Tesla, Inc.’s (NASDAQ:TSLA) vehicle production and delivery numbers witnessed sequential rise of 8% in fourth-quarter 2018. During the quarter ending on Dec 31, it manufactured 86,555 vehicles and successfully delivered 90,700 vehicles. Out of the total delivered vehicles, Tesla’s Model 3 accounted for 63,150 units while Model S and X were 13,500 and 14,050 units, respectively.

In fact, Tesla delivered 245,240 vehicles in 2018, which consisted 145,846 units of Model 3 and 99,394 units of Model S and X. The actual deliveries of Model S and X missed the set target of 100,000 units.

During the fourth quarter, all the Model 3 deliveries, comprising of a mid-to-high price range, were delivered only in North America. Apart from catering to the reserved bookings in the region, the company delivered the model to new customers as well.

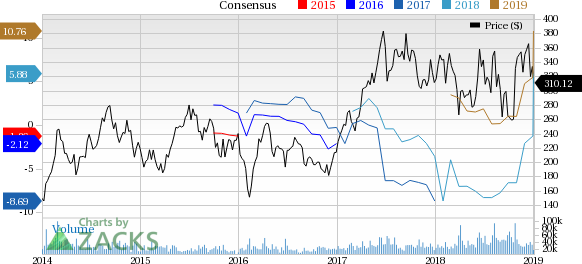

Tesla, Inc. Price and Consensus

Further, Tesla views good growth opportunities for Model 3 in markets outside North America. With this anticipation, the company plans to launch the lower-priced model variation in international markets. It will start delivering Model 3 in Europe and China from February 2019, gradually expanding to other markets.

Despite reporting decent fourth-quarter 2018 deliveries, shares of Tesla have plunged roughly 3.8% in a day’s trading on Jan 2. The dip in share price can be attributed to the company’s decision to slash all three model prices by $2,000 in the United States.

Tesla has decided the price cut, owing to the phasing out of federal EV tax credit, which has been dropped to $3,750 from the prior credit of $7,500, effective Jan 1, 2019. In a bid to keep the electric vehicles (EV) affordable for customers, the company adopted the strategy of partially absorbing the tax credit reduction.

Per a few analysts as reported in Reuters, the $2000 price cut for all models questions the demand for the California-based manufacturer’s EVs. The step might also imply a lowering demand for Tesla’s vehicles. Furthermore, as Tesla is already struggling to deliver profit, the recent move will further dent its profit margin.

Tesla is already under intense pressure to deliver annual profit, which the company has not been successful to achieve as of 2017. For the most of 2018, the company’s profit margin was hampered by high shipping and sourced component costs due to tit-for-tat tariffs of China and the United States. In the first nine months of 2018, the company’s loss from operations was $801.6 million compared with $1 billion recorded in the same period of 2017.

Price Performance

Over the past month, shares of Tesla have lost 13.8% compared with the industry’s decline of 9.6%.

Zacks Rank & Key Picks

Tesla currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader auto sector are Fox Factory Holding Corporation (NASDAQ:FOXF) , CarGurus, Inc. (NASDAQ:CARG) and O’Reilly Automotive, Inc. (NASDAQ:ORLY) , each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Fox Factory, CarGurus and O’Reilly have rallied 45%, 9.6% and 32.4%, respectively, in 2018.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Tesla, Inc. (TSLA): Free Stock Analysis Report

Fox Factory Holding Corp. (FOXF): Free Stock Analysis Report

O'Reilly Automotive, Inc. (ORLY): Free Stock Analysis Report

CarGurus, Inc. (CARG): Free Stock Analysis Report

Original post