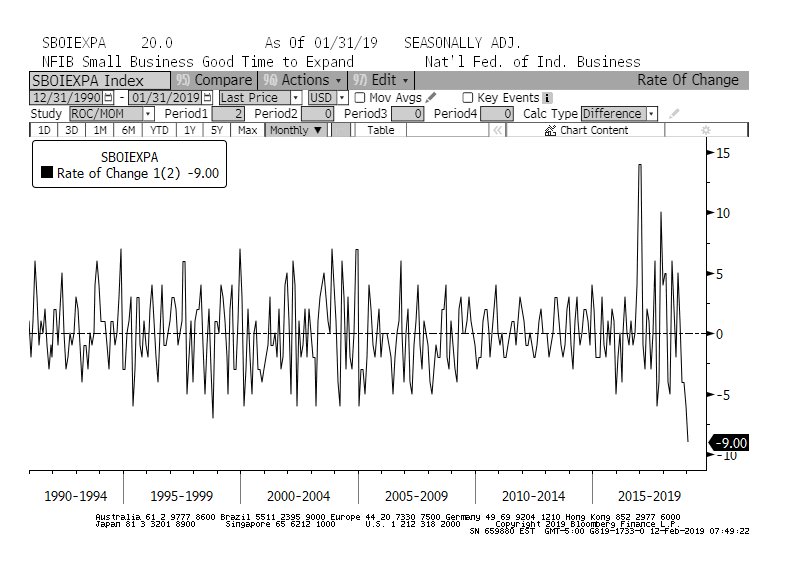

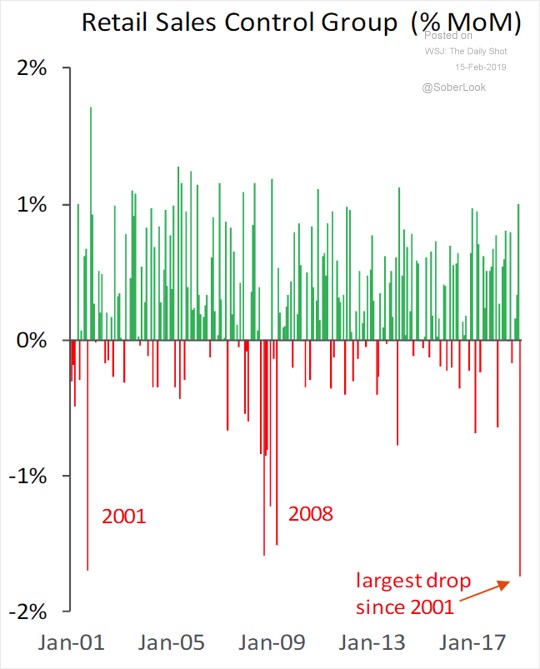

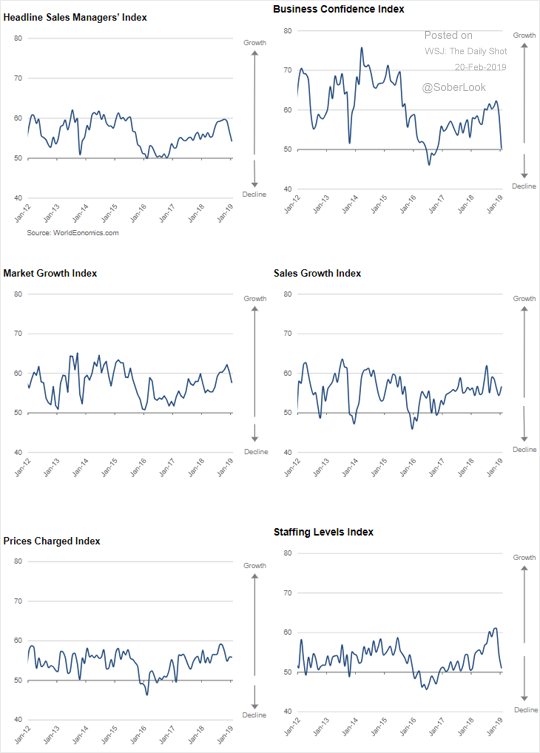

Since I am not the Treasury Secretary of the United States, who am I to argue. Therefore, I simply present some charts for you to consider with respect to whether a “recession cometh” or not.

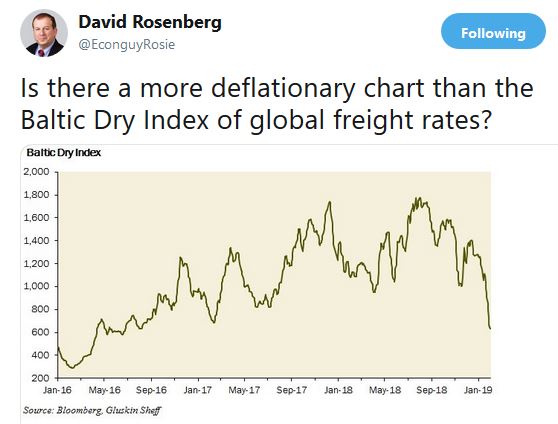

As David Rosenberg stated yesterday:

“I love to read the bloggers out there who say ‘a slowdown isn’t a recession.’ Someone should remind them of Newton’s laws of motion. A slowdown doesn’t morph into a recession when there is some exogenous postive shock that turns the tide. And when it isn’t about the Fed easing policy, then it is another Central Bank, like the ECB and BOJ in 2016.

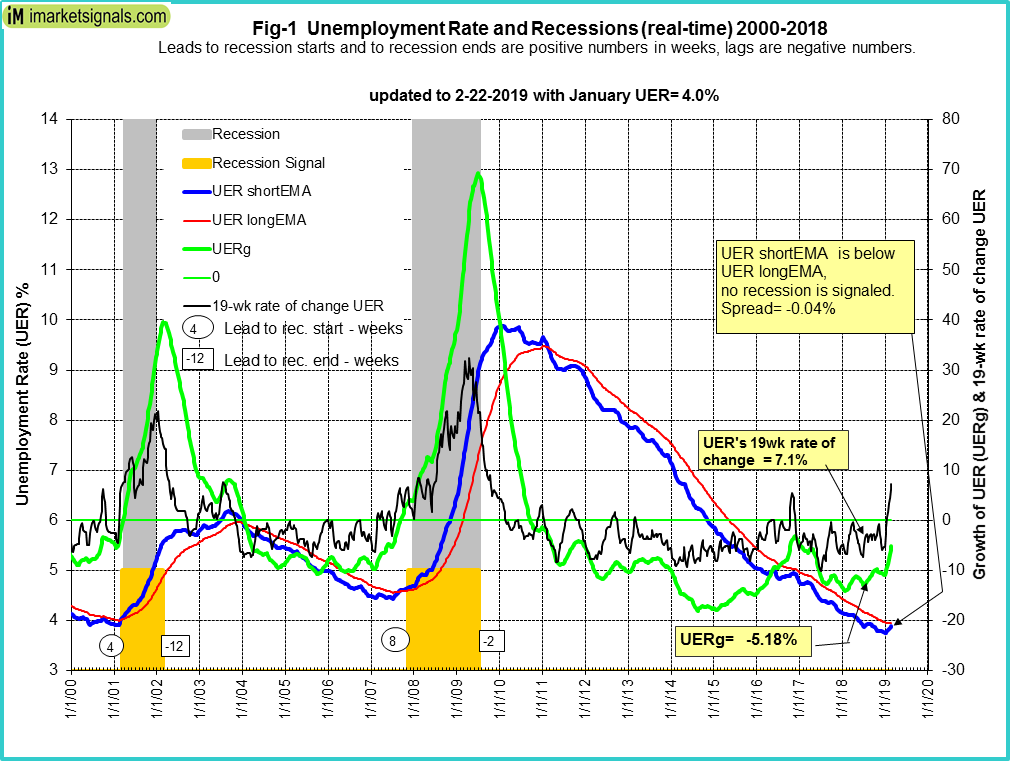

Initial jobless claims are a leading economic indicator and have already risen enough to suggest that recession odds have gone from close to 0% a year ago to around 40% today. Not a base case, but the direction is not something the bulls should be crowing about.”

No recession in sight?

Maybe? But if you wait for someone to tell you the recession has started, it really won’t matter much anyway.

As my friend Doug Kass noted in his missive yesterday:

“It remains my view that the weight of slowing global economic growth, untenable debt levels, political turmoil and policy issues/concerns could ultimately produce much lower stock prices than are present today.”