Are we still waiting for the recession, or are we past that now? I don’t hear about it much anymore. At the moment, the Atlanta Fed GDPNow is forecasting 4Q growth of 2.3%. At this rate, if we print a number like that for the fourth quarter, then we will have grown at over 2% in 2019, given the prior quarter’s readings. That isn’t precisely recessionary, or even close to recessionary. Sorry, not sure what to tell you. I have been saying since this time last year, there would be no recession, and sure enough, it never came.

Fantasyland, yes. Reality, no!

Oh well. I think it’s time to move on.

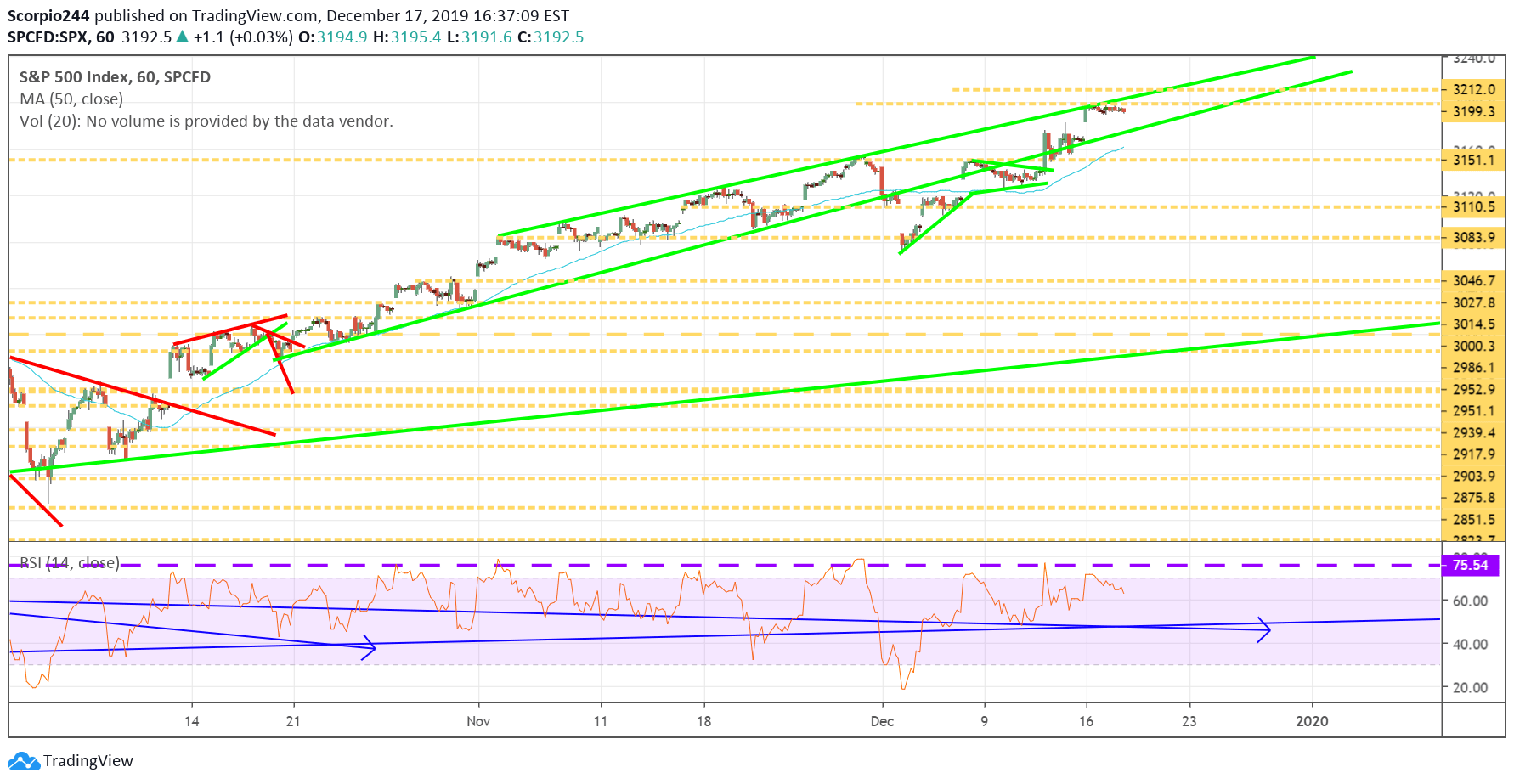

S&P 500 (SPY (NYSE:SPY))

The S&P 500 finished flat today, and there is nothing to say here. The market doesn’t seem to want to go down. With two weeks left and not much on the horizon, it looks like we are getting exactly the opposite of what happened last year. But instead of being sucked into the vacuum of the abyss, we are being pulled up into the atmosphere.

While I don’t know how long this will last, the one thing I am quite sure of is that it will not last forever. But the more significant issue, the more we go up into year-end, the more we take from next year, and the more likely it is we have some kind January/February pullback.

So enjoy these next few weeks if you can.

Oracle (NYSE:ORCL)

Things are not going well for Oracle (NYSE:ORCL), that is for sure. It sucks too because I had just noted yesterday how I thought the stock would rise — Oracle Shares May Jump By 10% – premium content. Now even the uptrend is broken, $51.85 is looking more likely at this point. Very dissappointing.

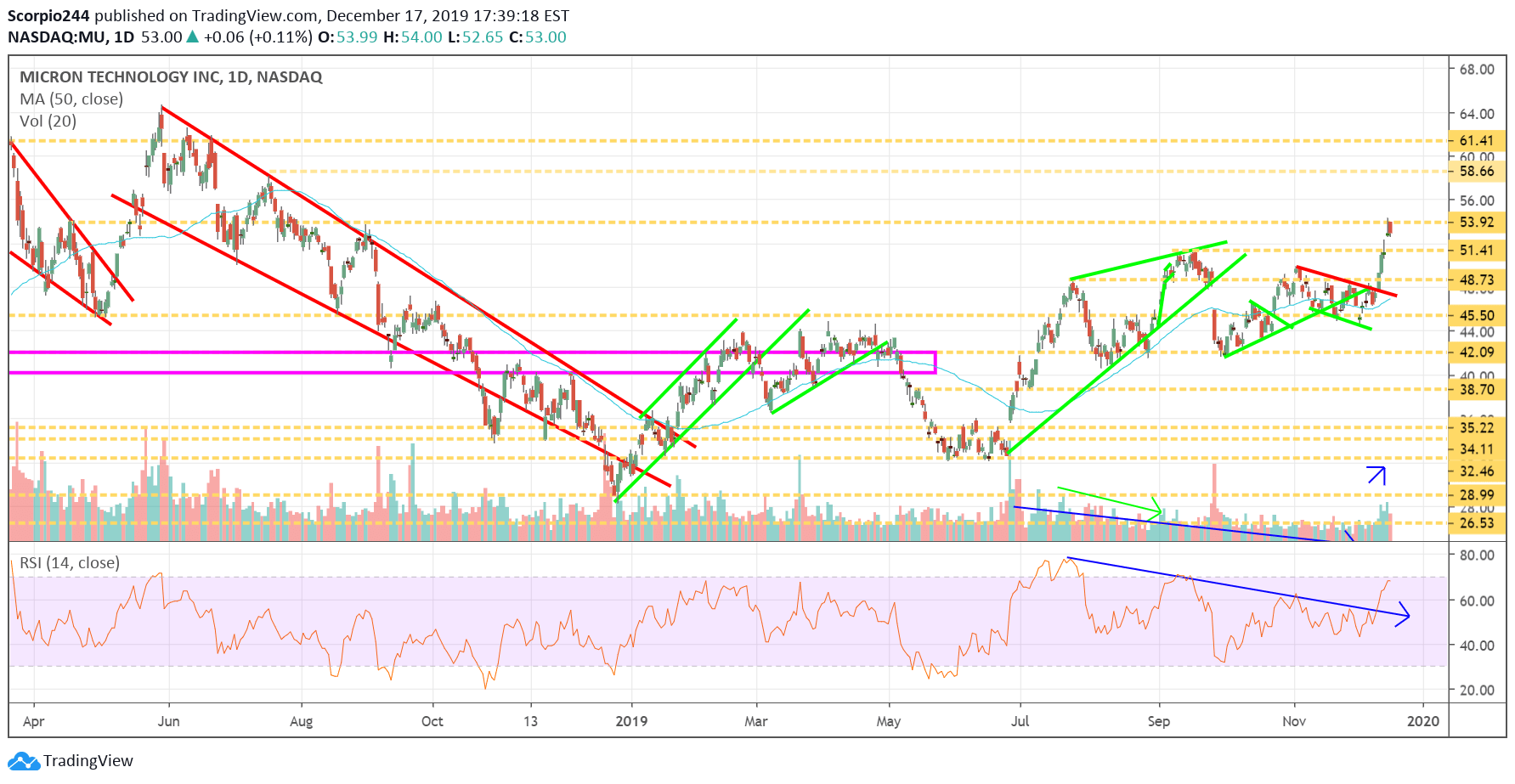

Micron (NASDAQ:MU)

Hopefully, things go better after Micron (NASDAQ:MU) reports results. I had seen some bullish betting in this one. Layer on some positive trends in the technicals, and I think the stock could rise following the results.

Netflix (NASDAQ:NFLX)

Netflix (NASDAQ:NFLX) is one that hit my short-term target. Finally, at least something is going my way. The stock jumped to a high of $317.50, over my $316 goal I laid out when the stock was $293 on December 11.

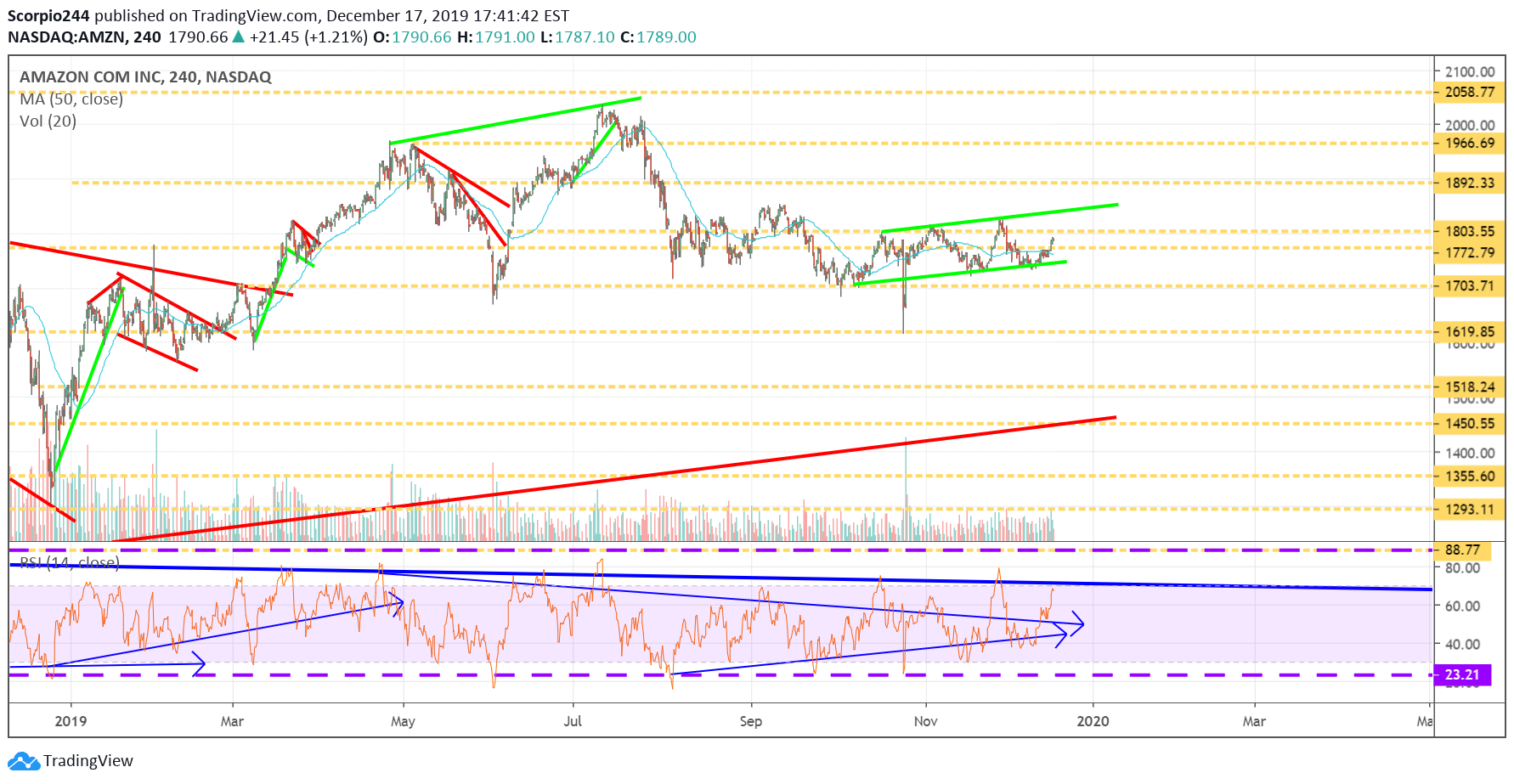

Amazon (NASDAQ:AMZN)

Amazon (NASDAQ:AMZN) is starting to come around too. I noted some bullish betting on December 9. I’m still thinking we get to $1840, and potentially higher.

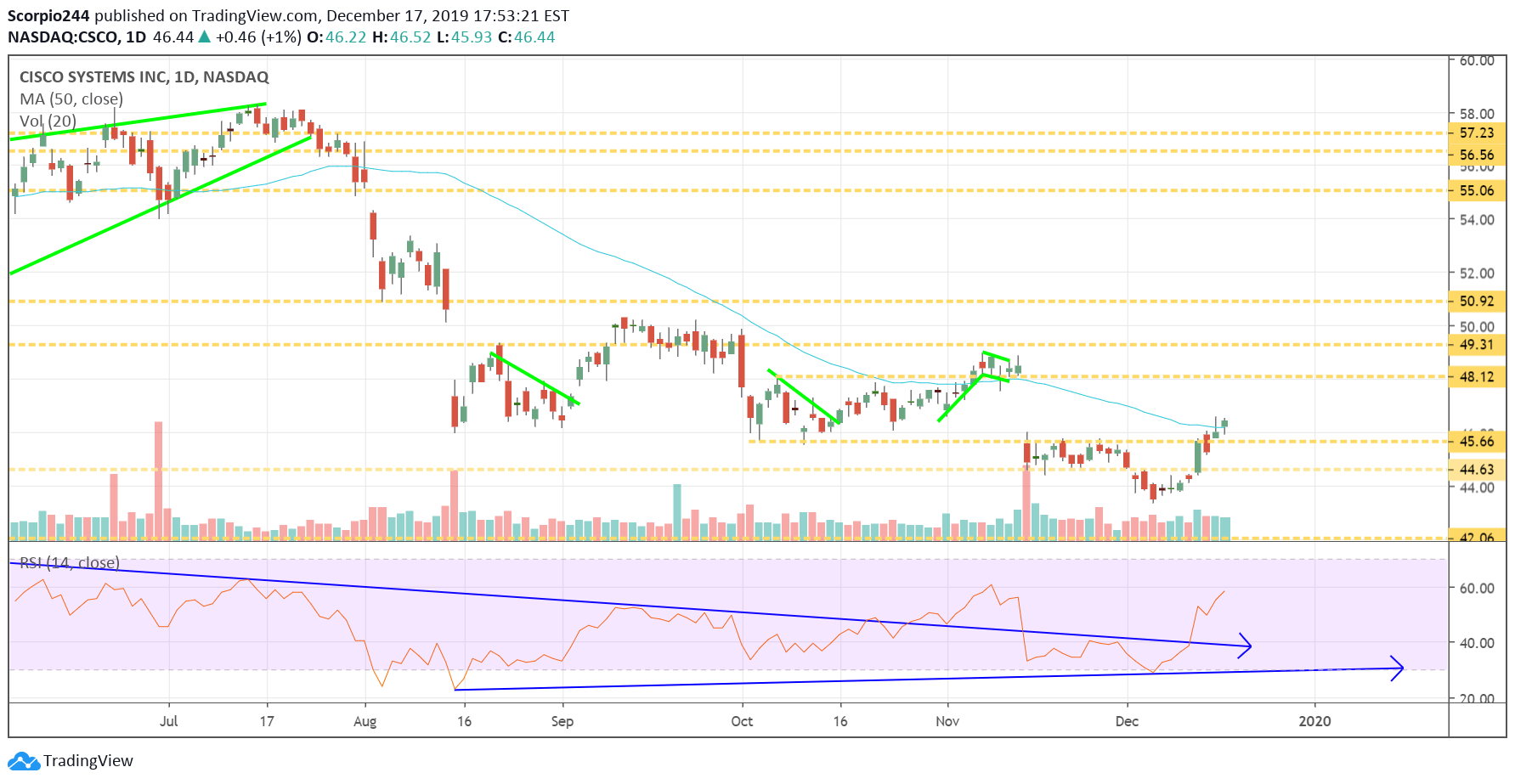

Cisco (NASDAQ:CSCO)

Cisco (NASDAQ:CSCO) is rising above resistance at $45.65. Is the stock trying to fill the gap? It looks like it. It would be too good to be true if the stock could get back to $48. I’ll take it.

That’s all for today.