multiple bellwether names are coming in light or otherwise missing estimates. Microsoft (MSFT), McDonald’s (MCD) and General Electric (GE) three of the latest offenders…

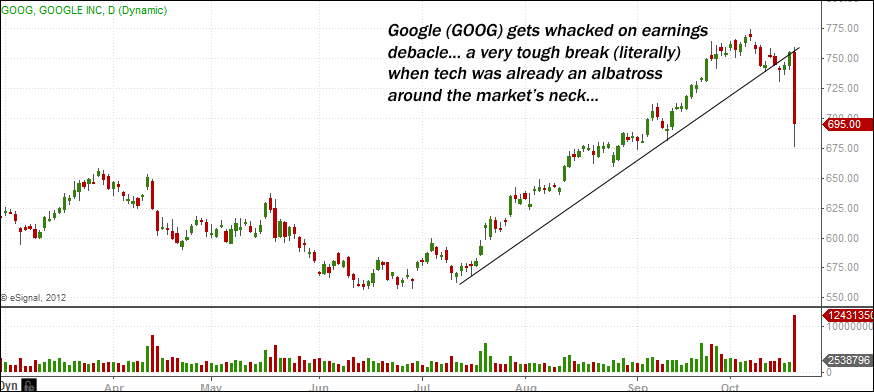

It’s GOOGLE (GOOG), though, that could really weigh heavily on speculative spirits after last Thursday’s earnings release debacle and ugly slide. GOOG is considered a market champion, a tech juggernaut perhaps second only to Apple (AAPL), and this kind of follow-up to the recent run has to be disconcerting indeed.

The FT has a very good summation of the current environment:

Bulls may have been able to shrug off disconcerting Google results if they were a tech outlier. But they have come alongside poorly received numbers from bellwether Microsoft, Intel and IBM.

Consequently, caution on the sector, and a wariness about the overall US earnings season to date, has seeped into trading on Friday, contributing to a 0.2 per cent decline for the FTSE Asia-Pacific index and a fall of 0.4 per cent for the FTSE Eurofirst 300.

But action generally is fairly mixed and mild as other factors provide underlying support for the bullish cause.

In particular, traders have welcomed recent data relating to the US economy. Thursday’s weekly initial jobless claims may have given back some of the previous period’s improvement, but other consumer-focused surveys, such as retail sales numbers and housing starts, point to the world’s biggest economy gaining some traction.

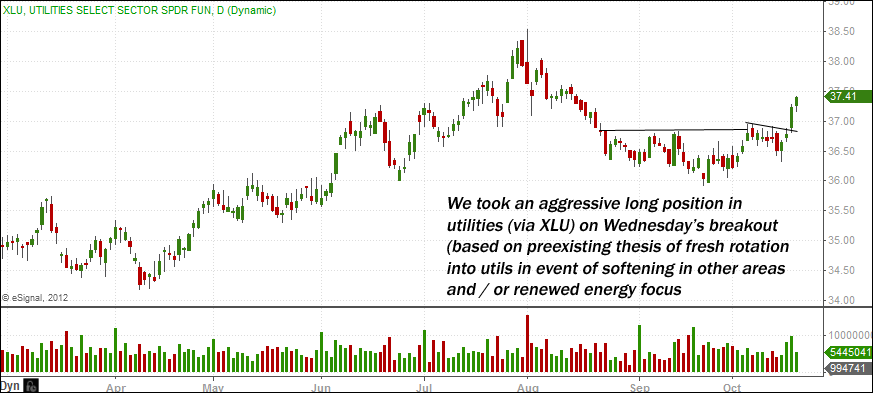

In a recent GMN we noted an aggressive allocation to energy names — Hess Corporation (HES) and Marathon Oil (MRO) among them — and continue to see energy as one of the most attractive areas of the market for capital rotation on new global growth hopes.

One particular subset of energy doing particularly well is utilities. We took a substantial long position (4x average position size) in utes (via the Utilities Select Sector SPDR ETF (XLU)) on Wednesday’s breakout… all positions time-stamped, with rationale and order broadcast in real time (almost always well before market open), via the Mercenary Live Feed.

This week’s must-read is a long-form New Yorker piece on the rampant corruption in China.

Here is an excerpt for flavor:

One of the most common rackets was illegal subcontracting. A single contract could be divvied up and sold for kickbacks, then sold again and again, until it reached the bottom of a food chain of labor, where the workers were cheap and unskilled. (The practice is hardly unique to the railways: in 2010, a rookie welder employed by an illegal subcontractor was working on a dormitory in Shanghai when he dropped his torch and set the building on fire; fifty-eight people died.) In November, 2011, a former cook with no engineering experience was found to be building a high-speed railway bridge using a crew of unskilled migrant laborers who substituted crushed stones for cement in the foundation. In railway circles, the practice of substituting cheap materials for real ones was common enough to rate its own expression: touliang huanzhu—robbing the beams to put in the pillars.

Again, you can (and should) read the whole New Yorker piece here… multiple sections will make your jaw drop.

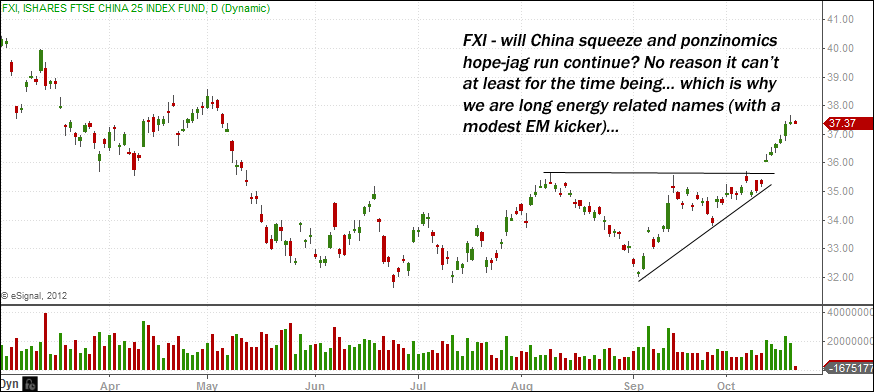

The rampant corruption in China only increases our conviction that China could be the biggest malinvestment case of all time. This reality does not preclude the possibility of a further rally, however, because “hope springs eternal” and “a rolling loan gathers no loss” as two of the old sayings go.

The irony is that, until it busts, a ponzi scheme of economic growth may actually look MORE robust than a pattern of true growth, because with the ponzi scheme you get active efforts from highly motivated parties to keep things propped up, whereas with true growth you get the unadulterated dips and valleys that come with most any organic journey from one place to another.

Given the above, we agree with the analogy that China is a fat guy running a marathon on crystal meth, but nonetheless see plenty of scope for a Soros-style “false trend” to extend for weeks or months as a general combo of short squeeze, ponzinomics and hope-jaggery. This is why we have allocated a large amount of capital to bullish energy names, which tie into institutional capital rotation on global growth optimism… and if tech continues to break down we will look to balance out our book somewhat with short exposure there as well.

Disclosure: This content is general info only, not to be taken as investment advice. Click here for disclaimer.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Tech Albatross And China Ponzinomics

Published 10/21/2012, 01:26 AM

Updated 07/09/2023, 06:31 AM

Tech Albatross And China Ponzinomics

Earnings whiffage is starting to pile up…

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.