On Tuesday, October, 5th, Constellation Brands (NYSE:STZ) will release its Q2 earnings results before the bell. The company is a Zacks Rank 2 (Buy), and they were upgraded within the last 30 days due to upward revisions in their earnings estimates.

Dave will investigate Constellation Brands past earnings, look at what is currently going on with the company, and give us his thoughts on their upcoming earnings announcement.

Furthermore, Dave will uncover some potential options trades for investors looking to make a play on Constellation Brands ahead of earnings.

Constellation Brands in Focus

Constellation Brands (STZ) is a leading international producer and marketer of beverage alcohol brands, with a broad portfolio across the wine, spirits and imported beer categories. The Company is the largest multi-category supplier of beverage alcohol in the United States; a leading producer and exporter of wine from Australia and New Zealand; and both a major producer and independent drinks wholesaler in the United Kingdom. Well-known brands in Constellation's portfolio include: Corona Extra, Pacifico, St. Pauli Girl, Black Velvet, and Fleischmann's.

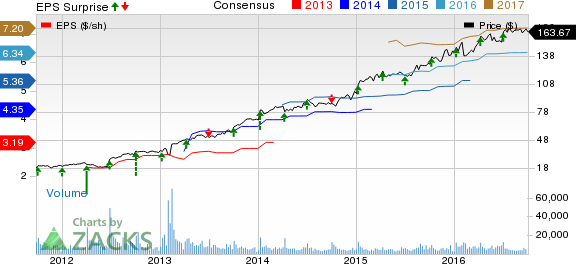

Constellation Brands is expected to report earnings at $1.66 per share according to the Zacks Consensus Estimate. Last quarter they reported an earnings at $1.54 per share beating the Zack’s Consensus Estimate of $1.51 per share, and they have an average surprise of 8.89% over the last four quarters.

MOLSON COORS-B (TAP): Free Stock Analysis Report

ANHEUSER-BU ADR (BUD): Free Stock Analysis Report

SABMILLER PLC (SBMRY): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

Original post

Zacks Investment Research