The Q2 earnings season is gradually nearing its end with more than 87% of the S&P 500 companies having already announced their results. Although the bulk of earnings releases have come from different sectors, most retailers are yet to post their financial results. Hence, investors are keeping their fingers crossed over retail's outcome.

Per our latest Earnings Trends report as of Aug 5, out of the 433 S&P 500 members that have come up with their quarterly numbers, approximately 70.7% have posted positive earnings surprises, while 52.7% beat top-line expectations.

According to the report, earnings for the 433 S&P 500 companies that have reported so far are down 4.1% from the same period last year, while revenues have declined 0.9%.

Per the latest report (as of Aug 5, 2016), nearly 77.1% of the Consumer Discretionary companies have already reported their second-quarter results, out of which 88.9% beat earnings and 44.4% surpassed revenue estimates. Total earnings for these companies were up 5.8% while revenues inched up 3.1% year over year. Textile-apparel stocks form a part of the Consumer Discretionary sector.

Among Textile-apparel stocks lined up to report this week, let’s take a sneak peek at two companies.

Michael Kors Holdings Limited (NYSE:KORS) is slated to report first-quarter fiscal 2017 results on Aug 10. The big question facing investors now is whether the company will be able to post a positive earnings surprise in the quarter to be reported. Last quarter, the company recorded a positive earnings surprise of 2.1%. The company notably surpassed the Zacks Consensus Estimate in all of the last four quarters, with an average beat of 10.1%.

Michael Kors continues to invest heavily in new store openings, expanding existing outlets and building its e-commerce infrastructure. As a result, operating costs are expected to rise, which will compress margins going ahead. Moreover, investments across the board will lead to about 690–740 basis point (bps) expansion in operating expenses as a percentage of total revenue in fiscal 2017.

Management anticipates first-quarter fiscal 2017 earnings between 70–74 cents per share in comparison to 87 cents earned in the prior-year quarter.

Michael Kors Holdings carries a Zacks Rank #3 (Hold), which improved from Zacks Rank #4 (Sell) recently and has an Earnings ESP of 0.00%. The Zacks Consensus Estimate for the quarter is pegged at $74 cents. (Read more: Michael Kors Q1 Earnings Preview: Let's Take a Look).

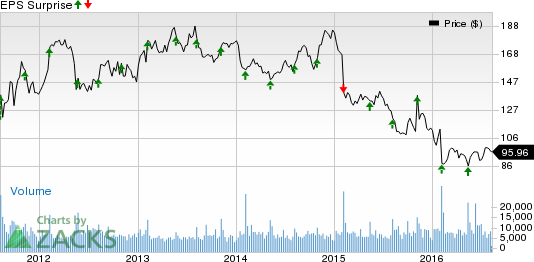

Ralph Lauren Corporation (NYSE:RL) is scheduled to release first-quarter fiscal 2017 results on Aug 10. In the previous quarter, this premium lifestyle merchandise retailer reported a positive earnings surprise of 6%.

Additionally, the company delivered an average positive earnings surprise of 7.5% over the trailing four quarters, with a beat recorded in each and every quarter.

Ralph Lauren's growth story looks compelling as it possesses a robust portfolio of globally recognized brands and a healthy financial status. This, along with constant initiatives focused on profitable areas, should boost growth.

However, the company has been suffering from weak year-over-year comparisons for profit and sales for over three years. Recently, the company’s new CEO Stefan Larsson identified key problems in its operations, which included too many brands and retail stores, huge dependence on department stores, high cost structure and inefficient inventory systems.

Ralph Lauren carries a Zacks Rank #4 (Sell), and has an Earnings ESP of 2.25%. The Zacks Consensus Estimate for the quarter is pegged at $89 cents. (Read more: Will Ralph Lauren Break its Earnings Beat Trend in Q1?).

RALPH LAUREN CP (RL): Free Stock Analysis Report

MICHAEL KORS (KORS): Free Stock Analysis Report

Original post

Zacks Investment Research