China acquired US soybeans

The intensity of the trade war between China and the United States is gradually decreasing. Will the growth of soybean prices continue?

China acquires about 60% of all the soybeans traded on the world market. Its main supplier is the United States. Sales of the US soybean to China are estimated at $ 13 billion per year. Last week, the Chinese state agrotrader Sinograin, for the first time since April of the current year, acquired soybeans from the US. Let us note that last week, the growth of soybean prices was observed despite the fact that its commercial reserves in China increased by a quarter compared to the middle of April and reached 7 million tons. This is the highest level since September last year. There are rumors in the market that China is going to increase the state soybean reserves. Official information about this is missing. Additional factors for the growth of soybean prices were the strike of truck drivers in Brazil, as well as the possible cancellation of the reduction of duties on the export of soybeans from Argentina.

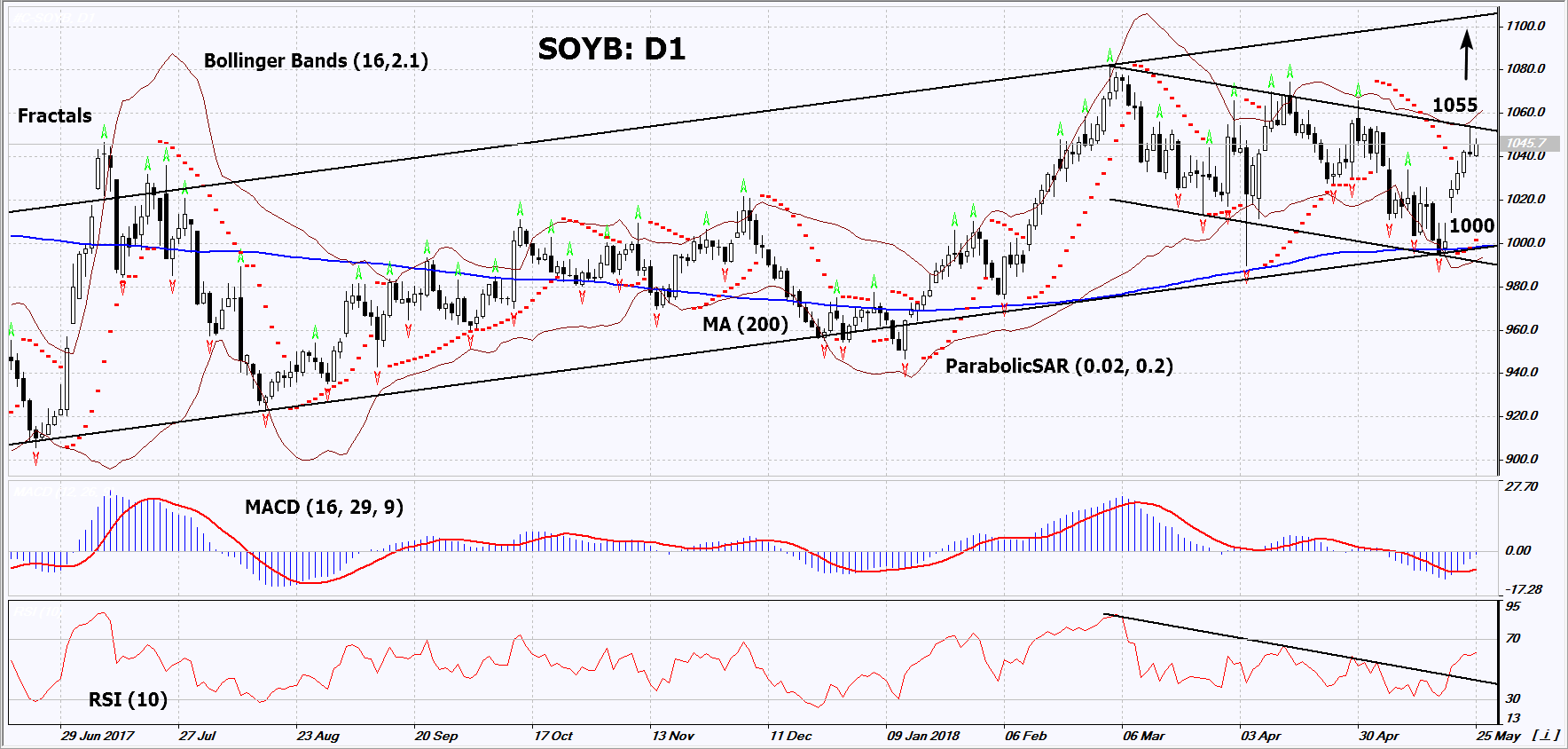

On the daily timefram, SOYB: D1 approached the resistance line of the falling channel. It should be breached up before opening a buy position. The further price increase is possible in case of bad weather conditions and an increase in exports from the US.

- The Parabolic indicator gives a bullish signal.

- The Bollinger bands® have widened, which indicates high volatility. They are titled upward.

- The RSI indicator is above 50. No divergence.

- The MACD indicator gives a bullish signal.

The bullish momentum may develop in case SOYB exceeds the last high and resistance line of the falling channel at 1055. This level may serve as an entry point. The initial stop loss may be placed below the last fractal low, the 200-day moving average line and the support line of the long-term uptrend at 1000. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level at 1000 without reaching the order at 1055, we recommend to close the position: the market sustains internal changes that were not taken into account.Summary of technical analysis

Position Buy

Buy stop Above 1055

Stop loss Below 1000