Rising oil lifts energy stocks

Energy stocks are rising as the recovery of oil prices from multi-year lows continues. Let’s study the performance of the PCI – Energy stocks index, composed of stocks of world’s biggest energy companies. Will the index continue rising?

Oil prices have been falling since 2014 as crude oil output consistently exceeded global demand, leading to build-up of stockpiles and downward pressure on crude oil prices. Since mid-June 2014 Brent oil price has fallen over 64%. Lower prices led to falling drilling and exploration activity: US oil rig count, which is a leading indicator of oil and gas sector supply, fell by 703 since March 2015. Energy company stocks have fallen with the continued decline in oil prices: the S&P 500 energy sector index lost 17.7% over the past one year period. Oil prices have been rising recently after major oil producers Saudi Arabia, Russia, Qatar and Venezuela agreed last month to freeze crude oil output at January levels if other producers also join the agreement. If successful, the output freeze may help rebalance the oil market, resulting in crude oil price recovery and gains in energy shares. However, Iran has stated it aims to increase output and exports to regain market share lost since the imposition of international sanction in 2012. Iranian officials have stated they plan to increase exports by 500000 barrels per day (bpd), which will add to current oversupply estimated to be between 1 to 2 million bpd. This will be bearish for oil prices and energy stocks.

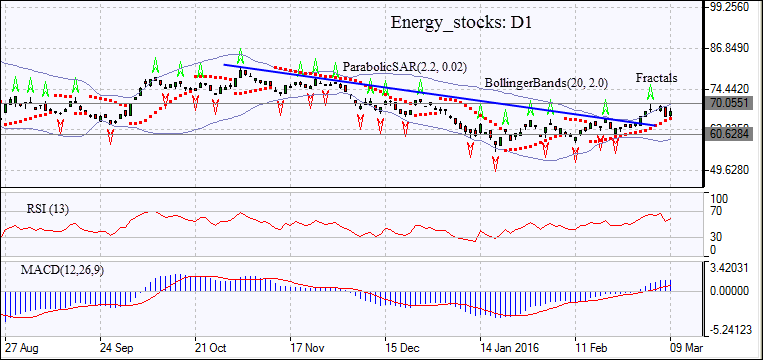

On the daily chart the Energy_Stocks: D1 reversed the downward trend and started rising after January 20 as oil prices hit multi-year lows and edged higher. The price has breached above the resistance line of the downtrend and is climbing. The Bollinger bands® are starting to widen, indicating increasing volatility. The Parabolic indicator gives a buy signal. The RSI oscillator is above the 50 level and rising, which is a bullish signal. The MACD indicator is above the signal line and the zero level which is a also a bullish signal. We expect the bullish momentum will continue after the price closes above the fractal high at 70.0551. It can serve as an entry point for a pending order to buy. The stop loss can be placed below the last fractal low at 60.6284. After placing the pending order, the stop loss is to be moved to the next fractal low, following Parabolic signals. By doing so, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level at 60.6284 without reaching the order, we recommend canceling the position: the market sustains internal changes which were not taken into account.

Position Buy Buy stop above 70.0551 Stop loss below 60.6284