People can “go green” all they want. After all, America is still the land of the free. But I just don’t recommend that investors do it.

And that’s not because I’ve got something against the tree-hugger mentality.

I actually consider people’s near-religious passion to improve energy efficiency -- and be responsible stewards of our world’s most precious resources -- both admirable and noble.

The only problem?

Nobility or admirable pursuits don’t automatically translate into profits. Actually, they seldom do. It’s why most noble causes set up shop in these things called non-profit organizations.

Myth Busting

Why bring any of this up, though? Because it’s Myth-Busting Monday, of course. And it’s time to debunk the stubborn myth that just because we should -- and in some cases must – go green, that it’s a smart investment, too.

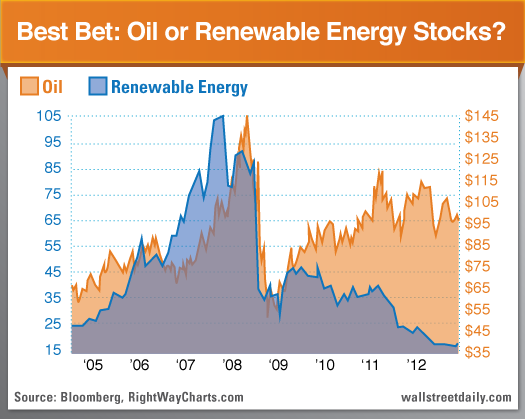

In reality, green energy’s a terrible investment. And I can prove it with a single chart.

But I’ll throw in more proof for good measure, just so you don’t complain about me slacking off.

Lies, Damn Lies And Al Gore

The tape never lies. And it’s sending a pretty clear signal. Green doesn’t pay. Not anymore, at least.

Case in point: the BNP Paribas Renewable Energy Index (BNPIREPR).

It tracks the price movement of up to 40 of the largest companies in the world in the renewable energy sector. And it’s down almost 90% from its 2007 peak. Ouch.

The peak for the Index is awfully suspect, too.

You’ll recall that 2007 was the year that former Vice President Al Gore’s career hit a crescendo. He won the Nobel Peace Prize after his book and accompanying documentary, An Inconvenient Truth, became a worldwide hit.

Before you scream “nonsense” because no single man could influence investor behavior so significantly, consider the testimony from Deutsche Bank (DB) Director of Global Asset Management, Kevin Parker. (Hat tip to Steve Goreham over at The Washington Times for digging this up).

[Al Gore] impressed us all at Deutsche Bank Asset Management. We invited him to an internal meeting in April 2007 during which we discussed the issue of climate change extensively. A few months later, he received the Nobel Peace Prize for his commitment. We then created a fund that invests in companies that position themselves as climate-neutral. Within two months, almost 10 billion dollars flowed into this fund. Can you imagine? 10 billion! There has never been such an overwhelming success.

Like I said, the peak is suspect. And it was most likely caused by massive amounts of hype and skyrocketing oil prices -- not the profit potential for alternative energy.

In other words, the soaring popularity of the green movement blinded investors to the economics. They just assumed green energy was ready to take center stage, especially with oil prices soaring. But then the recession forced reality upon us.

It also forced governments like Spain to slash their green energy subsidies by as much as 90%. So when oil prices soared again, renewable energy companies didn’t.

Long story short, the economics of alternative energy don’t work. Not yet, at least -- even with massive amounts of government subsidies.

Heck, the U.S. government’s been subsidizing the industry to high heaven with our tax dollars in recent years. And what do we have to show for it? A graveyard of green-energy companies.

Government-Backed Busts

All seven companies listed below were heavily backed by the federal and local government. Now they’re bankrupt, based on data from the National Center for Policy Analysis:

- Solyndra ($535 million)

- A123 Systems ($435 million)

- Beacon Power ($43 million)

- EnerDel ($118.5 million)

- Babcock & Brown ($178 million)

- Solar Trust of America ($2.1 billion)

- Abound Solar ($400 million)

On the surface, green energy sounds like a great investment. In reality, though, it’s too expensive, even with heavy government assistance. And when the economics don’t work, neither do the investments.

Even Mr. Gore is souring on green investments, though he’s still out crusading for the cause.

SEC filings show that his company, Generation Investment, bailed on its eight-figure investment in First Solar (FSLR).

The fund is also reportedly down 57% on its investment in Germany’s SMA Solar over the last year. And it’s hemorrhaging capital with its bet on China’s Suntech Power Holdings Co. (STP), which is off almost 60% in 2012.

Could Mr. Gore soon head for the exits with these investments, too? I’m sure if that happens, we’ll get spoon-fed a line about doing what he says, not what he does.

Sorry. Actions speak louder than words, particularly when it comes to investing. So I’m not going to buy it.

Bottom line: If you’re investing for green, don’t invest in green energy. Despite the myth, there’s no solid opportunity in the sector at this time.

Original post