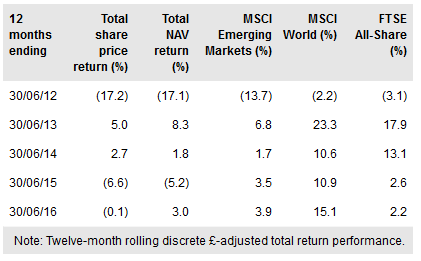

Templeton Emerging Mark Investment Trust (LON:TEM) invests in emerging market-listed equities or in companies listed elsewhere where the majority of their revenues are derived from emerging markets. Since 1 October 2015, TEMIT has been managed by Carlos von Hardenberg, who has broadened the trust’s exposure; he aims to generate long-term capital growth by investing in a portfolio of c 90 companies diversified by sector and geography. The manager has a value bias and stocks are selected following thorough fundamental analysis. Although performance in 2015 was challenging, the trust has outperformed its benchmark over 10 years and 2016 performance to date has shown a marked improvement.

Investment strategy: Disciplined stock selection

The manager and his team of c 50 global managers and analysts seek undervalued stocks with good fundamentals and strong management teams. The macroeconomic environment is considered and stocks undergo a disciplined evaluation process before being considered for inclusion in the portfolio. Stocks are held for the long term; the manager is patient, acknowledging that it can take time for value to be realised. Following the change in lead manager, there are a higher number of stocks in the portfolio with greater exposure to technology, smaller-cap companies and frontier markets. The trust typically runs a small cash balance.

To read the entire report Please click on the pdf File Below