Preparing for the publication of economic statistics

In this review, we consider the dynamics of the British pound against the Australian dollar. Is there a possibility for the GBP/AUD quotes to increase?

Such movement implies strengthening of the pound and weakening of the Australian dollar. The news about the possibility of soft Brexit and the maintenance of the basic mutual trade principles with the European Union is positive for the British currency. In addition, the strengthening of the pound may be supported by the decrease of inflation to 3% in December 2017, compared with 3.1% in November. The growth of consumer prices has slowed down for the first time since June of the last year.

Its November level has been the highest since the Brexit referendum in 2016. The Bank of England does not exclude a rate hike and forecasts a decrease in inflation to 2% by the end of this year. The dynamics of the Australian dollar is likely to strongly depend on the economic statistics, expected on Thursday. The data on the Australian labor market for December and a number of other indicators will come out. Besides, the publication of important statistics in China is expected: GDP for the Q4, as well as retail sales and industrial production for December. China is Australia’s main foreign trade partner.

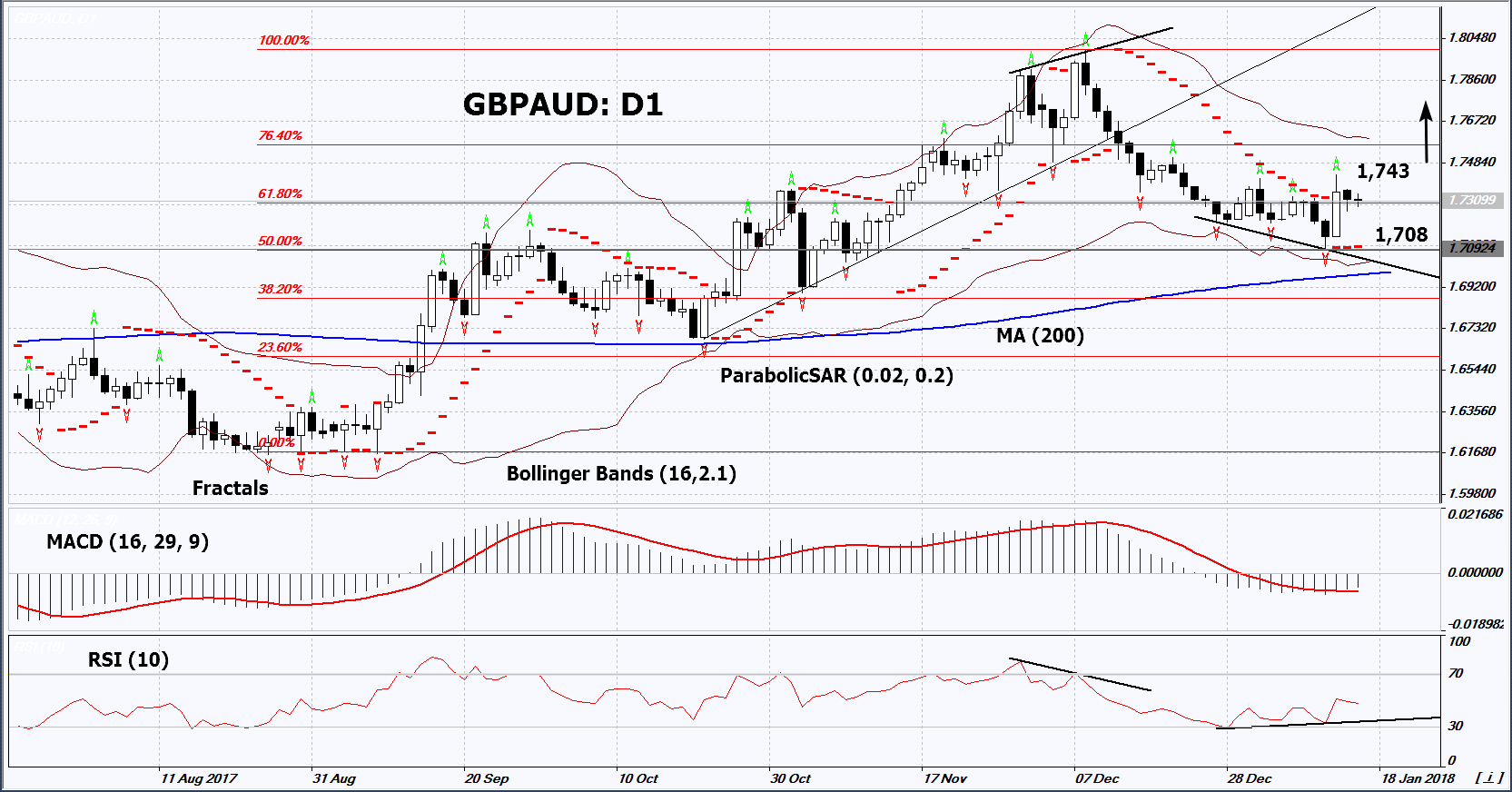

On the daily timeframe, GBP/AUD: D1 has reached the 50% Fibonacci level during its downward correction, but did not manage to overcome it. Currently, it is trying to increase and continue the uptrend, which started in September of the last year. The 200-day moving average line represents an additional support level for a new upward movement. The further price increase is possible in case of the worsening of the economic indicators in China and Australia and their improvement in the UK.

- The Parabolic indicator gives a bullish signal.

- The Bollinger bands have narrowed, which means lower volatility. They are tilted upwards.

- The RSI indicator is below 50. It has formed a positive divergence.

- The MACD indicator gives a bullish signal.

The bullish momentum may develop in case GBP/AUD exceeds the last fractal high at 1.743. This level may serve as an entry point. The initial stop loss may be placed below the Parabolic signal and the last fractal low at 1.708. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level at 1.708 without reaching the order at 1.743, we recommend cancelling the position: the market sustains internal changes that were not taken into account.

Summary of technical analysis

Position - Buy

Buy stop - above 1,743

Stop loss - below 1,708