The dramatic slide in the US stock market in recent days is effectively a forecast that an economic recession is fate. The assumed catalyst: coronavirus blowback. No one can dismiss this risk, but at the moment there are no hard numbers to confirm that a US recession is near. Nonetheless, it’s all but certain that growth will slow, perhaps significantly. Deciding if the economy will contract, however, remains debatable. Mr. Market, however, is assuming the worst with an aggressive round of discounting the future. The challenge in the days and weeks ahead is determining if the incoming economic data support the market’s worst fears.

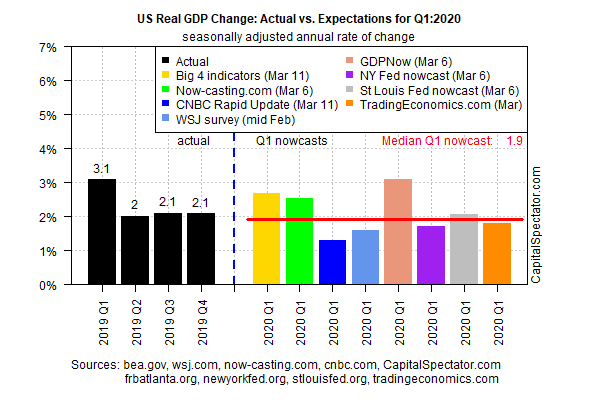

The good news is that the US economy is flying into the storm with a moderate rate of growth. CapitalSpectator.com’s current first-quarter nowcast for GDP is +1.9%, based on the median for several estimates (see chart below). That’s up slightly from the previous estimate (published Feb. 18), which suggests that economic growth was steady if not firming up before the coronavirus smackdown begins to bite.

Even if you take this median nowcast at face value, it indicates that, at best, the US economy is expanding at a rate that’s in line with the 2.1% increase reported for 2019’s second half. But this moderate pace is surely overstating the near-term outlook. The headwinds for the economy are mounting, including last night’s announcement by President Trump is suspending all travel from Europe to the US to battle the spread of the coronavirus.

In countless ways, the effects of trying to contain the virus, in the US and around the world, carry an economic price tag. It’s unclear at this point how deeply the effects will cut into growth. The truth will out, of course, as data is published. The likely path ahead: a gradual deterioration in the overall economic profile, with the full extent of the results emerging by the April economic profile, which will be available starting in May. Meantime, a guessing game for estimating downside risk will be front and center.

In an effort to minimize the fallout, the White House and Congress are discussing possibilities for economic stimulus. It’s debatable if the government can design an effective stimulus in a timely manner, but talking is easy. “We had a good reception on Capitol Hill. We’re going to be working with Republican and Democratic leadership to move a legislative package,” Vice President Mike Pence told reporters yesterday.

For some policy wonks, aggressive policy action is recommended to fend off the strengthening headwind. A top economist in the Obama administration, Jason Furman, says the federal government should send $1,000 to all US adults immediately. “We’ve reached a point where a stimulus package has very little downside and has potential upside,” he reasons. “It is absolutely unambiguously the right decision for Congress to make.”

Joachim Fels, global economic advisor at bond manager Pimco, says “we see a distinct possibility of a technical recession (two consecutive quarters of negative growth) in the US and the euro area during the first half of 2020 followed by a recovery in the second half as output and demand normalize.”

But “a recession is not inevitable,” says Gus Faucher, chief economist of PNC Financial Services Group (NYSE:PNC). “If we do get a recession, it is likely to be brief and much less severe than the Great Recession.”

Maybe, but the truth is that no one knows how this will play out. Uncertainty is unusually high. On the short list of indicators to watch is the number of coronavirus infections and deaths, which is available as reported via Johns Hopkins. The focus is looking for signs of peaking.

China’s top health commission says the country’s coronavirus epidemic has passed its peak. Good news, if it’s true. Of course, the outbreak started in China and so whenever the country’s infections peak the rest of the world will follow with a lag, perhaps a month or two at the least.

The US, unfortunately, is still in the early stages of this crisis. “I can say we will see more cases and things will get worse than they are right now,” Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, advised in testimony to Congress yesterday. “Bottom line is it’s going to get worse.”