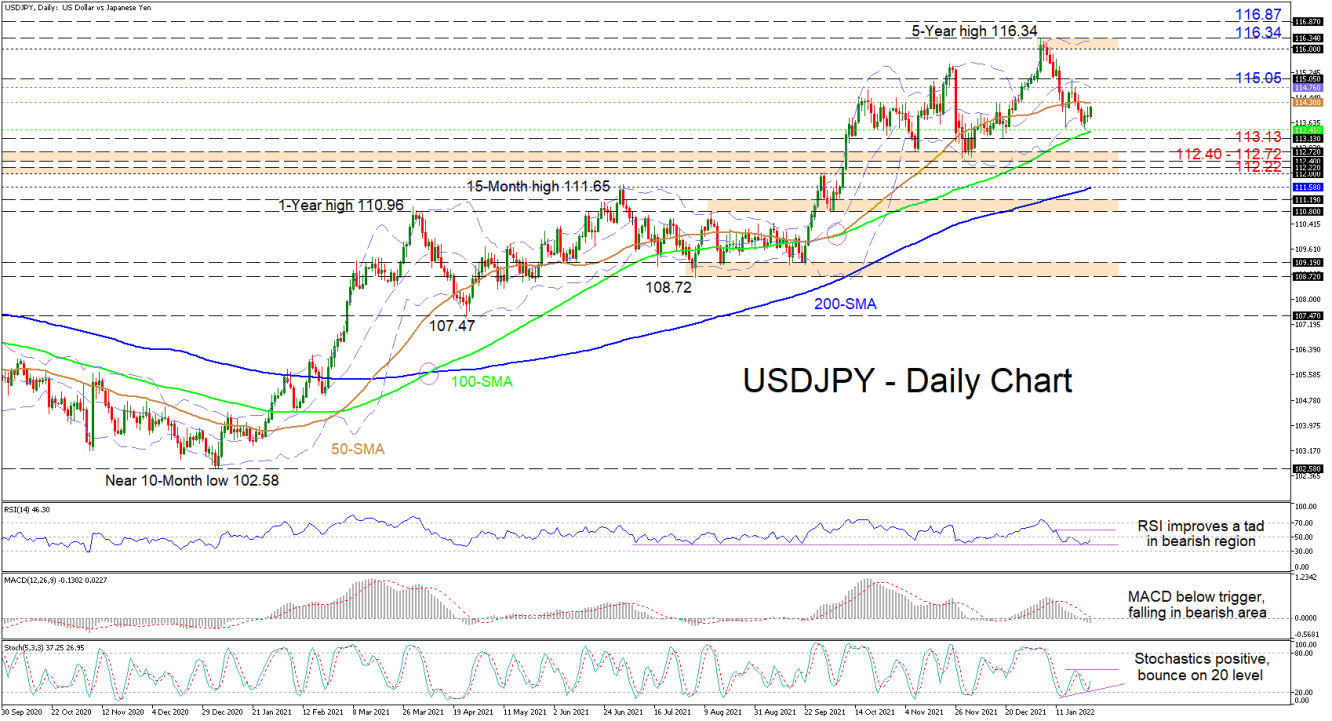

The longer-term SMAs continue to endorse the broader uptrend, while the slightly weakened incline of the 50-day SMA is reflecting the latest retreat in the pair.

The short-term oscillators are sending mixed messages in directional momentum. The MACD is falling beneath its red trigger and zero lines, while the RSI and the positively charged stochastic oscillator are promoting upside price action in the pair. The RSI is pointing north, nearing its 50 threshold and the stochastic %K line has rebounded off the 20 oversold level and over the %D line.

In the positive scenario, preliminary resistance could arise from the capping 50-day SMA at 114.30 ahead of a limiting area, between the mid-Bollinger band at 114.76 and the nearby high of 115.05. Rising beyond these obstacles, the price may then target the 116.00-116.34 zone of resistance. Should buyers overcome this fortified barrier, which includes the upper Bollinger band and the 5-year peak, the 116.87 high, identified in January 2017, could then come under attack.

Otherwise, if the 50-day SMA dismisses any positive developments in the pair, buyers could then try to create a foothold in the space between the 100-day SMA at 113.41 and the 113.13 low. If this region fails to provide the pair with support, the November and December 2021 troughs around 112.72 along with the April 2019 rally peak of 112.40 could forge a strong base. Moreover, the 112.00-112.22 adjacent border, extending back to February 2020, may further fortify upside defences.

Summarizing, USDJPY has managed to keep the broader uptrend intact above the 112.40-112.72 base. Furthermore, the current neutral-to-bullish tone in the pair is active north of the 100-day SMA at 113.41, and a price jump above 115.05 could fuel optimism. That said, for sellers to reinforce a negative trajectory, they would need to pierce beneath the buffer zone existing from 112.72 until 112.00.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

USD/JPY Constricted By MAs But Bears Yet To Dominate

ByXM Group

AuthorTrading Point

Published 01/26/2022, 07:36 AM

Updated 02/07/2024, 09:30 AM

USD/JPY Constricted By MAs But Bears Yet To Dominate

USDJPY is currently being squeezed between the 50- and 100-day simple moving averages (SMAs), also finding its feet on the lower Bollinger band in recent sessions, following the correction from the 5-year high.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.