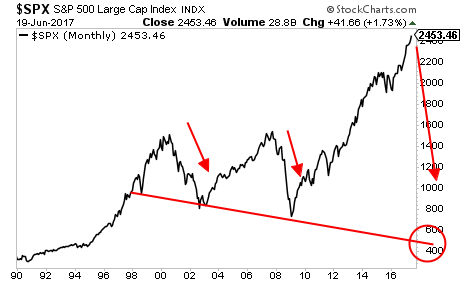

The Fed just “rang the bell” on the market top.

Fed Chair Janet Yellen’s right hand man, John Williams made the following statement yesterday:

“The stock market seems to be running pretty much on fumes,” San Francisco Federal Reserve Bank President John Williams said in an interview carried on Sydney’s ABC News affiliate and available on the internet on Tuesday. “It’s something that clearly is a risk to the U.S. economy, some correction there — it’s something we have to be prepared for to respond to if it does happen.”

Some context here: For eight years the Fed has propped up the stock market via $3.5 trillion in QE and seven years of Zero Interest Rate Policy or ZIRP. Indeed, the bull market in stocks is possibly the only real success the Fed can point to when it comes to its response to the 2008 Crisis (the real economy has lagged dramatically).

In this light, the above quote is an astonishing statement from a Fed President. And it serves as a clear signal that the Fed is willing to let the market fall and fall HARD.

A Crash is coming.

And smart investors will use it to make literal fortunes.

And smart investors will use it to make literal fortunes from it.