The economy is reopening, stock markets are already bouncing back in a hedge on the future, and we’re about to see the biggest shift in capital in years.

It’s a big money shift away from tradition and towards a future in which retail investors--and major hedge funds--demand that their investments go into companies that are sustainable.

It’s not politics or ideology. It’s not right or left. It’s pure free-market sentiment dictating what happens after the lesson the market has learned before and during a global pandemic:

Welcome to the $30-trillon-plus mega trend of sustainable investing, otherwise known as ESG (environmental, social and governance) Investing.

And welcome to one of the new companies positioned to give big capital exactly what it’s looking for: Canada’s Facedrive (TSXV:FD), the competitor to Uber (NYSE:UBER) that’s working to turn ride-sharing into a sustainable, more carbon-neutral industry.

Even better, while Uber has been burning cash like crazy for a decade and still isn’t profitable, Facedrive has an entire ecosystem of revenue generation setups that treat ride-sharing as much more than a ride: It’s a high-tech business segment that has many ways to generate revenue while the wheels are rolling.

Where Big Money Will Go To Multiply

Even before COVID-19, Big Money was shrugging off tradition, increasingly in favor of ESG investing, which hit $30 trillion even before the pandemic.

What the pandemic did was bring the enormous potential threat of climate change into a clearer focus. The new investment thesis rationale is this: If we weren’t 100% sold on the threat of climate change, we also weren’t 100% sold on a global pandemic after so many previous scares that turned out to be overblown.

The new investment thesis ties to risk mitigation and reputation. Companies that can’t withstand a crisis aren’t good investments. Likewise, companies that will be continually called out in social media for contributing to crises are also taking on too much risk in relation to future returns.

Gone may be the days when everyone across the board will throw endless amounts of cash at a company like Uber that contributes to pollution, constantly spars with authorities and its own drivers, and burns cash without making a profit.

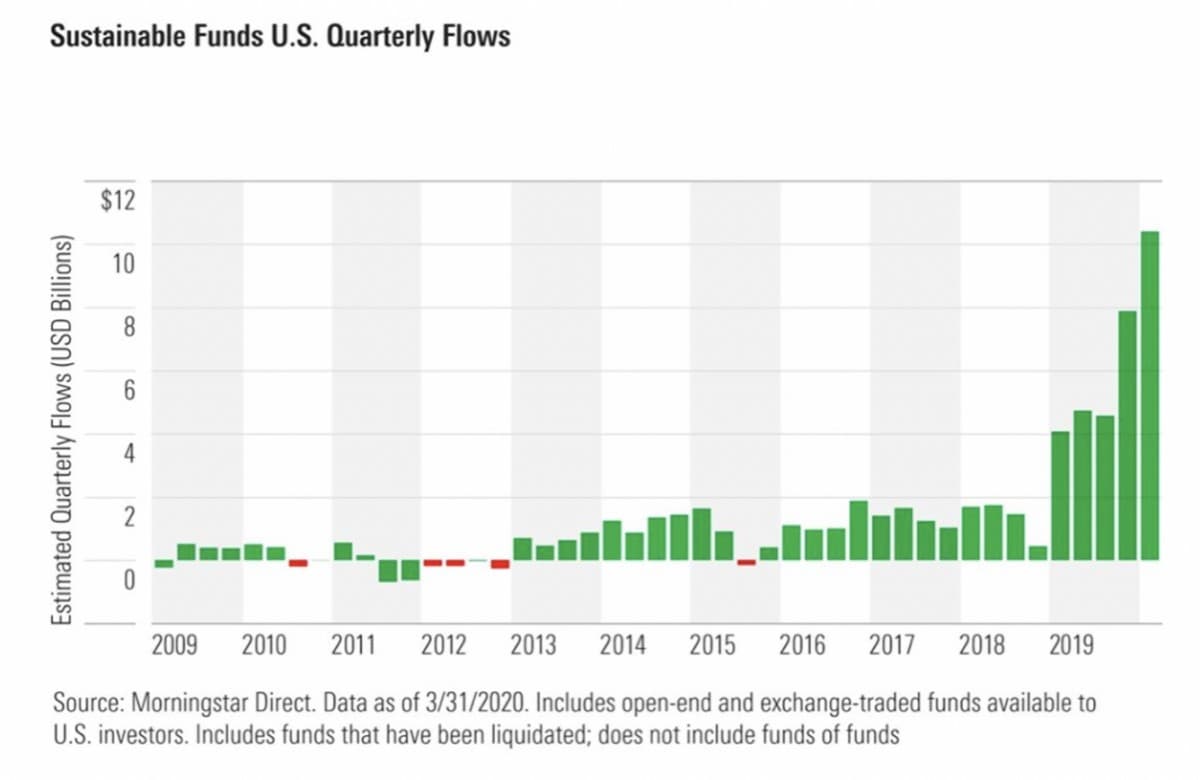

Tradition has been in the throes of a slow death since 2009:

And then came the pandemic, which has so far seen sustainable investments wildly outperformed conventional in Q1 2020.

Instead, big capital will start looking at ride-sharing 2.0, ushered in by Facedrive in 2019.

Facedrive knows sustainability. Its business model is about “people and planet first”. It also knows risk mitigation, views its drivers as integral stakeholders, and views ride-sharing in general as far more than a way to get from Point A to Point B. It’s targeting multiple revenue streams.

The Risk Mitigation Ride

Facedrive is transforming the ride-share space into something that everyone can get on board with.

It’s the first platform to offer a carbon-neutral solution by giving riders a choice of EVs or hybrids, and by planting trees along the way to offset emissions for any conventional rides.

That means a lot when you consider that the average U.S. ride-hailing trip results in 69% more pollution than whatever transportation options it displaced.

A highly strategic acquisition in March also saw Facedrive expand far beyond the first-and-last mile that is usually associated with ride-sharing. Facedrive acquired HiRide, an innovative new Canadian startup that emerged from Ontario’s “Technology Triangle” to rewrite the rules of long-distance car-pooling and bring it into the high-tech mobility fold.

Now, Facedrive covers every mile, and it’s about to expand into the United States and Europe.

Along the way, it’s unleashing plans for revenue stream after revenue stream because it doesn’t view ride-sharing as a simple “ride”. It views ride-sharing as part of a much larger ecosystem--and a much more profitable one than Uber pursued as it prepares, a decade later, to lose more than $1 billion this year. So much for Uber’s $100 billion valuation wishes.

Facedrive is already on the front lines of the COVID-19 battle, providing discounted rides for healthcare workers, developing the new TraceSCAN app to help keep communities and families safe by detecting instances of infection, and organizing a medical delivery service that keeps high-risk groups from unnecessary exposure.

Once the pandemic subsides, Facedrive will have an already proven and established healthcare initiative that includes specialized vehicles for anyone with additional needs to contactless delivery of essential over-the-counter medicines and medical supplies with high-tech management of automatic refills.

Facedrive’s entire ecosystem is about earning revenue from the rider relationship, keeping in mind that millennials want an all-inclusive experience.

The innovative high-tech mobility company has also rolled out Facedrive Foods, focused on sustaining relations between local food suppliers and restaurants and the communities they serve. And in line with the sustainability and impacting investing theme, they aim to provide riders with healthy choice deliveries.

Facedrive Foods, which is now piloting in six cities in Ontario and will expand to other regions soon.

But last week, Facedrive Foods provided a glimpse as to how serious the company is in targeting the Canadian food delivery industry. To kick-off its aggressive expansion drive in the segment, Facedrive Foods entered into a binding term sheet to acquire assets of Foodora Canada. This move is especially significant because Foodora Canada is a subsidiary of Delivery Hero, a $20 Billion European multi-national food delivery service that operates in over 40 countries internationally and services more than 500,000 restaurants.

Facedrive Foods acquisition of Foodora Canada’s assets would give Facedrive a billion dollar boost and huge jump on its major Canadian food delivery competitors such as Uber Eats and Skip The Dishes. Facedrive would obtain instant access to hundreds of thousands of Foodora Canada’scustomers, and 5,500 new restaurant partners. With this move, Facedrive Foods would overnight position itself into the top echelon of Canadian food delivery services and turn up the heat on major incumbents in the space.

Nor does the ecosystem end here: No successful millennial-driven platform is anything without their own “merch” to go along with it. That means celebrity tie-ins for big branding.

Will Smith’s Bel Air Athletics clothing brand is betting that Facedrive is the ride of the future. That’s why he’s co-branding an entire line of merch with Facedrive.

It’s also why WestBrook Inc., the company Smith shares with his wife Jada Pinkett Smith, is partnering with this environmentally conscious startup that is now expanding globally to challenge Uber in more countries.

Some 1,000 new products co-branded by Bel Air and Facedrive are ready to launch, with pre-orders coming soon on the Facedrive website. And it’s all sustainable, made in North America.

Uber was a taxi replacement. Facedrive is a lifestyle.

It’s a lifestyle that is not only positioned to survive the coronavirus culling but to thrive in the new environment that has big money moving away from tradition and whole-heartedly towards companies who understand the risk we all face.

COVID-19 has shown us exactly how deeply interconnected our basic systems of survival are, whether it’s to battle a virus or fight climate change. Facedrive figured this out back in 2016. Now it’s ready to launch globally, and the timing is indeed evolutionary.

Other companies looking to capitalize on the $30 trillion sustainability push:

Microsoft (NASDAQ:MSFT) is a genuine leader in the sustainability push. The company is going above and beyond in its emissions goals, aiming to be carbon neutral in the next ten years. A feat that will not be an easy task for such a massive technology corporation. Additionally, Microsoft is has also pioneered new solutions to aid other companies in curbing their emissions as well.

Microsoft has built hardware and software to help monitor and better understand the effect of different institutions have on the planet, gathering data to better figure out how companies and people can improve. The company is creating tools to better handle the b the world’s growing waste crisis.

Other tech giants are getting involved, as well. Both Facebook (NASDAQ:FB) and Google (NASDAQ:GOOGL) have embarked on similar paths to Microsoft, with massive business-wide changes with the goal of becoming leaders in the sustainability space.

Take Google (GOOGL), for example. Despite being one of the largest companies on the planet, in many ways it has lived up to its original “Don’t Be Evil” slogan. Not only is Google powering its data centers with renewable energy, it is also on the cutting edge of innovation in the industry, investing in new technology and green solutions to build a more sustainable tomorrow. It’s bid to reduce its carbon footprint has been well received by both younger and older investors. And as the need to slow down climate change becomes increasingly dire, it’s easy to see why.

Social media giant Facebook (FB) is doing its part, as well. Not only have they made dramatic progress towards their goal to run on 100% renewable energy by the end of 2020, they’re working to build more water-efficient data centers. In fact, their data centers use 80 percent less water than typical data centers.

Facebook has even gone a step further with its focus on building more sustainable workplaces. It’s building designs incorporate a number of renewable energy sources and water recycling methods, in addition to promoting the recycling and sustainability of all products consumed on site.

Energy companies are doing their part, as well. As one the world’s leading renewables producers, NextEra Energy (NYSE:NEE) is literally building the path towards sustainability. To make matters more exciting, the company was the number one capital investor in green energy infrastructure, and the fifth largest investor across all sectors.

In addition to its already massive impact combatting the world’s looming climate crisis, it has ambitions of investing an additional $55 billion in infrastructure in the next two years in the United States. And while it helps deploy the world’s new energy reality, it has also committed to weaning itself off foreign oil. And shareholders are all in. Over the past 15 years, shareholders have seen 945% returns.

Even Big Oil supermajors have been diving head first into the ESG trend, diversifying their portfolios and to hedge their bets in the rapidly changing new reality of energy. And no other oil major takes this more seriously than Total (TOT). maintains a ‘big picture’ outlook across all of its endeavors. It is not only aware of the needs that are not being met by a significant portion of the world’s growing population, it is also hyper-aware of the looming climate crisis if changes are not made. In its push to create a better world for all, it has committed to contributing to each of the United Nations’ Sustainable Development Goals.

Total checks every box in the ESG checklist. It is promoting diversity and safety, making massive changes in its day to day operations to ensure that its business is environmentally sound, and has even committed to going carbon neutral by 2050 or sooner. It’s no surprise that shareholders are loving its forward-thinking approach.

Canadian companies are doing their part as well:

Let’s start with some Canada’s renewable energy push. Boralex (TSX:BLX) is one of Canada’s premier renewable energy firms. It played a major role in kickstarting the country’s domestic renewable boom. The company’s main renewable energies are produced through wind, hydroelectric, thermal and solar sources and help power the homes of many people across Canada and other parts of the world, including the United States, France and the United Kingdom.

Polaris Infrastructure (TSX:PIF) Is a Toronto-based renewable energy giant with a global footprint. The company’s biggest projects are in Latin America. It’s Nicaragua geothermal project, for example, is already producing over 77 MW of renewable electricity. And in Peru, its El Carmen and 8 de Augusto power plants, is set to produce a combined 17MW of electricity in the near future.

Westport Fuel Systems (TSX:NASDAQ:WPRT) is a renewable energy provider for the transportation industry. it provides systems for less impactful fuels, such as natural gas. In North America alone, there are over 225,000 natural gas vehicles. But that shies in comparison to the global 22.5 million natural gas vehicles globally, which means the company still has a ton of room to grow!

While renewable providers clearly take the lead, Canada’s tech and telecom giants won’t be left out!

Take telecom giant Shaw Communications (TSE:NYSE:SJR.B), for example. Shaw is taking a leadership role among Canadian telecom providers through its use of renewable energy, In fact, it is one of the biggest customers of Bullfrog Power which sources its electricity from a blend of wind energy and hydropower. It is also building its own portfolio of clean energy investments.

BCE (TSX:NYSE:BCE)) is another Canadian telecom giant going to great lengths to reduce its carbon footprint. For the past 25 years, BCE has been at the forefront of the environmental movement. Their environmental management system (EMS) has been certified to be ISO 14001-compliant since 2009.